Market Overview: FTSE 100 Futures

The FTSE futures market increased last month, closing at an all-time high with a FTSE big bull breakout. Bulls need another bull bar for consecutive bull bars and breakout and follow-through, but the tail on January’s bar might reduce the number of bulls willing to hold long there. Bears need a reasonable sell signal or a reversal bar and follow-through to sell a double top for a possible swing down.

FTSE 100 Futures

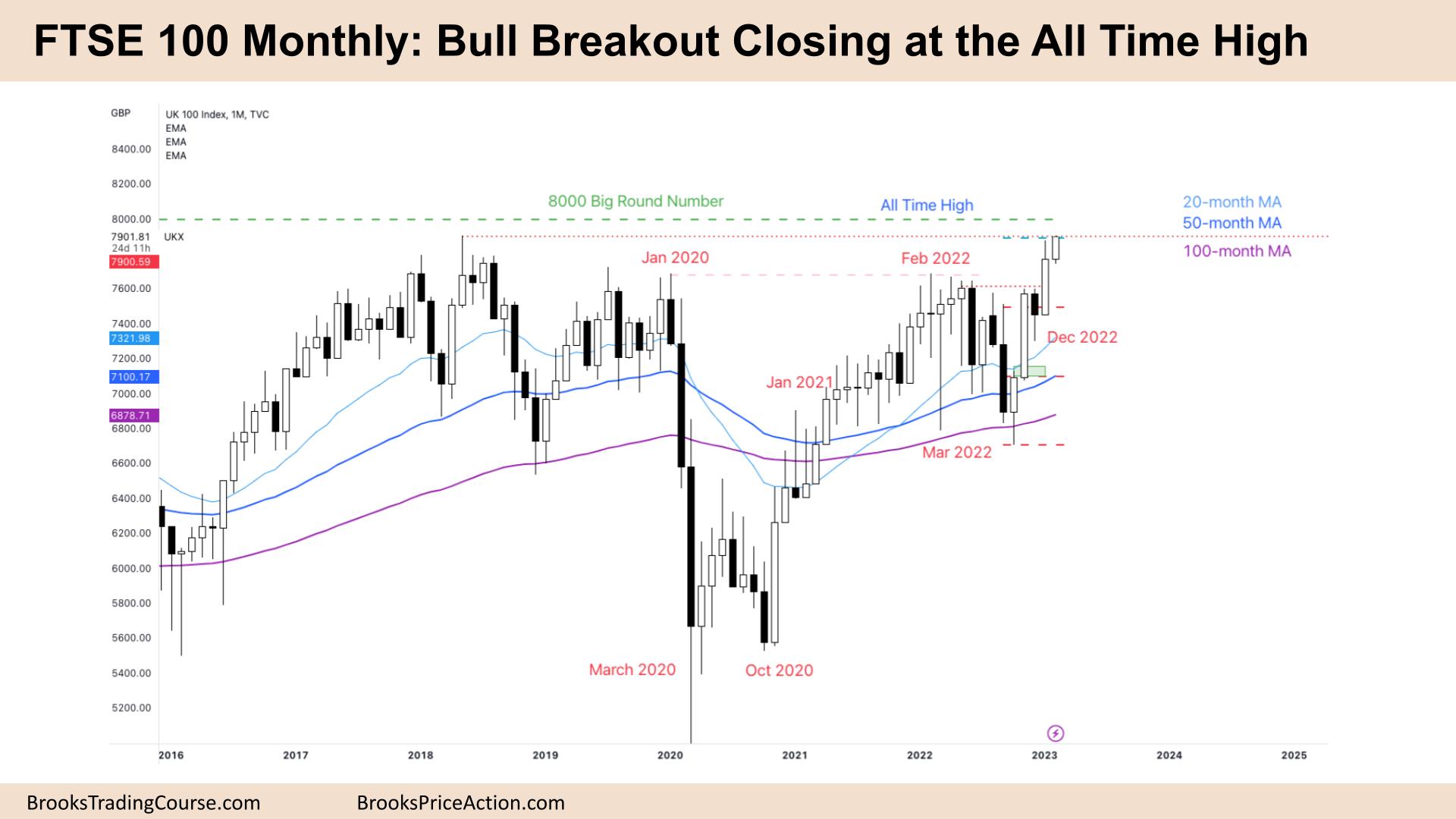

The Monthly FTSE chart

- The FTSE 100 futures was a big bull bar last week with a tail, a bull breakout closing at an all-time high.

- It is a 4-bar bull micro channel.

- We are always in long. Most traders should be long or flat.

- The bulls hit a measured move target, a swing buy from trading above October 2022, and they got their 2:1.

- Traders expected two legs sideways to up after the pullback from February 2022 and trend resumption.

- The bulls want a consecutive bull bar to close above the highs for a breakout and followthrough.

- The bulls see a breakout and want a measured move up from below October 2022, and they might get it. Look left. How many bear bears on the monthly do you see? Few.

- Traders are confident even if next month is a bear bar, it will be a reversal that is likely to fail.

- Bears see a trading range and a weak bull channel and expect to reach the February 2022 breakout points. They will make money if they sell the BO and then sell higher below a bear bar.

- The bears see a weak trend on the monthly: overlapping bars, tails above and below, it looks like a leg in a trading range, and they might be right.

- Expect sideways to up next month. February will probably also have a tail above it, like January.

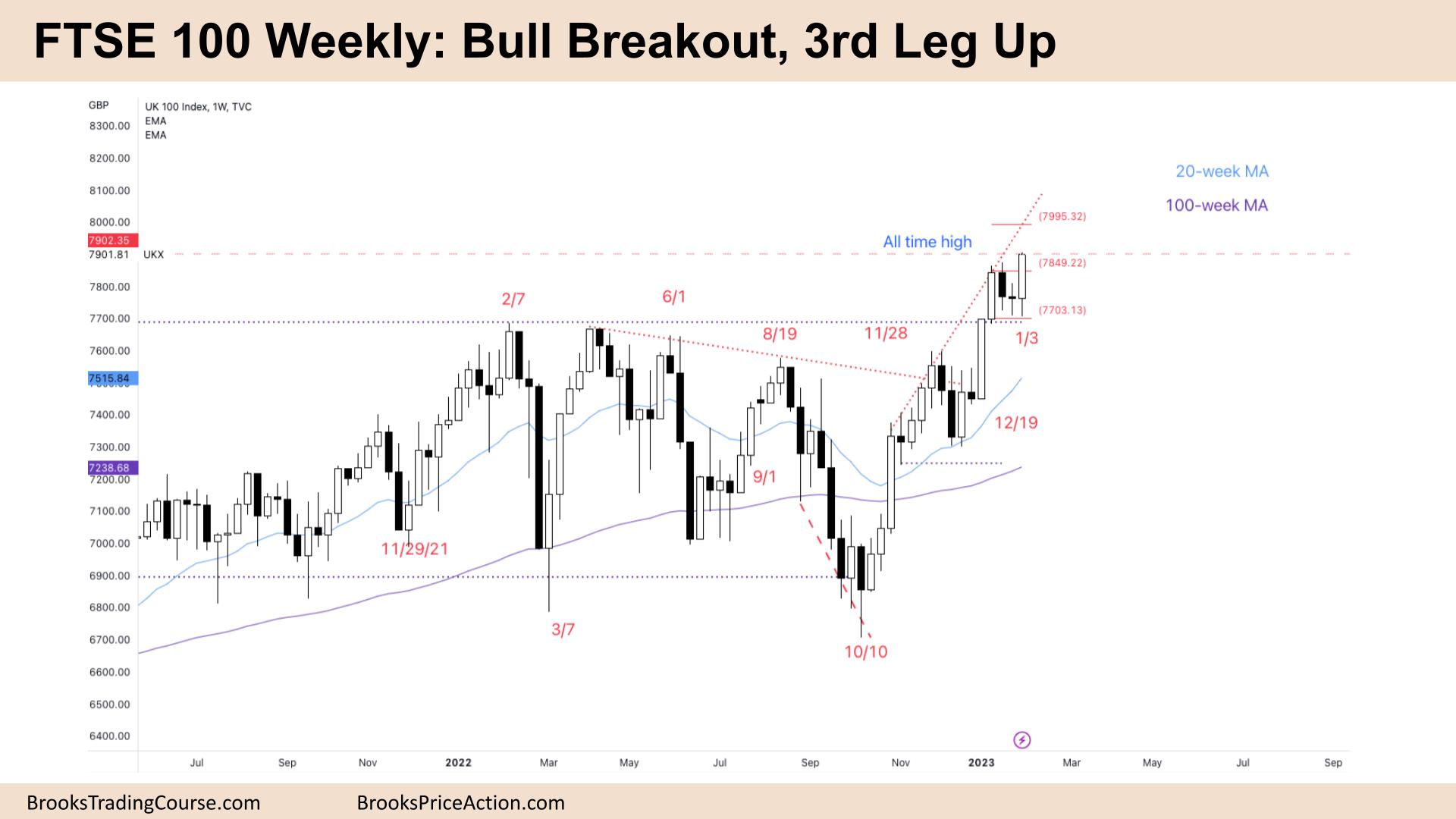

The Weekly FTSE chart

- The FTSE 100 futures was a bull bar closing on its high.

- The bulls see a bull breakout and a 3rd leg up. They want to reach a measured move target above.

- Last week was a bad buy signal, a bear doji. So we might return to retest the high of that bar as some bears would have sold there.

- The channel is tight. The bulls know the best the bears can get here is a deep pullback and a trading range. They will be happy to scale in lower.

- The bears see an expanding triangle, a trading range sloping up and will look to sell higher.

- The bears want a double top and failed breakout above a trading range, but no bear bar exists. Most traders should sell below a bear bar closing below its midpoint.

- It is a High 1 buy. Traders can get long here and buy lower if it goes down. But the stop is far away, so they need to trade small.

- There are gaps open above October, so although the bears want a strong reversal, it is unlikely to collapse into a bear trend.

- In trading, we need to be prepared for the unlikely can happen. Bulls will exit below a bear surprise bar and look to get back in on a High 2.

- Traders all see we are far away from the moving average. They will watch for late acceleration, a sign of a buy climax and an area to take profits.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Great reports Timothy, your analysis&phrasing further enriches my understanding of the market, thanks for that!