Trading Update: Thursday June 24, 2021

Emini pre-open market analysis

Emini daily chart

- After 2 big bull days, yesterday was likely to pause, and it did. It was a small bear doji bar.

- The Emini might pull back for a day or two, but traders should expect a break to new high.

- Yesterday is a sell signal bar for a double top with June 14 all-time high.

- Since it was only a small bear bar, it is a weak sell signal. There will probably be more buyers than sellers below its low.

- The reversal up on Monday and Tuesday from the sell climax test of the 50-day MA and the bull trend line was strong enough to continue up to a new high.

- There is a 40% chance that the rally goes up for a 200-point measured move over the next month.

- In addition to the Emini being in strong bull trends on the weekly and monthly charts, the Emini tends to rally at the end of June.

- Can this rally be a bull trap and reverse down from the top of the 3-month trading range? There is currently a 40% chance. If there is a big bear bar closing near its low this week or three consecutive small bear bars, the bears will have a 50% chance of stopping preventing a bull breakout.

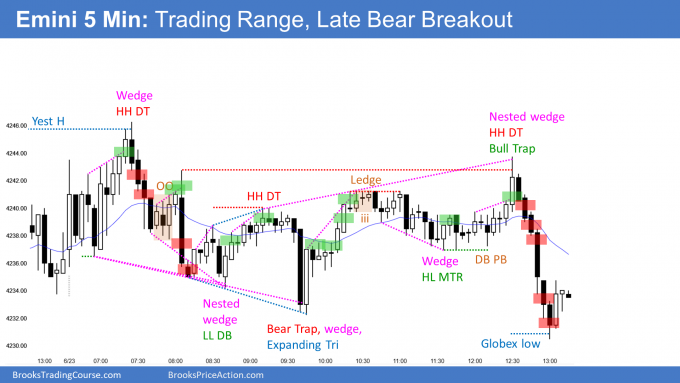

Emini 5-minute chart and what to expect today

- Emini is up 20 points in the overnight Globex session.

- Might gap up to new all-time high.

- Bears want a double top with June 14 high.

- Bulls want resumption of 2-day rally and strong breakout.

- Increased chance of trend day.

- If trend, up is more likely.

- If another trading range day, odds still favor strong breakout above trading range within a week.

Yesterday’s Emini setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

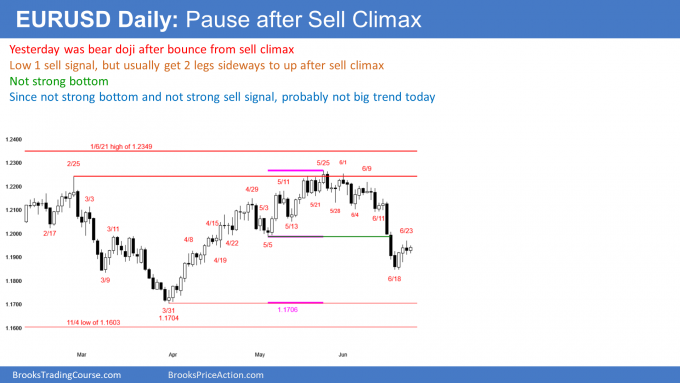

EURUSD Forex daily chart

- Small bear body yesterday. It is a weak Low 1 sell signal bar, especially after 2 bull bars and a sell climax.

- Many bears will wait for a 2nd leg up before selling again after a sell climax.

- Is the selloff a bear trap? After such a strong selloff, most bulls will want at least a micro double bottom before concluding that the bear breakout is failing.

- With many bulls and bears waiting for 2nd signals, the EURUSD might have to go sideways for at least a couple more days.

- Tomorrow is the last day of the week.

- Bulls want the week to close near its high to increase the chance of higher prices next week.

- Bears want the week to close below the midpoint of the week to increase the chance of sideways to down trading next week.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

- Today gapped up to a new all-time high.

- A gap up above major resistance often leads to a few sideways days before traders decide if the gap is the start of a big rally or a bull trap.

- Odds favor higher prices. Despite buy climaxes on weekly and monthly charts, there is no credible top. Also, end of June into early July is seasonally bullish.

- At least 30% chance of 200-point measured move up, and it could happen quickly. Look at the early April breakout as an example.

- Bears want wedge rally to a higher high double top. Wedge is May 7 and June 14.

- Also, a reversal down would be a nested expanding triangle starting April 16 and again May 25.

- Bears need consecutive big bear bars closing on their lows before traders will think that a correction might be underway.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the market reports on the Market Update page.

Hi Al,

Are the trade setups you give at the end of each day, all swing setups? Or are they a combination of swing and 2pt scalp setups?

I find that I do very good on trending days, but then I start giving back too much profit on trading range days.

I believe a culprit for doing bad on trading range days may be a distrust of the market cycle and being too afraid of a breakout taking place where im looking for market to reverse.

Also it seems like the emini has been having either very strong trend days or very quiet trading range days lately.

Any thoughts on this? Any tips on getting past it? Thanks!

If I may say, it has been unusually frustrating in recent weeks for 5min emini swing traders, as most good swings have been either in the overnight sessions, or in the last 90 mins of the day sessions (when most emini daytraders dont trade).

do you sell options using price actions?

mostly people say selling options is risky but sometimes we have higher probability trades and what should be our stop loss?

That question needs a much longer answer than what I can give here. Every spread has a short option so I am willing to sell options. I am also willing to sell an out of the money put on a stock I want to buy.

However, just selling options because you probably will get to can collect some premium is a losing strategy. Traders have to consider risk and reward in addition to probability.

thanks for the reply sir.