Emini and Forex Trading Update:

Thursday November 12, 2020

I will update again at the end of the day.

Pre-Open market analysis

The Emini yesterday was a small bull day that closed near its high, but just below the September high. Yesterday’s close was just above the September 2 close, and therefore it was a new all-time highest close. The bulls need follow-through buying over the next few days, or the bears will get a lower high and a 2nd leg down.

The bears want Monday to remain the high for the rest of the year. But they need several big bear bars before traders will believe that the high is in.

When the market is deciding between a bull flag and a bear trend reversal, it sometimes will go sideways for several days. The trading range can even last several weeks before either the bull trend resumes or the bear trend has another leg down.

The past 2 days were small. That means traders lack conviction. They want to see more and bigger bull bars, or more and bigger bear bars before they will bet on the direction of the next move. In the meantime, day traders will expect mostly sideways trading, like the past 2 days. However, with a strong 2-week rally to a new high, the odds favor higher prices soon.

Bullish time of the year

This is a bullish time of the year and the bulls had a very strong rally last week. The odds favor sideways to up trading over the next week or two, and possibly into the end of the year.

But if the bears can prevent the rally for a couple weeks, traders will begin to wonder if the high is in for the year. This could result in bulls exiting their longs, which would result in a move back to the middle of the 4-month trading range.

Overnight Emini Globex trading

The Emini is down 10 points in the Globex session. Today is Thursday and the Emini is in the middle of the weekly range and at the September 2 prior all-time high. After Monday’s strong reversal down and now 2 sideways days, today will probably not be a big bull day. But the bulls would like the week to close above its midpoint and above the September 2 high. They can achieve both with trading range days and therefore do not need a big bull day.

The bears want the opposite. While they would like the week to close on its low, they would be satisfied with today, and tomorrow closing below the September 2 high and near the low of the day. That would increase the chance of at least slightly lower prices next week.

After Monday’s big reversal down from a buy climax and 2 small sideways days, today will probably be a trading range day. But if there is a series of strong trend bars up or down, day traders will hold onto early positions as long as the trend lasts.

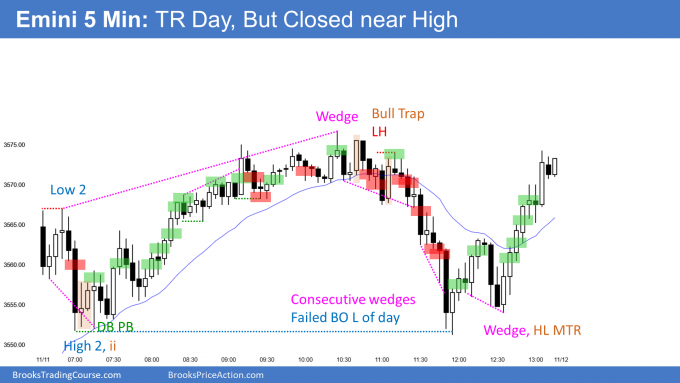

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart pulled back for 3 days after a strong 4-day rally. The rally barely broke above the September 10 lower high. It was strong enough for traders to expect at least a small 2nd leg sideways to up.

The bulls want a breakout above the September 1 high, which is the top of the range. Since most breakout attempts fail, the odds are that this rally will fail to get much above that high, if it gets above that high.

This 3-day selloff looks more like a bull flag than a bear trend reversal. It lacks consecutive big bear bars; yesterday closed in its middle; last week’s rally was strong and, today tested yesterday’s low and reversed up. These factors make traders expect a 2nd test of this week’s high within a week.

It is still possible that this is the start of a reversal down from a double top with the September 10 lower high. If the selloff continues for a few more days and has bear bars closing on their lows, then it will probably continue down to the November 4 low. Without that, traders will continue to expect at least a small 2nd leg sideways to up.

Overnight EURUSD Forex trading

The 5-minute chart of the EURUSD Forex market reverse up from a test down to just above yesterday’s low. But the rally failed to get above yesterday’s high.

Today so far is a bull inside day. If it closes above its midpoint, traders will see it as a buy signal bar for tomorrow. If not, traders will expect a 4th sideways day tomorrow.

As strong as the overnight rally was, the EURUSD retraced about half and it fell more than 30 pips from the overnight high. That increases the chance of a trading range. Day traders will look to buy selloffs, sell rallies, and take quick profits.

The bulls would like a strong bull trend day. But they do not need it. All they really need is for today to be a good buy signal bar for tomorrow. The more today closes near its high, the higher the probability will be that last week’s rally is resuming. If today reverses back down to the low of the day, traders will expect more sideways to down trading tomorrow.

With the past 4 days all having prominent tails on the daily chart and the past 3 days being sideways, traders see the EURUSD as fairly neutral. That reduces the chance of today closing on the high or low of the day. The fight will be over the size and direction of the body.

The reversal up overnight makes today likely to have a bull body. If the bulls are strong enough to get today to close near the high of the day, traders will be more willing to buy tomorrow, looking for a resumption of last week’s rally.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

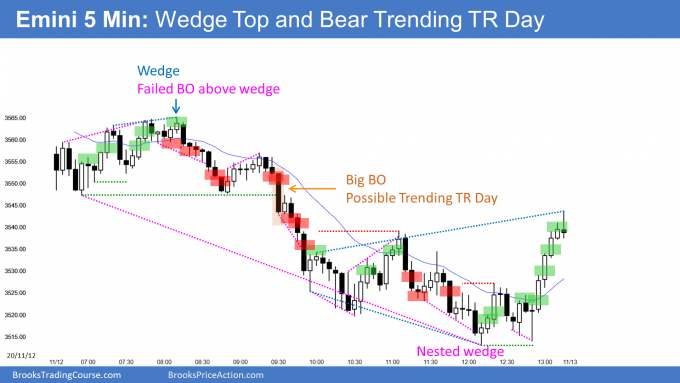

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

Today was in a trading range for 3 hours, despite a wedge top. The Emini then broke strongly to the downside. It then entered a lower trading range and formed a bear Trending Trading Range Day.

There is a 60-minute tight trading range just below 3500 from last week. That is a good candidate for a Final Bull Flag. It is therefore a magnet below. The Emini might have to test the bottom of that range, which was last Friday’s low, before the bulls will consider buying aggressively again.

Tomorrow is Friday so weekly support and resistance can be important. That includes last week’s high, the October 12 high, and last Friday’s low.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi, why after the BO on the low (triangle) at around 9:30am, a possible bear trending day is expected? Instead of a bear trend down. Thanks.

When a market is in a trading range for several hours and then breaks out, the breakout is usually brief and leads to another trading range. The Emini traded down for 5 hours, and it was therefore in a bear trend. However, after the 5 bars of the breakout, the remainder of the selloff was likely to be part of a trading range, which it was.

21 closed in the last second below 17, when this happens: do you sell the close or wait for FT?

When in doubt, like when something happens fast, it is usually better to sell using a stop to enter below the bear bar closing near its low. This gives a trader a few more seconds to think about the trade. Depending on circumstances, it can be better to wait to see the follow-through bar.