Trading Update: Friday September 10, 2021

Emini pre-open market analysis

Emini daily chart

- Yesterday traded above Wednesday’s high and then below its low. It was therefore an outside down day. Bear hoping 15 percent correction has begun.

- Since it closed near its low and below yesterday’s low, there is an increased chance of follow-through selling today and possibly a gap down.

- The day after an outside day has an increased chance of having a lot of overlap with the outside day. Remember, an outside day completely overlaps the day before.

- The day after an outside day is sometimes an inside day. That creates an ioi Breakout Mode pattern. All financial markets might be mostly sideways ahead of the September 22 FOMC announcement.

- The magnet below is the August 26 low.

- September or October should begin a 15 to 20% correction, but it will not be clear until it is half over.

- Until then, traders will continue to buy every reversal down, including this one, betting on another new high.

- Therefore, there is only a 30% chance at the moment that this week’s selloff is the start of the correction. If there are additional big bear days over the next week, the odds that this is the start of the correction will increase.

- However, even if there a breakout above 4,600, there is probably not much left to the 18-month rally before there is a correction. That means the next 15% move will more likely be down than up.

Emini 5-minute chart and what to expect today

- Yesterday was rollover day. Day traders should trade the December contract today.

- Emini is up 19 points in the overnight Globex session.

- Today will probably open in the middle of yesterday’s range. That would increase the chance that today will be an inside day. Even if it breaks above or below yesterday’s range, it will probably not get far beyond that range. Therefore, there will probably be sellers around yesterday’s high and buyers around yesterday’s low.

- Yesterday was a sell climax day. There is a 75% chance that today will have at least a couple hours of sideways to up trading that begins by the end of the 2nd hour.

- Since today is Friday, weekly support and resistance can be important, especially in the final hour. The most important magnets are last week’s low, yesterday’s low, and the open of the week. That is just above the open of the month, which is another important magnet.

Yesterday’s Emini setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

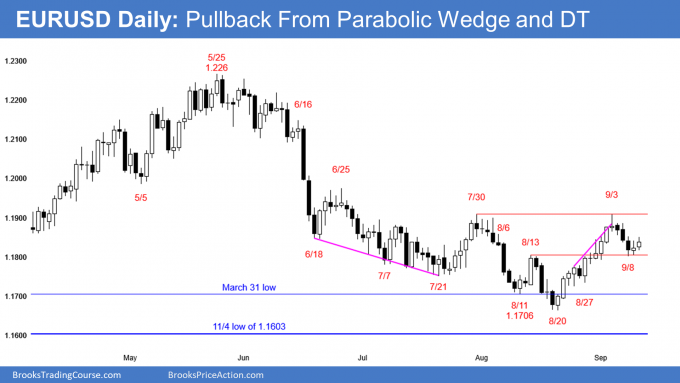

EURUSD Forex daily chart

- Still pulling back from parabolic wedge rally to a double top.

- Traders expect at least a small 2nd leg sideways to down, especially after 3 consecutive bear days.

- 2-day rally will probably form lower high within a few days.

- Selloff could reach August 28 buy climax low within a couple weeks and a 50% retracement before bulls will buy.

- After sell climax bottom on August 20, should get 2nd leg sideways to up for a few weeks. It should begin once this pullback from the September 3 high ends within the next week.

- The bulls want a break above the June 25 high and then a measured move up to the January high. That is the top of the yearlong trading range.

- Finally, they want a break of the February 2018 high of 1.2555. That is the high of the 7-year trading range on the monthly chart.

- Then, they want a 2000-pip measured move up. That would take years. Over the next several months, traders expect the yearlong trading range from 1.16 to 1.23 to continue.

- Bears want the July 30/September 3 double top to lead to a resumption of the bear trend. They want a break below the August 20 low, which is the neck line of the double top. They then want a 200-pip measured move down.

- That would break below the November 4, 2020 low, which is the bottom of the yearlong trading range.

- If they get that, they then would try for a 700-pip measured move down. They currently have a 30% chance of achieving these goals.

- Markets resist change. Therefore, it is more likely that the yearlong trading range will continue for at least a few more months.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

End of day summary

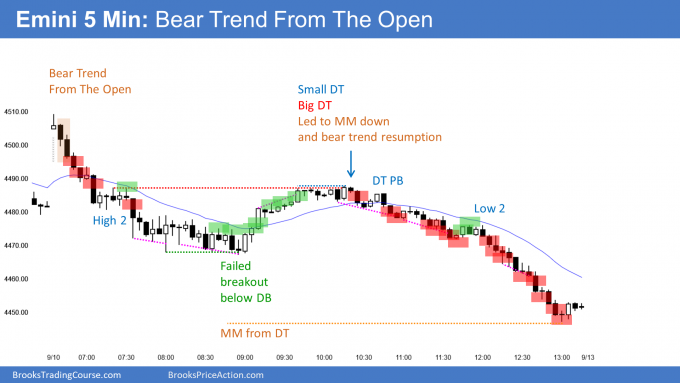

- Bear Trend From The Open.

- Broke below yesterday’s low and then entered a trading range.

- Reversed up to middle of range and yesterday’s close.

- Sold off strongly in a tight bear channel to test below the August 26 low at the end of the day.

- The low was a measured move down from the double top bear flag.

- Might get follow-through selling and a gap down on the weekly chart next week.

- 5-day pullback is a lot, compared to other pullbacks since pandemic crash. Might get bounce early next week.

- Also might go sideways up to the September 22 FOMC announcement.

- I have been saying that September or October should be start of 15 to 20% correction for a couple months.

- There is a 40% chance that it is already underway, but might get one more new high and a blow-off top first.

- Next 15% move in the Emini is more likely to be down than up.

- Last week reversed down from measured move based on height of pandemic crash, but bears still need to do more if this is the start of the correction.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

I find two sites confusing. As I had subscribed to both but I can log in into only one site.

Please an explanation as to which login and password I can use for either site and the site will be useful as well.

Thanks

Hi Ranvir,

The 2 sites are completely separate and independent. You need different username and password for each. Why would you think one set of credentials works for 2 different websites? Having said that this is a common problem!

To log in to other site (BrooksPriceAction.com) you need to register over there for free.

Hope that is clear.

PS. Ref your other comment here that was held for moderation (due to links) your password is far too weak. As noted on site you must use a minimum of 12 mixed characters for security, or system may reject your login.

Hi Dr. Brooks

Want to ask if we enter long above bar 25 or 27. Where should we set the stop loss? If we set right below the outside bar 18, it will be hit at bar 29 and reverse up.

Under situation like this, should we wait till the close of bar 29 before deciding to quit our position? I think this is always a dilemma for me. Thank you.