Emini and Forex Trading Update:

Friday April 23, 2021

Pre-Open market analysis of daily chart

- Yesterday was an Emini outside down day. It traded above Wednesday’s high, and then below its low.

- There is now a small lower high double top on the daily chart, and therefore an increased chance of a pullback.

- But trends resist reversing. Therefore it is still more likely that the Emini will stay sideways, or go a little higher.

- Yesterday closed above Wednesday’s low, and the Emini has been sideways for 8 days. Also, the April bull trend was strong. This is therefore not a strongly bearish event.

- The bulls want a micro double bottom with Wednesday’s low, and then a breakout above yesterday’s high, which is the neckline of the micro double bottom.

- A measured move up would be above 4,200.

- It is more likely that the Emini will continue sideways into next Wednesday’s FOMC announcement.

- Yesterday had a big range with a prominent tail below. That increases the chance that today will be an inside day (not break above yesterday’s high or below its low).

- The streak of 13 consecutive bull days in April is likely to be the final strong move up, before a pullback in May.

- There might be one or two minor new highs before the Emini pulls back.

- Once there is a pullback, it could last a couple months. This is because the April buy climax has been unusually extreme.

- When there is a reversal from an extreme buy climax, the profit taking often leads to a pullback that is deeper, and lasts longer that most pullbacks. Since most pullbacks over the past year were only a week or two, the next one will probably last longer, like last year’s September/October pullback.

- Because the bull trend has been so strong, the bulls will buy the pullback, even if it is more than 10%.

- Today is Friday so the Emini might have a move in the final hour to test support or resistance on the weekly chart.

- After 4 consecutive bull bars on the weekly chart, and with the Emini now below the open of the week, it will probably close below the open of the week.

- Other magnets below are last week’s low and the 4,100 Big Round Number.

- The bulls want the week to close at a new all-time high, but that is unlikely after yesterday’s selloff.

Overnight Emini Globex trading on 5-minute chart

- The Emini is up 4 points in the Globex session.

- Yesterday had a strong selloff, and then it entered a trading range.

- Yesterday ended with higher low major trend reversal. The bulls hope today will trend up.

- The bears want any rally to turn down from below yesterday’s high. That would be a lower high major trend reversal.

- Yesterday was a big outside down day.

- The day after a big outside day is often an inside day.

- Therefore, if there is a selloff, there is an increased chance that it will reverse up from above yesterday’s low.

- There is an increased chance that a rally will reverse down from just below yesterday’s high.

- The day after a big outside day usually does not break far above or below that day. Therefore, there will probably be buyers not far below yesterday’s low, and sellers above yesterday’s high.

- What about yesterday’s news on a tax hike? The market factored that in yesterday.

- However, yesterday’s selloff was a Major Bear Surprise. That increases the chance that it could be the start of a swing down. Traders today will decide if it is the start of a pullback or just a 1-day bear trap.

- Even with that increase in probability of a selloff on the daily chart, the odds are always greater that the Emini will stay sideways until there is a strong breakout with follow-through.

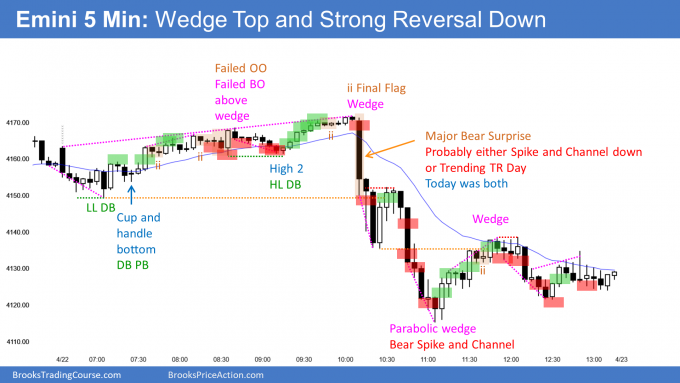

Yesterday’s Emini setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

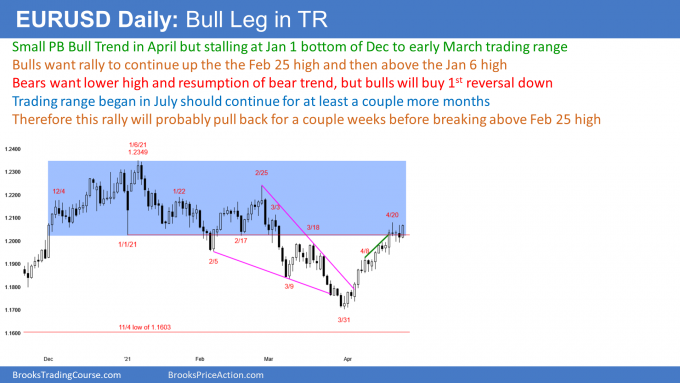

EURUSD Forex daily chart

- So far, today is big bull day closing near its high. Bulls want resumption of Small Pullback Bull Trend after 3 sideways days.

- Yesterday was an outside down day (it traded above Wednesday’s high, and then below its low), but it closed in the middle, and therefore was not particularly bearish.

- The EURUSD is in the middle of a 9-month trading range, and testing the bottom of a 3-month trading range.

- The 3-week tight bull channel has had 3 or more small legs up. This is a parabolic wedge buy climax.

- It is at the resistance of the bottom of the December to February range, and the 3 past days have had prominent tails on top. There is a 50% chance it will pullback from here, and a 50% chance it will successfully break above the resistance, and test the next resistance, which is the February 25 lower high.

- A Small Pullback Bull Trend is a strong bull trend. Once there is a pullback, it is often more sideways than down.

- Trading ranges resist chance. The 9-month trading range will probably continue for at least a couple more months.

- Today is Friday and weekly support and resistance can be important, especially at the end of the day.

- The bears want the week to close below the midpoint, and below the January 1 low, but they will probably not succeed.

- The bulls want the week to close on the high and far above the January 1 low. Today is currently at the high of the week. That increases the chance of at least slightly higher prices next week.

- If next week is a 4th consecutive big bull bar, the rally should continue up to the February 25 lower high.

Overnight EURUSD Forex trading on 5-minute chart

- Rallying in a Small Pullback Bull Trend since the US session start.

- Day traders have only been buying, and they have been swing trading.

- The day’s range is about the size of an average day. That typically reduces the chance of the rally continuing much higher.

- The bulls do not need it to go much higher. Simply having it stay around the high will create a strong bull bar on the daily and weekly charts, which would increase the chance of higher prices next week.

- Day traders should not sell until the strong rally evolves into a trading range. They should wait until there is at least a 20-pip pullback before considering to sell.

- If the rally converts into a trading range, there will only be a 20% chance of a trend reversal. Therefore, bears should only scalp.

- Even if it converts into a trading range, day traders will continue to buy, but they will switch to scalping.

- Unless there is a series of strong bear bars, day traders should focus on buying.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

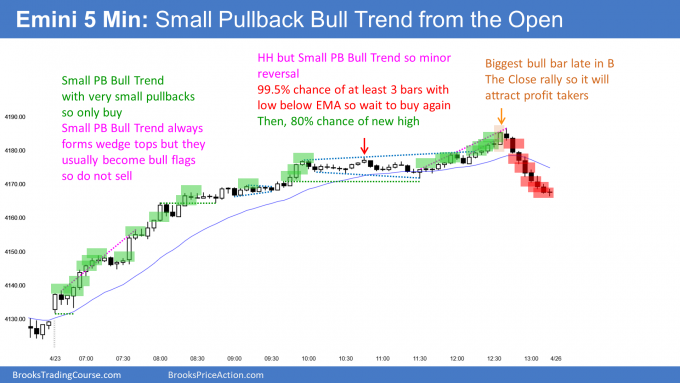

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

- Small Pullback Bull Trend From The Open that broke above yesterday’s high and to a new high.

- There were at least 3 bars with lows below the EMA, which happens 99.5% of the time, even in the strongest bull trend days, like today.

- There was a 20 Gap Bar buy setup that led to a new high, which usually happens.

- Late selloff down to open of the week, but closed above the open of the week. This was the 5th consecutive week with a bull body, which is rare.

- Small chance of gap up on Monday to new all-time high. There would be a gap on the daily and weekly charts.

- Because today was so climactic, there is a 75% chance of at least a couple hours of sideways to down trading on Monday that starts by the end of the 2nd hour.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.

Hi, Al. I looked everywhere in your books about the “Everyday there’s a 99.5% chance of 3 bars with lows below the EMA, even in the strongest bull trend days, then 80% chance of new high” and I couldn’t find anything. Is this a “new” thing you realized after you wrote the books? If so, is there any place I can find more of these useful pieces of information since they’re not in the books? Thank you very much.

Al. Any plan for a bitcoin update? My take is a daily wedge buy climax. April 13th was a nice bull trap, exhaustion gap bar. Now working back down to the bottom of the daily channel, March 1st low and weekly 20 simple magnet. Since going up strongly on the monthly chart, expecting a trading range/bull flag with a 60k test before a endless pullback/bear trend. Thanks for the help! Erik

I might write something soon. Everyone knows that Bitcoin has had very big selloffs since it started, and each one led to a new high. Traders expect that again, especially since there is now a lot of institutional buying. Traders believe that the institutions will be quick to buy, which will prevent a 50% or more selloff.

While I think this is not the beginning of the end of Bitcoin, I think it is a mistake to assume that the institutions will soon buy and that the pullback will end soon. Anyone buying here has to be a HODL buyer because Bitcoin could easily drop to 20,000 before testing the old high.

Big stops mean that a trader has to trade small. It is better if they can trade small enough to allow scaling in lower.