Emini and Forex Trading Update:

Wednesday September 30, 2020

I will update again at the end of the day.

Pre-Open market analysis

The Emini reversed up from a small wedge bottom last week on the daily chart. It normally would have at least a small 2nd leg up. However, with the insanity of last night’s presidential debate, the swing down might resume today. The country might be so distracted and angry that they might not be willing to buy right now, at least at the current price. We’ll find out today.

If today is not a huge bear day, the bulls will probably get at least a small 2nd leg sideways to up. But if today is a huge bear day, the 3-day rally might be forming just another lower high in the 4-week bear trend.

I said yesterday that the pullback did not reach the 60-minute EMA. I further said that it might have to get down there before the bulls can get a 2nd leg up to the September 16 lower high.

Whether or not the rally continues up to above 3400, traders should expect the Emini to fall below the July 30 low at the bottom of that streak of 9 consecutive bull bars in early August. Consequently, the upside from here should be small, and the rally will likely end within a week or so, if it did not already end with the debate.

Overnight Emini Globex trading

The Emini is down only 3 points in the Globex market after selling off strongly from last night’s debate. So far, the technical factors are more important than the debate. As I said above, traders expect a 2-legged rally up to the top of the small wedge on the daily chart. As long as today is not a big bear day, that is still what is most likely.

Most of the trading over the past 2 days has been sideways. Since the Emini should work up to above 3400 over the next week, day traders will be looking to buy selloffs, hoping for a resumption of Monday’s rally.

Even if today is a 3rd consecutive sideways day, the daily ranges have been big. Therefore, day traders would expect at least one or two swing trades, even if today is a 3rd trading range day.

Can today be a huge bull or bear trend day? Any day can be. If there is a strong trend, up is more likely because the reversal up from the wedge bottom has not lasted as long as it should after a 3-week wedge. Also, it has not yet reached the start of the wedge, which traders expect it to do.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

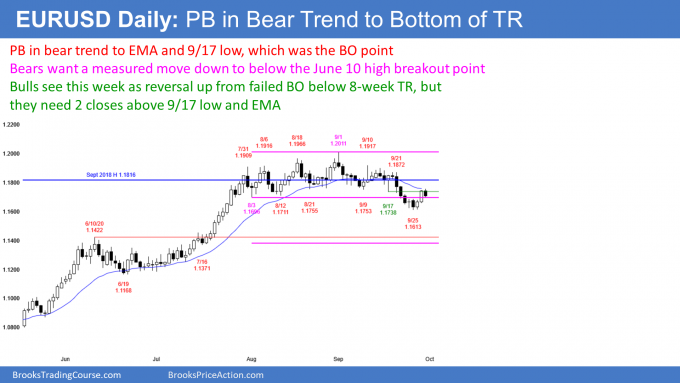

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has been trending down in September after a strong 4 month rally. This week pulled back to the breakout point at the bottom of an 8-week trading range.

Traders are deciding if the bear trend will continue down to support below. Unless the bulls get a couple closes above the September 17 low and the EMA, traders will expect the EURUSD to fall for about a measured move.

Furthermore, the July rally broke strongly above the March 9 and June 10 highs. Those were the breakout points at the top of a yearlong trading range. The EURUSD might now be working down to test those breakout points, which are about a measured move down.

The bears need follow-through selling on the weekly chart

The weekly chart is more important at the moment. Last week was a big bear bar closing on its low. It was a strong reversal down from a wedge rally to resistance.

This week is the follow-through bar. If it has a bear body, traders will see this week as confirmation of the reversal down. That will increase the chance of lower prices.

But if this week has a bull body, traders will wonder if last week’s bear breakout will fail. This is especially true if this week closes on its high.

If this week has a small bull body, traders will expect at least slightly lower prices, but they will see the selloff as just a pullback to the breakout points in the 5 month bull trend.

Overnight EURUSD Forex trading

The 5-minute chart of the EURUSD Forex market rallied strongly yesterday to just above the September 17 low and the EMA. However, so far, today sold off from that resistance. Today is currently a bear body on the daily chart.

If today closes near its low, today will be a sell signal bar on the daily chart for a Low 1 bear flag. It would increase the chance of lower prices. However, the bears really need the week to close below the open. Then, this week would have a bear body on the weekly chart. That would confirm last week’s bear breakout and increase the chance of lower prices next week.

Even though the EURUSD has trended down overnight, the selloff has not been strong. Day traders have been making money buying reversals up as well as selling small rallies.

The key today will be the close. If the bears can get the day to close near its low, today will be a good sell signal bar on the daily chart. That would increase the chance of tomorrow and Friday selling off back to below the open of the week and therefore having a bear body on the weekly chart. But if the bulls can get today to close in the middle or back near the high, the EURUSD will probably be sideways to up tomorrow.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

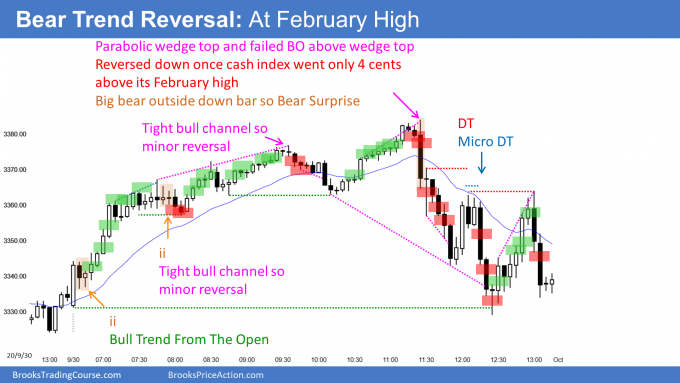

End of day summary

The Emini today rallied in a Bull Trend From The Open to above the February high and then entered a trading range for a couple hours. After the cash index went 4 cents above its February high, the Emini reversed down 27 points in 6 minutes! Of course there must have been news, but this was really just technical. I and other traders saw the February high as important resistance. The selloff continued to a new low of the day.

I have been saying in the chat room for a few days that the Emini was likely to pull back to the 60 minute EMA this week. Today’s collapsed down to it. Although it bounced for 30 minutes, the day returned to the low by the close of trading.

The Emini probably did not adequately test the September 16 lower high. Therefore, even though today is a reversal bar on the daily chart, there are likely buyers not far below today’s low. The Emini might pull back for a day or two, but traders should still expect it to test the September 16 lower high.

Unless the Emini breaks strongly above the September 16 lower high, traders will continue to expect it to break below last week’s low and the bottom of the 9 consecutive bull bars in July/August before making a new high.

Final trading day in September

Today was the final day in September. September was an outside down month and it had a big bear body. This is good for the bears and it increases the chance of another month or two of sideways to down trading.

However, September closed in the middle of the month’s range instead of on its low. Also, it followed 5 big bull bars. Therefore, the bulls will buy the 1st reversal down. This is true even if the Emini retraces half of the rally.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.