Market Overview: Weekend Market Update

The Emini formed a micro double bottom at important support this week. If the bulls get follow-through buying this week, there will probably be a test of 3,000 in May.

The crude oil daily chart has probably entered a trading range. It is searching for a bottom. The legs up and down will probably last 2 – 3 weeks.

The EURUSD weekly Forex chart is in a weak bear channel. Traders are continuing to look for 100 – 200 pip moves up and down, lasting 2 – 3 weeks.

Crude oil Futures market:

First leg down in developing trading range

The crude oil futures market has sold off for 3 weeks from a buy climax at a measured move target. Nothing is coincidental, and it is amusing that the diabolical traders chose a religiously significant number (66.60) for the top.

In mid-April, I said that the 8 day tight trading range would probably be the Final Bull Flag and that the high would be just above the measured move target. In addition, I said that there would be a pullback that had at least 2 legs down, and it would dip below the March 21 high. It has achieved all of those goals.

Finally, I said that the market would probably enter a trading range for a couple months. That is still the case. The market is now searching for the bottom of the range. The bulls want it to be the low of the May 6 outside up day.

However, the 3 week bear channel is tight. In addition, the 6 day tight range below the EMA is a bear flag. Also, the absence of a clear buy signal make it likely that the daily chart will be sideways to down for at least another week.

2nd leg down likely

This 3 week selloff is probably just the 1st of at least 2 legs sideways to down. If there is a rally for a week or two, traders will expect it to be only a test of the April high. They will sell the rally. That would create a lower high major trend reversal sell setup. Traders would then expect a 2nd leg down.

However, a major sell setup only has a 40% chance of starting a bear trend. More likely, the bears would get a few weeks down to one of the higher lows in the 4 month rally. The bottom will probably be below 58. Much less likely, it would be around the January 14 low of 51.42.

Confusion and uncertainty create trading ranges

After a reversal down from a buy climax, traders become uncertain. They are confident that the market will not quickly go too high or too low. This results in them taking quick profits.

It also makes them comfortable scaling into shorts during rallies and into longs during selloffs. Buying low, selling high, and taking quick profits creates a trading range. This process is currently underway and it will probably last at least another month.

After the extreme 2018 sell climax and the extreme 2019 rally, the trading range could last many months and possibly for the remainder of the year.

EURUSD weekly Forex chart:

Endless weak, tight bear channel

The EURUSD weekly Forex chart has been in a tight bear channel since last June. It continues to reverse every 2 – 3 weeks. Yet, it also is making lower highs and lows, and it is therefore in a bear trend.

The trend is so weak that it is almost sideways. Traders see the chart as a breakout mode pattern. It has lasted an unusually long time. Consequently, traders will switch to trend trading once there is a clear breakout up or down.

The past 2 weeks had bull bodies. This is a weak bear flag. Traders will probably buy below this week’s low.

If next week trades above this week’s high, it would trigger a buy signal. The bulls see this week’s bull inside bar as a buy signal bar for a failed break below a 5 month trading range. However, 3 sideways bars just below the EMA is a weak buy setup. It is simply a continuation of the yearlong price action.

No sign of a breakout

There is no sign of an imminent breakout up or down. Traders will continue to look for 100 – 200 pip moves up and down, and then another reversal.

Until there are either consecutive big bull trend bars closing on their highs or consecutive big bear trend bars closing on their lows, traders will bet on a continuation of the weak, tight bear channel.

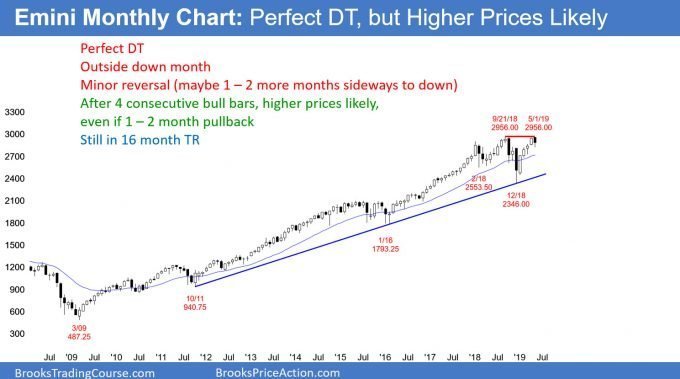

Monthly S&P500 Emini futures chart:

Emini monthly double top, but weak sell setup

The monthly S&P500 Emini futures chart traded above the April high and then below the April low. May is therefore an outside down month. In addition, it formed a double top with the September all-time high.

However, there were 4 consecutive bull bars closing near their highs. In addition, the December selloff was simply a pullback to the 20 month EMA and a 10 year bull trend line in a strong bull trend. Consequently, there are probably more buyers than sellers below the April low.

This is a low probability top. Traders should expect a new all-time high within a month or two. Since there are several weeks left in May, the bulls might get their new high this month. If so, May would then go back above the April high. As a result, it would become an outside up bar after 1st being an outside down bar.

Limited new high likely

That would slightly increase the chance of higher prices this summer. But, the multiple reversals means there is balance between the bulls and bears. It increases the chance of June largely overlapping April and May.

The strong 1st 4 months of the year make it unlikely that the bears can get more than a few months of sideways to down trading. However, the Emini is now at the top of a 16 month trading range. Markets have inertia. This means they resist change. Traders should assume that the current market condition will continue indefinitely until it clearly as changed.

This means that a break to a new high will probably not last more than a few bars before there is a pullback into the range. Since this is a monthly chart, a few bars is a few months. It can also mean a couple hundred points. Therefore, in addition to not much downside risk, there is probably not much upside potential either this year.

Traders will soon realize that the downside risk to the December low is more than the upside potential above the all-time high. This will make them hesitate to buy much above the September high.

Emini transitioning into 10 year trading range

The 16 month trading range will probably get a higher high, but not much higher. A reversal down would form an expanding triangle top. That is a variation of a higher high major trend reversal.

It is important to note that major reversal patterns only actually lead to a major reversal 40% of the time. Therefore the 16 month range will probably continue for many more months.

Furthermore, the stock market has been in a huge 10 year bull trend. Also, there is a major top on the monthly chart in the bond market. The Emini is probably in the early stages of a huge trading range that could last a decade, like from 1998-2009 and 1965- 1980.

During those times, there were several 30 – 50% selloffs of 50% and 50-100% rallies. There is money to be made when buying low and taking profits near the high. However, buy and hold traders will probably not make much money over the next 10 years.

Weekly S&P500 Emini futures chart:

Consecutive doji bars after double top

The weekly S&P500 Emini futures chart formed doji bars over the past 2 weeks. The bears want a trend reversal down from the double top.

However, last week was a bull doji bar. That is a low probability sell signal bar. While this week had a bear body, it was small. The week was another doji bar with a big tail below. This is a bad entry bar for the bears. In addition, the 4 month bull trend is strong. Consequently, the weekly chart does not currently have much downside risk.

The 2 dojis represent balance. Traders are not rejecting the all-time high as too expensive. They are also not yet buying aggressively.

This week was a pullback in a 4 month trend. That makes it a High 1 bull flag. But a bear doji is a weak buy signal bar. There might be more sellers than buyers above its high, just as there were more buyers than sellers below last week’s low.

This could result in a few more weeks of sideways to down trading before a new high. The absence of a credible top or strong reversal down make higher prices likely soon.

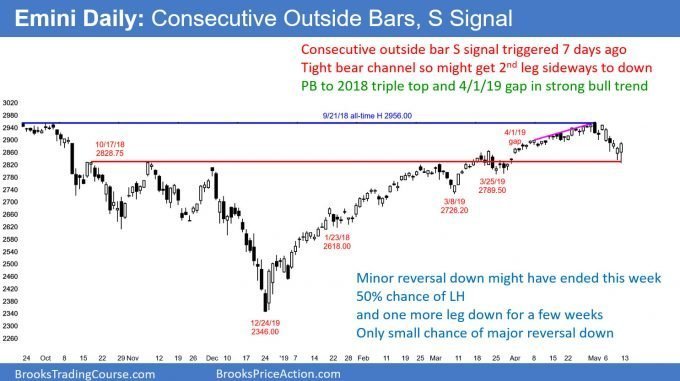

Daily S&P500 Emini futures chart:

Pullback testing major support at 2018 triple top

The daily S&P500 Emini futures chart had consecutive outside bars 8 days ago. At that time, I said that it was a reliable sell setup. I said that traders should expect at least a couple legs down for 2 – 3 weeks, and possibly a couple months.

In addition, I talked about the targets below. I wrote that the pullback would dip below the March 21 high and probably would close the gap above the March 29 high. That would also result is a breakout pullback test of the October-November-December triple top.

The bears achieve all of these objectives this week. They always want more. They would like to get down to the March low, a 50% retracement, or even the December low.

Buy signal, but possibly more trading range

Friday was a big outside up day. It followed a good bull day on Thursday. This is a micro double bottom and it is at important support.

Friday is a buy signal bar for Monday. This pullback is about the size of prior pullbacks in 2019. The all-time high is a strong magnet above. Therefore, traders are wondering if the pullback ended this week.

They will find out early next week. If the bulls get a series of bull bars closing near their highs, especially if the bars are big, they will probably get their new high in May.

Alternatively, if Monday is an inside day, or if it goes above Friday’s high but has a bear body or a close in the middle, the Emini will probably go sideways for a few days. Traders will wonder if the chart will form a lower high and then fall for a 2nd leg down.

Because the micro double bottom was strong and at important support, a break below would have a 50% chance of a measured move down. That would be around 2700 and a 50% retracement of the 2019 rally. At the moment, it is more likely that the Emini will make a new high before falling far below the May low.

Risk of 2nd leg down

That final target is unlikely without 1st seeing a new all-time high. However, the 8 day bear channel has been tight. In addition, a consecutive outside bar top sometimes leads to a selloff that lasts more than 20 bars. Therefore, traders will watch to see if any rally over the next week or two begins to stall below the all-time high.

If so and if there is a bear bar closing near its low, traders will have a swing sell setup. If that were to happen, many of the bulls who held through this 1st leg down would wonder if the selloff would reach those lower targets.

This could result in chain reaction selling. As the selloff begins, it could scare an increasing number of bulls out of their longs. Theirs is a crowded trade. If many sell at the same time, the result could be a panic selloff similar to the one in December.

But, the 2019 bull trend has been strong. In addition, the 16 month trading range is within a 10 year bull trend. Therefore, even if there is a surprisingly quick selloff to 2600, the bulls would still probably buy it, like they bought the December crash.

Big double top, but small risk

There is a double top on the monthly chart. But the 2019 rally was exceptionally strong and it followed a reversal up from a monthly bull trend line. Consequently, there is currently only a 30% chance that this double top will lead to a strong break below the December low.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

On Crude Oil (daily TF)

Price has been far from 20ema for 18 bar and now we have moving average Gap bar, may this lead to a test of old high, maybe a higher high MTR or a lower high MTR? Looking at the Weekly TF this is still a pretty good bull trend, with only 2 Bear bars pulling back from April’s high and giving a bull bar from last week. Aren’t the Bulls taking this as a signal bar and waiting for a “high 1” buy set-up?

Thanks for Your answer, if any 🙂

The entire rally is a retracement of the bear trend that started in October. Big Down, Big Up, Big Confusion typically means trading range.

The rally was a buy climax that tested a measured move. There will therefore probably be a 2nd leg down. While it might come from a lower high, it could also begin from above the April high. The developing trading range will probably last at least a couple months after an extreme sell climax and then a buy climax. Therefore a move up or down will be a leg in a trading range and not the start of a trend for at least a couple months.

Thanks Al,

Well noted. 🙂