Emini and Forex Trading Update:

Wednesday November 25, 2020

I will update again at the end of the day.

Pre-Open market analysis

Yesterday gapped up and rallied from a higher high double bottom on the daily chart. It was a bull bar that closed on its high. Because the all-time high is only 6.5 points above yesterday’s high and yesterday rallied strongly, traders expect another attempt at a new high today. This is especially true with the Emini breaking above the day session all-time high in today’s Globex session. It did not break above the November 9 all-time Globex high.

Can today break far above the old day session high? Why not? Will it? Probably not because there have been so many reversals over the past 3 weeks, and most days have had a lot of trading range price action. However, the Emini will probably break at least a little above the all-time high today or soon.

Remember that tomorrow is Thanksgiving and there might be less interest in trading today. When I started trading back in the 1980’s, there were no computer algorithms. All trading was done in the pits with traders flashing signals to one another. The day before a holiday was usually small because lots of traders left early for the holiday.

That is less an issue today because most of the volume is now being traded by computer algorithms. There is more potential for today to be a normal day.

Overnight Emini Globex trading

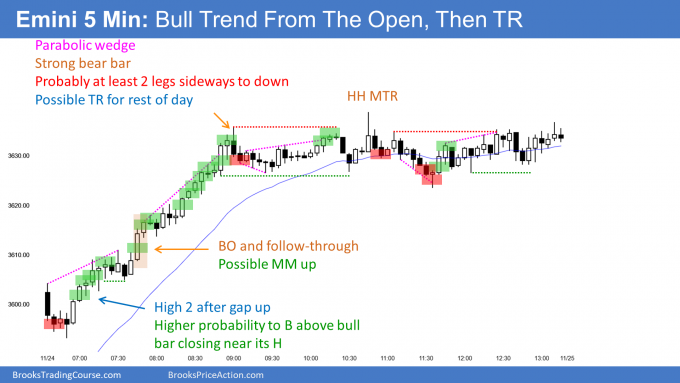

The Emini rallied strongly yesterday on the 5-minute chart and then went sideways. The bulls see the trading range as a bull flag. The all-time high and the Globex high are magnets above. Traders expect at least some trend resumption up today.

Because of yesterday’s strong bull trend and the magnets above, there is an increased chance of at least a 1 or 2 hour rally to above those magnets this morning. Also, there is euphoria over the election being settled, and markets sometimes break far above resistance. There is therefore an increased chance of a bull trend day.

Traders know that yesterday’s 4-hour trading range is a bull flag. But they also know that when a trading range has more than 20 bars in it, the market is getting close to neutral. The bears want a trend reversal down either from the tight trading range or from a bull breakout that fails. They want to see at least a couple big bear bars closing below the bottom of yesterday’s trading range to confirm the reversal down.

Because today is at a critical price on the daily chart, there is an increased chance of a trend day up or down. However, day traders know that most days in November have had a lot of trading range price action, and at least one swing up and one swing down. They are assuming that today will be like that unless there is a series of strong trend bars in either direction. If they get that, they will look for a trend day.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart today broke above yesterday’s ioi Breakout Mode pattern, and the September 10 top of the 3-month trading range. However, the breakout was small, and the EURUSD is currently trading back near the open of the session, and below the September 10 high.

So far, this is a weak breakout. While the bulls want today to close far above the September 10 high, their minimum goal is for today to close above the open. It would then have a bull body, and that would increase the chance that the bulls will try for the breakout again over the next few trading days.

The bears want the breakout to fail and for the EURUSD to reverse down to the bottom of the 4-month trading range. If today is a bear reversal bar closing on its low, traders will expect lower prices tomorrow. That would increase the chance of a reversal down.

Daily chart continuing to form new Breakout Mode patterns

The daily chart is repeatedly forming Breakout Mode patterns. Instead of the EURUSD breaking out of a pattern, the pattern evolves into another Breakout Mode pattern.

Since the daily chart is still in Breakout Mode, traders believe the chance of a bull breakout is about the same as for a bear breakout. They are unwilling to hold onto positions for more than a day or so as they wait for a breakout.

The bulls want to see a couple closes above the September 10 high and then above the September 1 high. The bears want to see a strong reversal down and then a couple closes below the November 11 low, and then the November 4 low. Until either of those breakouts forms, traders will continue to look for reversals.

Overnight EURUSD Forex trading

The 5-minute chart of the EURUSD Forex market broke briefly above the November 9 high at the top of the 3-month trading range overnight and then reversed down. Both the breakout and the reversal were small. Today so far is a small trading range day.

Because of the breakout to a new 3-month high, there is an increased chance of a conversion to a trend day in either direction. However, so far, day traders are scalping for 10 pips up and down. There is no sign that this is about to change before the end of the day.

The key prices are the open of the day and the November 9 high. The bulls want the day to close above both and the bears want the day to close below both.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

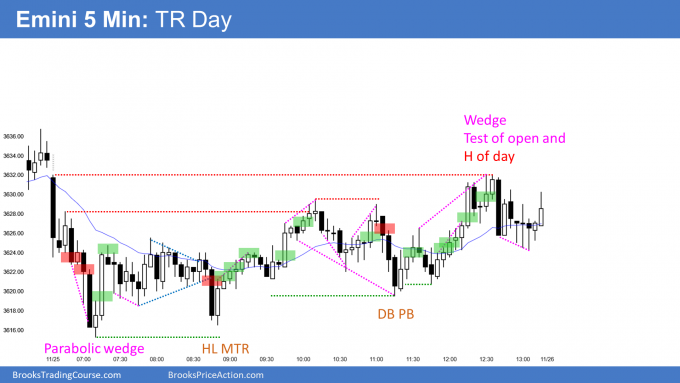

After yesterday’s rally, today was an inside day and a trading range day. It is both a buy and sell signal bar for Friday.

The Emini has been stuck for 2 days around last week’s high. Last week is a High 1 buy signal bar on the weekly chart. But it was a bear bar and therefore a weak setup. Yesterday went above last week’s high and triggered the buy signal. However, as I said was likely, there were a lot of traders looking to sell above a bad buy signal bar.

Friday has an early close. The day after Thanksgiving typically has a small range. If the bars on Friday are small and sideways for the 1st hour, the rest of the day will likely be quiet, and it will probably better to not trade.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Cody!

This comparison of gambling vs/trading is explained very well by Al in his book TPA-Reversals on pg 20-23.

I have to refer to Al’s own words and clear this common/popular misconception:

“Since trading is fun and competitive, it is natural for people to compare it to games, and because wagering is involved, gambling is usually the first thing that comes to mind. However, a far more apt analogy is to chess.In chess, you can see exactly what your opponent is doing, unlike in card games where you don’t know your opponent’s cards…In chess nothing is hidden and it is simply your skill compared to that of your opponent that determines the outcome.Your ability to read what is in front of you and determine what will likely follow is a great asset both to a chess player and to a trader.”

Thank you Al !

Thank you Edith! I appreciate you locating and sharing this info. To me, trading is like playing chess and fishing at the same time while riding an emotional roller coaster.

Hi Al!

My first post ever. I want to take this opportunity to thank you for your unwavering dedication and commitment to teaching us retail traders on how to trade and compete with the “big boys.”

Your hard work along with Richard is very much appreciated. Your trading course is hand down the “best in class.” You are also a great teacher and it shows in the work that you produce. Your passion for trading is contagious.

Now onto my question. I have friends and family that keep telling me I am a gambler since I day trader. Can you please offer some advice to counter their false accusation? Thanks in advance.

I look forward to writing you an awesome testimonial when I, “turn the corner.” I have NO doubt that will happen soon if I don’t quit and stick with your course and all the supplemental materials.

Have a great Thanksgiving and be safe! We need you back.

-Cody

Thank you for your kind words.

The gambler analogy was popular about a decade ago. The reason it went away is because the more people thought about it, they realized it was more of just a way to insult someone than an actual fact.

Day trading is no different from buying a rental house or a pizza parlor or buying GE and holding it forever. That is a gamble as well. All that is different is the time frame. Remember, 20 years ago, GE was the biggest company in the world, but it then lost 90% of its value. Buying it was a gamble.

The main difference between gambling and trading is that a casino makes the gambling rules and guarantees that it will have a mathematical advantage. You can not get an edge.

As a trader, whether a day trader or an investor, you can create a mathematical advantage. You can have an edge. That means that a good day trader or investor can consistently make money. But, it takes a lot of work.

Thank you Al! I understand that hard work is needed and the $$ I’m losing now is just tuition fees. Rome wasn’t built in a year…

-Cody

NgoLimit: Al has actually talked about this many times in his podcasts, Q&A and webinars. I’m surprised you missed it. I can’t remember which podcast has this in it, but i highly recommend listening and watching all these Ask Al series videos / audios, they’re all gold: https://www.brookstradingcourse.com/blog/ask-al/

Yes Jakub,

Cody – here is one of the Ask Al’s that talks about gambling (question 1):

Ask Al: Full trading room Q&A session

Thank you Richard! Appreciate the actual link!

-Cody