Emini and Forex Trading Update:

Monday October 12, 2020

I will update again at the end of the day.

Pre-Open market analysis

The Emini broke above the September trading range on Thursday and had a bull follow-through bar on Friday. The Emini is up in the Globex market and it will probably gap up on the weekly chart. There were several weekly gap up openings in the summer rally. Although most closed before the end of the week, they were a sign of strength and led to higher prices.

The bulls want the rally to make a new all-time high. There is currently a 50% chance they will succeed. If the Emini can get 2 closes above 3500, the rally will probably test the September 2 all-time high

The Emini is in the Sell Zone between 3400 and 3500. The bears will look for a reversal down this week from a lower high.

But the bull channel from the September 24 low is tight and there are now 2 consecutive closes above the September 16 top of the month-long trading range. Therefore, the bears will probably need a micro double top before they can get a reversal down. Consequently, traders will buy the 1st 1 – 2 day pullback, expecting a test back up.

Last week was a big bull bar on the weekly chart. Sometimes the following week is a big bear bar, like in early June. If today or tomorrow is a big bear day, last week’s bull breakout will probably fail. More likely, with all of the gaps up on the weekly chart this summer, there is an increased chance of a gap up today on the weekly chart.

Overnight Emini Globex trading

The Emini is up 24 points in the Globex session. At the end of Friday, I said that the bulls would try to create a gap up on the weekly chart this week. They probably will succeed.

When there is a big gap up on the 5-minute chart, the Emini is far above the 20-bar EMA, which is one measure of the average price. Traders do not like to pay far above average unless they are getting something that is far above average. Many bulls will wait to see a couple big bull bars closing near their highs before buying far above the EMA.

Most often, a gap up leads to a trading range open for the 1st hour or two. That is because the 20-bar EMA is based on the most recent 20 bars. It takes that long before the EMA is based mostly on today’s early bars, putting the EMA up near those bars. Traders then see the price as being near average, and the bulls become more willing to buy.

There is a 20% chance of a strong bull or bear trend from the open. But if the Emini has its usual trading range open, the bears will look to sell a rally to a double top or a wedge top for a test down to the EMA. They bulls want to buy a reversal up from a double bottom or wedge bottom near the EMA.

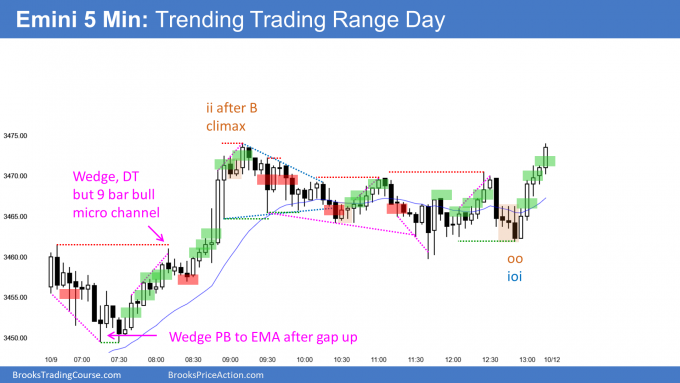

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

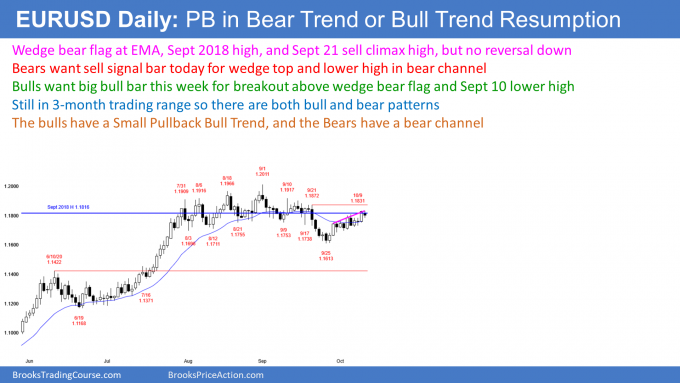

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has a wedge rally in a bear trend. The bears want today to close near its low. Today would then be a sell signal bar for a lower high in a bear channel. Also, it would be at the resistance of the September 2018 high and the September 21 sell climax high. They then would hope for another leg down in their bear channel and a test of the June 10 high. That was the breakout point of the summer rally.

Since the EURUSD is still in its 3-month trading range, there is always going to be a bull argument as well. The bulls see the 2-week rally as a Small Pullback Bull Trend. They want a breakout above the September 10 lower high. That would end the bear argument because a bear trend needs lower highs. They they would try to break above the September 1 high and continue the rally to 1.25 at the February 2018 high.

One problem for the bears is that he 2-week rally is near the September 21 sell climax high but did not reach that magnet. When a market is near a magnet, it usually will get there. Consequently, the EURUSD will probably have to go at least a little higher before the bears can regain control. However, if today closes near its low and tomorrow is a big bear day, traders will conclude that another leg down was underway.

Overnight EURUSD Forex trading

The 5-minute chart of the EURUSD Forex market reversed down overnight from 1 pip below yesterday’s high. However, the selloff was a wedge and the bulls got a strong bounce an hour ago. A reversal up from a wedge typically has at least 2 legs. Consequently, the EURUSD might begin to go sideways to up for at least another hour.

The bears want a strong sell signal bar on the daily chart. They will sell rallies today to try to get today to close near its low. At the moment, that is unlikely.

The decent bounce from a wedge bottom increases the chance that today will not close near its low. Additionally, many traders believe the 3-week rally will have to reach the September 21 sell climax high before the bears will sell. That reduces the chance of a strong sell signal bar today and a strong bear entry bar tomorrow on the daily chart. It therefore also reduces the chance of a big trend down from here on the 5-minute chart.

These conflicting signals and the overnight trading range price action make it likely that today will not close on the low, but not become a big bull day. For the bulls, they want today to have a bull body on the daily chart. They will therefore buy 10 – 20 pip dips today.

At the moment, traders believe today will be sideways to up. They will look to sell again once there is a 2nd leg up from the wedge bottom. However, both the bulls and bears will probably scalp for 10 – 20 pips.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

I will post chart after the close.

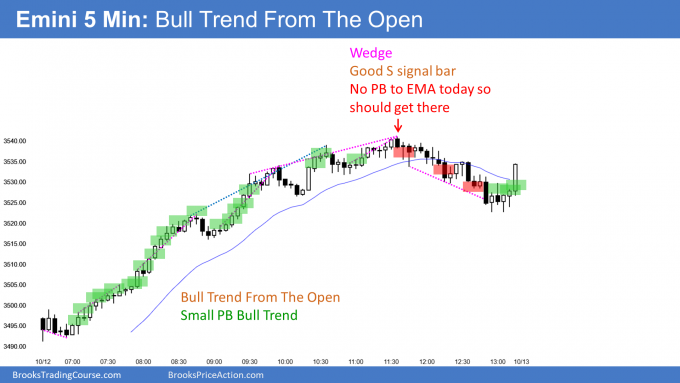

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

The Emini gapped up, creating a gap up on the weekly chart. On the 5 minute chart, the bulls had a weak rally for more than an hour. But the bull trend became much stronger when it started forming bull bars closing on their highs. Today was a Bull Trend From The Open. There was a late test of the EMA, but the rally to get back to the high of the day started too late to make a new high.

There are now 3 consecutive closes above the September trading range on the daily chart. Traders expect a test of the all-time high. Furthermore, the 3 day breakout is strong enough to expect traders to buy the 1st 1 – 2 day reversal down.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Al, I entered a long at 11:31 am PT and added more at 11:35 am PT on the breakout to HOD. What did I not see ? In your BTC blog, you mentioned 11:30 am PT is actually a good short entry point, noting the wedge. What did I miss?

These trades were made on Oct 12, to be clear.

Hi Al, can you help to explain which bar(s) on the morning (especially after bar 6) changed the character of the market and made you place your first order instead of waiting for some kind of DB close to EMA?

Hi, Al

I followed your blog for years. I read your first book carefully and watched most of your videos. I learned a lot from you.

Now I am really screwed up with a problem. when the trend is clear I can enter the trade and stay through the trend. but when TR or pullback channel, I often make mistakes, exit too late or scale in in wrong direction, which easily removes most of my profit.

I know I should focus on structuring profit trade, when the things are not clear, I must wait or use very small size. But when one/two fail trade, I am eager to get it back, which makes me nervous.

How to overcome this shortcoming?

thanks

It sounds like you understand the problem and know how to fix it, but that does not mean it is easy to do. I could write pages on this. The short answer is to trade smaller than what you think is small so that you do not think about money.

By being eager to make back a loss, you are thinking about something in addition to structuring and managing the trade that you are about to take. That piece of your brain that is now unavailable for trading puts you at a disadvantage. It is better to wait until you are back at your best and not suffering because of the last trade.

I will give an example that helps make my point. I do not like to reverse. Sometimes I’ll take profit on a trade and see an opposite trade on the next bar. I usually wait at least a couple bars before taking an opposite trade because it takes me that long to be completely objective again.

In trading, everyone’s edge is small. If it is smaller for any reason, like a distraction, you may not have any edge at all. That guarantees losing money over time.

I never worry about making back a loss from a trade. It is now someone else’s money and I am not going to think about it. I only look forward, trusting that as long as I do what I am supposed to do, I will soon be ahead again. No rush. Just do what is right.

thanks AL, I need ponder over your words.