Emini and Forex Trading Update:

Monday March 30, 2020

I will update again at the end of the day.

Pre-Open market analysis

Friday was an inside day. It is therefore both a buy and sell signal bar for today. Since it was a doji bar, it will probably not lead to a big more up or down.

With the 3 day rally as strong as it has been, today might start a 1 – 3 day pullback. The bears hope that the bear trend will resume today. It is more likely that there will probably be more buyers than sellers not far below Friday’s low. The bears will probably need at least a micro double top before they can resume the bear trend.

The bulls want a V bottom and a rally up to a new high. After the March coronavirus crash, a trading range is more likely.

Last week reversed up strongly from the bottom of a 2 year trading range. It formed an outside up bar on the weekly chart. Last week is therefore a buy signal bar for this week on the weekly chart. However, the prominent tail on top of last week’s candlestick make is a less reliable buy signal bar.

Traders expect a 2nd leg sideways to down at some point. However, because the sell climax and the reversal up were extreme, traders are exhausted and confused. That typically results in a trading range. It could last all year.

End of quarter window dressing

There is often buying into the end of the 1st quarter. This is especially true after such a dramatic bottom. Consequently, there is buying pressure into tomorrow’s close, which is the final trading day of the month. That reduces the chance of a strong bear day today.

With Thursday and Friday being mostly sideways, today might be sideways as well. If so, that would leave tomorrow as the final day for the end of the quarter window dressing (buying).

Overnight Emini Globex trading

The Emini sold overnight to below Friday’s low, triggering a sell signal on the Globex daily chart. However, it then reversed up and it is near the high of the session.

The bears want today to trade below Friday’s low on the day session’s daily chart as well. That would trigger the sell signal on that chart and give them another chance of resuming the 2 month bear trend.

As I wrote above, last week’s reversal up was strong enough to make traders eager to buy the 1st brief selloff on the daily chart. Furthermore, there is typically buying pressure into the end of the quarter. Consequently, today will probably not be a big bear day, even if it triggers the sell signal on the daily chart. More likely, it will be either a bull trend day or another trading range day.

There have been many surprisingly big days up and down for 2 months. That increases the chance of a surprise today. Traders will therefore be ready for anything.

With Friday being a trading range day and today opening around Friday’s close, there is an increased chance of a trading range open. If so, day traders will take quick profits until there is either a strong breakout up or down, a double bottom, a double top, a wedge bottom, or a wedge top.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

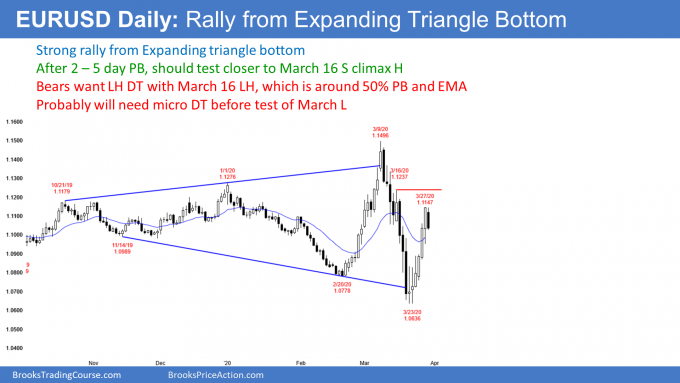

EURUSD Forex market trading strategies

The daily chart of the EURUSD Forex market rallied strongly from a 5 month expanding triangle bottom. It is now back in the middle of the triangle.

After 4 big bull days, the stop for the bulls is far below. Many traders will reduce risk by taking profits (long liquidation or long covering). This will probably result in several days of sideways to down trading. The overnight selloff is a sign that this has begun.

The bears want today’s reversal to form a double top bear flag with the March 16 high. They are hoping that the 5 day rally is just a unusually big pullback from a breakout to a new low in the 2 year bear trend. But they know that they will probably need at least a micro double top before they can get a new low. Consequently, traders will buy the 1st 1 – 5 day pullback.

Over the past 2 months, there have been 2 big moves down and 2 big moves up. The EURUSD is now in the middle of all of those moves. What is more likely, the start of a strong breakout of the 5 month range or a continuation of the range?

Big reversals create big confusion. Confusion means there is no consensus about the direction. Traders expect at least a few more weeks of sideways trading before there might be evidence that a trend will begin.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market tested Friday’s high overnight and then sold off in a weak bear channel. While much of the time was sideways, there was as series of lower lows and highs. It has been easier to make money shorting. There is no sign of a bottom.

However, the body of today’s candlestick on the daily chart is about as big as Friday’s bull body. There is now symmetry, and markets often make symmetrical moves.

Also, Friday was a huge bull day in a strong rally. It is unlikely that today’s range will be much bigger than Friday’s.

Consequently, the selloff will probably convert into a trading range soon. But as long as it is in a tight bear channel, it will continue to be easier to make money by selling rallies than by buying reversals up.

Once there is a 30 – 40 pip rally, traders will conclude that the bear trend is evolving into a trading range. They then will be more willing to buy reversals up for 20 pip scalps. However, they will continue to sell rallies unless today reverses up strongly into a bull trend.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

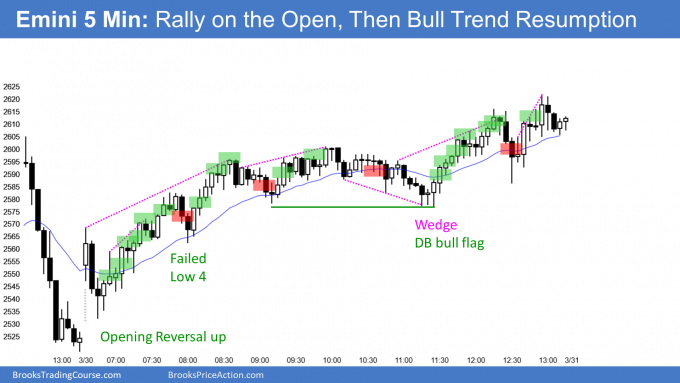

End of day summary

The Emini briefly sold off on the open and had an Opening Reversal up from a test of the EMA and around a 50% pullback from Friday’s low. The rally was a weak Bull Trend From The Open. The Emini then went sideways for several hours before resuming up.

By breaking above yesterday’s high, it triggered a High 1 buy signal on the daily chart. It did not yet go above last week’s high to trigger the weekly buy signal.

Tomorrow is the end of the month and the end of the quarter. There is probably some more window dressing buying left to do tomorrow. This rally will probably soon test the March 13 close of 2697.25 before the bears will be able to get more than a 3 day pullback.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Al, would you consider open B4 as a brkout pb as well? Also, do you still use first trade of day to determine your stop size for remainder of day…would pb after B6 entry be that size…approx 9pts? Thanks!

Yes, it is a pullback from a break above yesterday’s tight bear channel. It is also a higher low major trend reversal. I always pay attention to the size of the early moves to get a sense of how big scalps will be for the day.

Hi Al,

Last hour really disappointed me. I had long at 2594 early yesterday and believed it will break out finally and my target is around 2620. Market in the last hour suddenly dropped greatly. Fear of behaving like last Friday, I settled my position at 2600 after the market bounced back from 258x as I guess the bull trend maybe got damaged with such a sudden drop. However the trend resumed and got to the new high which I was not dare to enter the market again.

May I know how we should react to market like this? As there is chance the market would drop like last Friday.

Thank you!

There were a couple special things today that were different from Friday. First, the Emini was testing Friday’s high and last week’s high. That means the buy signals on both the daily and on the weekly chart. Those were magnets.

Next, I wrote that there was a good chance of buying today and tomorrow because of end the the quarter window dressing. This was especially true after such a dramatic last week.

I never get upset by anything and have not for decades. If a trade does not do what I was expecting, I just get out and wait for the next trade. Also, if I feel less than perfect for any reason, I get out.

I never trade using the rear view mirror. I always look ahead. Friday made it no more likely that today would sell off than it would rally. Being able to trade stupid is an asset. I just trade what is in front of me and I don’t worry about anything else.

Thanks much for sharing your experience!