Emini bear rally in January after December sell climax

I will update again at the end of the day.

Pre-Open market analysis

Monday formed an inside day on the daily chart. It did not trigger the sell signal on the daily chart by going below Friday’s low. Likewise, it did not trigger the weekly buy signal by going above last week’s high, which was Friday’s high.

The bears will probably trigger a minor sell signal on the daily chart within the next few days. But last week’s reversal up was strong. In addition it was from the support of a 20% correction and the monthly bull trend line. Consequently, there will probably be a 2nd leg up after the 1st pullback.

Last Monday was the buy signal bar for the bear rally. Since it was a big bear bar closing on its high, there were bears selling with limit orders at its high. They have been scaling in higher. Since that is reasonable, they should be able to make a profit. Traders should expect a dip at least a little below last Monday’s high within a couple of week’s. The overnight selloff might be the start of the move down.

The buy signal on the weekly chart is minor since it is coming after a strong selloff. Therefore, even if the Emini rallies over the next several weeks, it will probably sell to below last week’s low within a couple months.

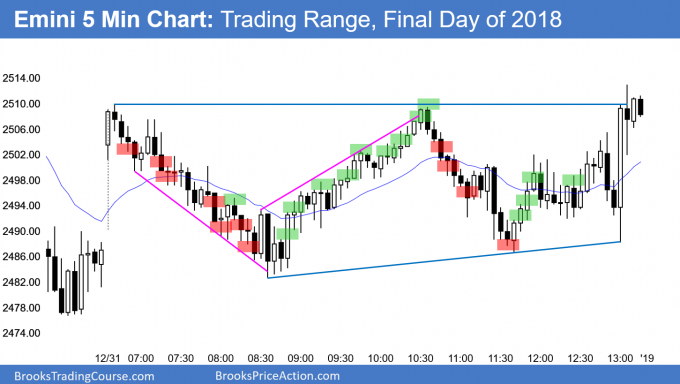

With a climactic reversal up last week, the Emini will probably be in a trading range for a month or more. Traders will look for reversals ever few days and they will take quick profits. This week is still a holiday week. That increases the chance of mostly trading range trading today.

In addition, the bulls will likely trigger the weekly buy signal.

Overnight Emini Globex trading

The Emini is down 39 points in the Globex session. There might be a gap down on the open. By trading below Monday’s low, the Emini would trigger a sell signal on the daily chart. Since last Monday was a bear bar and therefore a bad buy signal bar, there is a magnet at its high of 2412.50. That might be too far below to reach today. However, typically a market pulls back to at least one tick below a bad buy signal bar’s high. Consequently, the Emini will probably get there within a couple weeks.

Last week’s reversal up was strong and it followed an extreme sell climax. That makes a 2nd leg sideways to up likely. Sometimes the 2nd leg up begins after a test below the low. Traders will expect buyers somewhere around either last Monday’s high or low.

A big gap down increases the chance of a trend day. Down is more likely. However, the Emini will open far below the 5 minute EMA. Traders do not like to sell too far below the average price. Therefore, when there is a big gap down, there is an 80% chance of at least one reversal in the 1st hour. Usually, the Emini usually has to get closer to the EMA before a trend begins. The bulls want either a double bottom or a wedge bottom. The bears try to create a double top or wedge bear flag near the EMA.

Monday’s setups

Here are several reasonable stop entry setups from Monday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex bear trend reversal after failed bull breakout

The EURUSD daily Forex chart broke far above the 2 month trading range on Tuesday, but reversed down from a wedge top. Today triggered a sell signal by falling below yesterday’s low.

I have been writing over the past several weeks that currency markets have an increased chance of beginning a trend in early January. The bulls yesterday failed in their attempt to break above the 2 month trading range. They now hope that the selloff will form a double bottom with the December 26 or 14 lows.

They want the bull channel or trading range to continue. To them, the wedge rally is a bull channel after the November 20 spike up. A Spike and Channel bull trend usually evolves into a trading range and not a bear trend. If the bulls can prevent a strong break below the December low, the 2 month trading range will continue.

However, yesterday was a good sell signal bar. In addition, the context is good for the bears. Finally, today so far is a strong entry bar for the bears. Therefore, there is better than a 50% chance chance of a bear break below the trading range within a few weeks and then a bear trend.

Until there is a breakout, there is no breakout. The probability for a bear trend is not yet 60%. The bears need big bear bars closing below the December and November lows. Without that, the 2 month trading range will continue.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart fell 130 pips overnight in a Small Pullback Bear Trend. While that is climactic, there is no sign of a bottom. Consequently, the bears will continue to sell even 10 – 20 pip rallies. They want today to close near its low. That would create a strong entry bar on the daily chart and increase the chance of lower prices tomorrow and next week.

The bulls 1st need to stop the selling. If they can create a 1 – 2 hour trading range, day traders will begin to scalp longs for 10 – 20 pips in addition to selling rallies.

However, they know that the 1st reversal up in a strong bear trend is typically minor. To get a reasonable chance of a 50+ pip rally, which is unlikely today, they usually need some kind of double bottom. That requires 20 or more bars. Without that, most bulls will not buy.

Today’s close is important. The bears want the daily chart to begin a bear trend. Bear trends have lots of bear days closing near their lows. If the bulls can get late rallies, the bars on the daily chart will have big tails below. That would discourage traders from continuing to sell at the low and reduce the chance of a bear trend over the next few months.

On the other hand, the more consecutive bear bars that close near their lows, the more likely this will be the start of a bear trend. The bears need to show that they can beat back the bulls every day.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

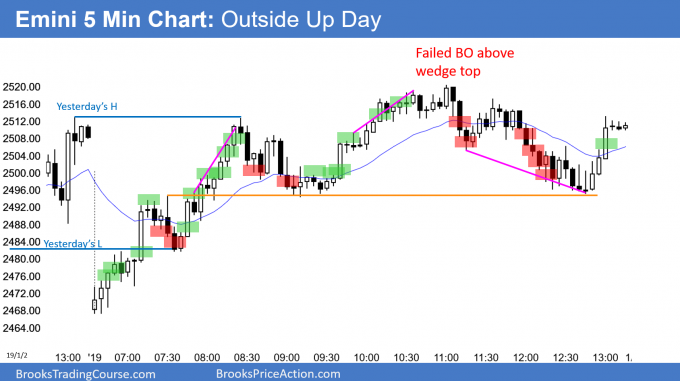

By trading below Monday’s low and then above its high, the Emini formed an outside up day today. However, it did not trigger the weekly buy signal. Last week’s high is just above today’s high. Therefore, the bulls will probably trigger buy this week.

The 5 day rally from the sell climax and the 20% correction is still probably a minor reversal. It was strong enough to make 2 legs up likely. Therefore, bulls will buy selloffs. The bears will wait for at least a micro double top.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, when scalping, I think it is probably a must to get out when there is a buy/sell signal appears against my entry direction, but how about if I am swinging trading? In general, is it better to rely on original stop (which can be wide) and wait for a few more bars to see how it unfolds, or better to do the same thing – get out when signal appears on the other side using stop order (and re-enter if it later turns out my earlier premise is still valid)?

Some traders do not like to get in and out. They rely on a wide stop. I usually do that if I day trade with options. I think if it like trading on a higher time frame, like the 15 or 60 minute chart. When I day trade Eminis, most of my trades are scalps. I get out whenever there is a reasonable opposite signal.

Both approaches are reasonable. Traders chose based on their personalities. A trader needs to be having fun. If either of the 2 choices creates too much stress, he needs to use the other.

Hi Al,

In today’s webinar, you said that on the daily chart the Dec 24th bear bar was a bad buy signal bar, so the market should come back below the high of the bear bar to let disappointed, scale-in bears exit breakeven on their first entry. Wouldn’t the disappointed bears already have exited on Dec 27th, especially after the huge bull entry bar on the 26th? The Dec 27th low was below the high of Dec 24th.

Thanks!!

I was talking about theoretical bears who could use wide stops, like above the December high and scale in on any rally toward that high. I am confident that there are institutional traders who trade like that because it makes sense.

Most individual traders are “traders.” They look for moves that last 1 – 5 days or so and would not use a wide stop. As soon as they are disappointed, they get out and look to enter in the new direction.

Why was there no buy above 27? Because of 8 point risk and only 4 points from a prior DT? It was a H1, followed a tight bull channel, and had tested an uptrend line (2, 7, 13, 26). It was my biggest loss of the day.

A trader could buy above 27 because of the micro double bottom with 25. That is a reasonable option, but not the best.

In the room, I said that the buy climax top at 23 was likely to have at least 2 legs down, AND that the size of the pullback is typically about half as many bars as there were in the rally.

I said that the pullback to 26 was therefore probably not enough to relieve the exhausted bulls. The odds favored a 2nd leg down. I also said that the reversal down would be minor. Consequently, if a trader bought above 27 and put a stop below 14, he could have avoided a loss. If he scaled in lower, he would have made money.

Traders who take reasonable entries and manage well have an 80% chance of making money or avoiding a loss.