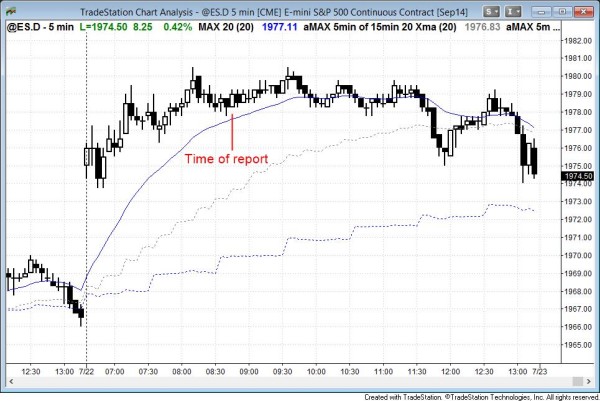

I posted this chart after the close. The Emini and stock market broke to a new all time high, but the breakout and follow-through were weak. The market entered a tight trading range. The bears were able to test the open of the day in the final hour, but the Emini worked back up into the tight trading range. Once the S&P500 cash index failed to close at a new all time high, the Emini sold off in the final three bars.

Posted 8:45 am PST.

The most important price action in today’s intraday report is the breakout to an all time high. However, the bars were small, there were no consecutive big bull trend bars, and the follow-through was weak. This increases the chances of a trading range or a trend reversal down.

At 8:10 am, the Emini turned down after a third push up, but the sell signal bar had a bull body and there was a seven bar bull microchannel. Since the rally is so weak, this might become the high of the day. The bulls want the small pullback bull trend to continue and to break out above this wedge top, and then rally for a measured move up. The bears want the wedge top to hold and for the market to fall to a new low of the day and then for a measured move down.

Until there is a strong breakout up or down, the market will remain quiet. It is currently still always in long and in a small pullback bull trend, but it will probably turn down and form a trading range soon because the rally is so weak and the market is at an important resistance level (the all-time high).

See the weekly update for a discussion of the weekly chart.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.