Emini bulls need follow-through buying after October bear trap

I will update again at the end of the day.

Pre-Open market analysis

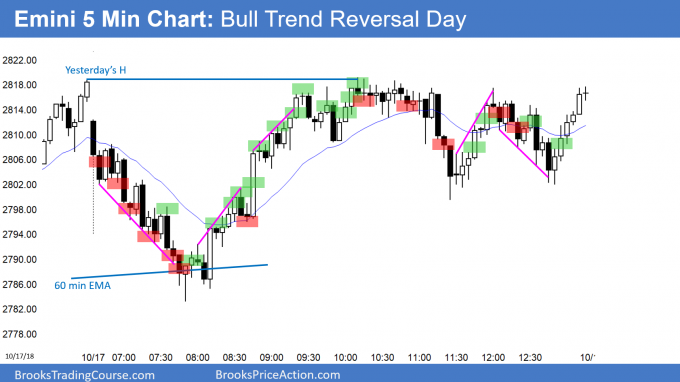

Yesterday sold off to the 60 minute EMA and reversed up to above Tuesday’s high. The 2nd half of the day was a trading range and the day closed just above the open. While bullish, it increases the chance of more trading range trading today.

The bulls still need strong follow-through buying after Tuesday’s reversal before traders will believe that the bull trend has resumed.

Since the reversal up was strong, the bears will probably need a micro double top before they can resume last week’s selloff.

The big reversal up created confusion, which usually leads to a trading range for a few days. The bulls will probably get at least some follow-through buying today or tomorrow.

Overnight Emini Globex trading

The Emini is down 11 points in the Globex session. Since the dominant recent feature is Tuesday’s strong reversal up, the odds favor at least a small 2nd leg up. The rally might reach the 20 day EMA at around 2850.

Trading ranges usually continue longer than what seems reasonable. Therefore, today might continue yesterday’s trading range. Traders will look for reversals until there is a sustained breakout up or down.

Yesterday’s range had lower highs and higher lows. Consequently, it was a triangle. The 1st breakout of a triangle has a 50% chance of failing and reversing. In general, there is a 50% chance that the successful breakout will be up or down. Since Tuesday’s bull trend was strong, there is a 60% chance of a bull breakout in this case. But, that probability will drift down to 50% if the trading range continues sideways for another day or two.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex higher low in 3 week trading range

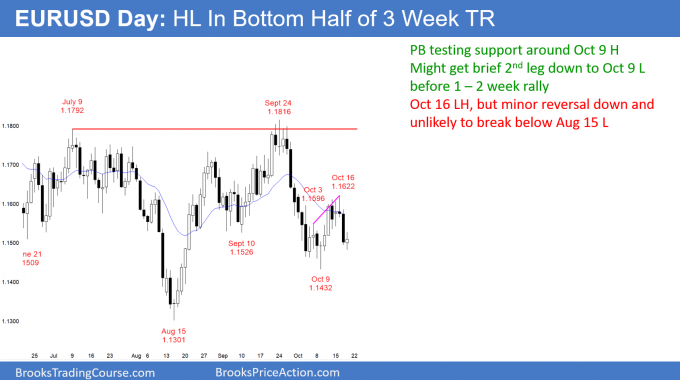

The EURUSD daily Forex chart is in the bottom half of a 3 week, 200 pip tall trading range. This is in the middle of its 6 month trading range.

The EURUSD daily Forex chart has been in a 200 pip trading range for 3 weeks. It is now testing support at the October 9 high and 1.15. However, after last week’s parabolic wedge rally, there might be one more brief leg down to the October 9 low. There will then probably be a bull leg lasting at least a couple of weeks.

While eventually this 6 month range will break into a trend, there is no indication that the is about to happen. Consequently, traders will continue to look for reversals every 2 – 3 weeks.

The dominant feature is the strong August reversal up from below the bottom of a 4 month trading range. Therefore, as long as pullbacks stay above the August 15 low at 1.13, the odds favor an eventual breakout above the top of the now 6 month range.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart reversed up overnight after testing the October 9 high and the 1.15 Big Round Number. Since Monday’s selloff was strong, the bulls might need a micro double bottom before they get a rally to last week’s high. This is especially true after the October 16 wedge top. A selloff from a wedge top typically has at least 2 small legs down.

Because the daily chart is at support, day traders will look to buy reversals up. The overnight rally is likely to have at least a small 2nd leg up. Consequently, the bulls will look to buy the current pullback to around 1.15.

Since a big rally is unlikely after yesterday’s strong selloff, the bears will sell rallies. They, too, will only scalp because the overnight rally was strong and the chart is at support.

With both the bulls and bears scalping, today will probably form a small trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

By trading below yesterday’s low, the Emini triggered a Low 1 bear flag sell signal. But, yesterday was a bull doji and it followed a big bull day. This is a low probability sell setup. Consequently, the Emini is more likely to go sideways for at least a few days rather than down. The odds are the that 5 day developing trading range will last another week or more.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.