Emini and Forex Trading Update:

Tuesday June 25, 2019

I will update again at the end of the day.

Pre-Open market analysis

By trading below Friday’s low, the Emini triggered a minor sell signal yesterday. The downside is small because the bull channel is tight. It could pull back to the tight trading range around 2900 over the next week.

However, the Emini has been sideways for a 3rd consecutive day. It might continue sideways into the China trade talks at the end of the week.

There are only 4 trading days left in June. The bulls have already achieved their goal of creating a buy signal bar on the monthly chart. This is because June is now the 2nd consecutive outside bar in a bull trend. The bulls would like June to close at a new all-time high on the monthly chart. If it closes near the high of the month, it will be a higher probability buy signal bar for July.

Overnight Emini Globex trading

The Emini is down 4 points in the Globex session. Traders are deciding if the Emini will pull back from here or have 3rd leg up on the 60 minute chart before pulling back. Because the month-long bull channel is tight, sideways to up is still more likely than down. Consequently, today will probably be another trading range day rather than a bear trend day. This is true even though yesterday triggered a sell signal on the daily chart.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

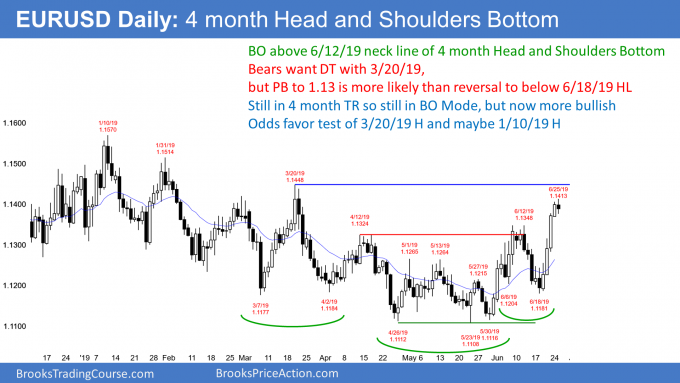

The EURUSD daily Forex chart has rallied strongly above the neck line of its head and shoulders bottom. I said that it would probably test the March 20 lower high and then pull back to below the 1.13 neck line.

It is now in the vicinity of that high. It should pull back to below the April 12/June 12 double top within the next week to test the 1.13 breakout point. Since the chart is still in a trading range, traders expect overshoots and undershoots. Therefore, the chart will likely close the gap above that double top.

In addition, it will probably break above the March 20 high within a couple weeks as well. It can do that before or after the pullback to 1.13.

I continue to make the point that the chart is still in a trading range. While it is now also in an early bull trend, that bull trend still has a 50% chance of being only a bull leg in the 4 month range and not the start of a move up to the September 1.18 start of the yearlong bear channel.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart sold off 30 pips overnight from above yesterday’s high. After a 200 pip rally to near resistance, the bulls are taking some profits.

Because the bull trend was so strong, the bulls will probably buy the 1st 50 – 100 pip selloff. Consequently, the best the bears can probably get over the next couple days is a trading range.

But the overnight selloff was big enough so that bear day traders now can finally begin to scalp. Furthermore, the rally was climactic and now near resistance. As a result, the bulls will switch to buying pullbacks and scalping for 10 – 20 pips. Traders expect a trading range for a couple days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

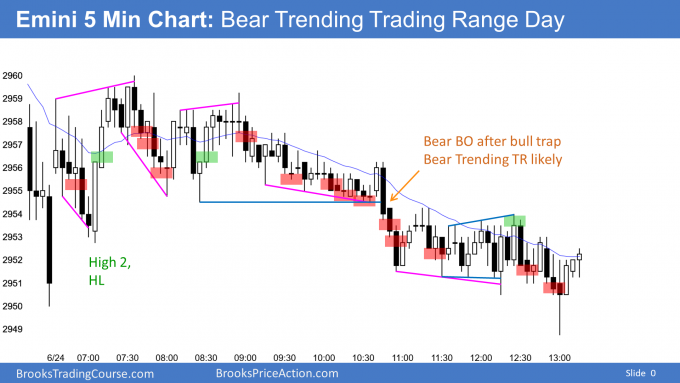

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini sold off in a Bear Trend From The Open. This is the 3rd day in its reversal down from above the September/May double top. It might continue down to below 2900 because there was a tight trading range there. That is a potential Final Bull Flag and therefore a magnet below.

A bear channel has a 75% chance of a bull breakout. Therefore, it is a bull flag. Traders should expect a break above the bear trend line at some point tomorrow and at least a couple hours of sideways to up trading.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, what was wrong by selling below bar 2? I saw it as a good follow through bar after the sell below 1. I also felt it was a good potential for a measured move down. I appreciate your opinion. Thank you.

Al, thanks for addressing my question about getting whipsawed with tight stops. I assume from your answer that using tight stops only works with stop entry swings, and that scalping requires scaling in. For example, I bought below 8, a second entry buy, expecting a 2 point scalp to the MA. Ordinarily I would have used a wide stop and been able to exit break even. A tight stop meant stopping out. I sold for a 2 point scalp below 14. It made 1, but not 2. With a wide stop I could have made a profit, knowing that if the short wasn’t immediately profitable, a wedge usually results in a trading range.

I don’t always scale into scalps. It depends on what the market is doing. For example, if I buy and there is a Bear Surprise Bar, I typically quickly exit and look to sell. This is especially true of the context makes a swing down likely. I only scale in if I believe that my initial entry might be early and that the pullback might need to go further before going my way.

Hey Al, now that we have micro products would you take longer term positions using them? or is there a reason that would be a bad idea? I know in the past you said that you use options for longer term positions but just wondering if you started using the micros for that

A big thanks for everything you guys do

Nick

I continue to use options, but I think that the micro Eminis are another good choice if a person did not want to risk as much as he would need to if he traded an Emini.

Hi Al,

I have a trade management question for you. I got short below bar 7 (L1). After bar 8 I moved my stop to 1T above bar 8 since it closed on its high and my target to Break Even, 1T below bar 7.

Was that the correct trade management after bar 8 (disappointment bar) or should I just have moved my stop above bar 8. Thanks

Daniel

In that case, had I sold below 7, I would also have put my stop above 8. When an obvious stop does not get hit, it is a surprise. That usually means lower prices. 9 was a Bear Surprise Bar and it therefore made lower prices likely.

It’s always okay to exit when you are disappointed. This was a special situation, but traders did not have much time to think about it. When that is the case, exiting is a good choice.