Stock market sideways before Gorsuch Senate nuclear option vote

Updated 6:53 a.m.

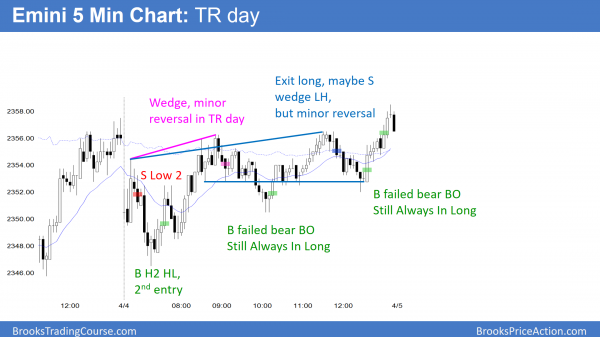

The Emini opened with a doji bar in the middle of yesterday’s final leg up. This is therefore a trading range open. In addition, yesterday was a Big Down, Big Up day. Consequently, traders are confused. This therefore further increases the chances of a lot of trading range trading. Finally, the Emini is in the middle of a 4 day and 2 month trading range. While any day can be a trend day, the odds are that the trading range trading will continue.

Both limit order bulls and bears made money in the 1st 4 bars. This is an additional sign of confusion. Because there was both a reversal up and down, the Emini is in breakout mode. Traders will therefore look for a breakout and measured move up or down for the initial swing. Because of the trading range behavior in a trading range setting, the odds are that the 1st swing will last 2 – 3 hours and then reverse. Less, likely, today will be a trend day.

Pre-Open market analysis

Yesterday sold off after a 2 day rally that looked like a leg in a trading range. Therefore, yesterday was the start of a bear leg in that trading range. Furthermore, the Emini is in the middle of a 2 month trading range. Consequently, it will probably be sideways this week. In addition, most days will continue to have both swings up and down.

Breakout mode

Even if the bulls succeed in breaking above the March 15 lower high, the odds still favor a bear channel on the daily chart. The bulls need a strong breakout above the March 15 lower high to convince traders that the bull trend has resumed. Without that, the Emini is still in a 2 month trading range. In addition, it is also in an early bear trend, with an important magnet 5% down at the December close.

Since this current rally is a test of the March 15 high, the Emini might be forming a double top with that high. Last week’s low is the neck line. If the bears get a strong break below last week’s low, a measured move down would be close to the target of last year’s close.

Overnight Emini Globex trading

The Emini is down 8 points in the Globex market. Today will therefore probably gap down. Since yesterday was a bear channel and a lower high, it was a bear flag. In addition, the 2 day selloff was in a tight bear channel on the 60 minute chart. Hence, yesterday’s reversal up was probably minor. Consequently, the bulls will probably need to test yesterday’s low before they will be able to create a major reversal.

The Emini has been in a trading range on the 60 minute chart since last Wednesday’s pullback. Since there is no sign of a breakout, the odds favor more trading range price action again today. Consequently, there will again probably be at least one swing up and one swing down. Traders do not yet know which will come first.

EURUSD Forex market trading strategies

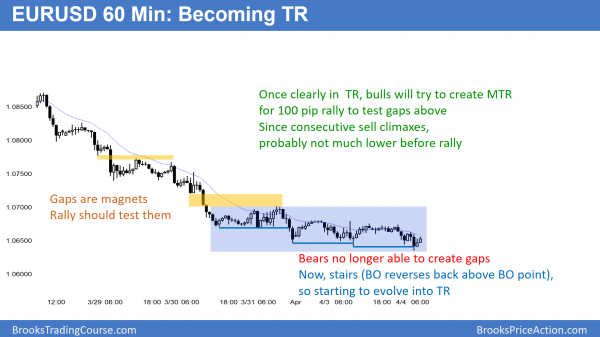

On the 60 minute EURUSD Forex chart, bear breakouts now reverse back above the breakout point. This is a stairs pattern and it usually means that market is evolving into a trading range.

The EURUSD Forex chart sold off strongly for 3 days. Yet, the selling has greatly weakened. Bears are now buying back shorts at new lows. They therefore are switching from swing trading to scalping. In addition, bulls are beginning to buy at the prior low. Hence, the bear trend is transitioning into a trading range. Since the selling has been in a series of sell climaxes on the 60 minute chart, it is unsustainable. Consequently, the odds favor a bear rally soon. The targets for the bulls are the gaps above, which begin at the lower highs. Hence, the EURUSD will probably rally at least 40 pips, and probably over 100 pips over the next 2 weeks.

Since the 6 day bear channel has been tight, the reversal will probably be minor. This means that it will probably lead to either a bear flag or a leg in a trading range. In either case, the bears will sell it because they know that the odds are, it will lead to a test down to the current low. At that point, the bulls will try to create a major trend reversal. As a result, they plan to continue the 5 month trading range.

After the bear rally, the bears will once again try for a breakout below the 5 month trading range, and below the 2 year range. Since most breakout attempts fail, it is more likely that the trading ranges will continue.

Overnight EURUSD Forex trading

The EURUSD Forex market continued its 3 day weak bear channel. The odds are that it is the start of a trading range. Hence, the EURUSD market will probably begin to trade up about 40 pips within a day or two. That will convert the bear channel into a trading range. While the trading range would be in a bear trend, The selloff has been climactic. Therefore, the odds favor a 100 pip rally over the next week or so.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range today. I left just before the close.

Today was a trading range day in the middle of a 2 month trading range. There is no sign of a breakout. Consequently, the odds favor another trading range day tomorrow.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

I am expecting a wedge reversal after the trend line break on the 4 hrs chart of e-mini. Please give your comments. Thanks a lot.

Because the Emini is in a trading range, the probability is 50% for the breakout up or down. I assume you are talking about a wedge top after 1 more new high. If so, I think that you are right. The odds are a test of the March 15 lower high. If so, that would create a wedge rally since March 22, and then a double top with the March 15 high. It will be interesting to see if there is a reversal or a breakout.

Thanks Al,

Exactly as you explained above , i am going short at wedge top today , Risk reward is in favor with small stop above mar 15 lower high. I hope the reversal happens on downside . I will add more if wedge is broken.

Al, in your overnight comment you mention yesterday was a bear channel and a lower high, which is a “bear flag”. I’m thinking bear channels are generally “bull flags”. Am I incorrect here?

Yes, a bear channel is a bull flag. The odds favor a bull breakout. Yet, on the daily chart, the bear channel is still early and if might be the start of a bear trend. The bears need a bear breakout.

In general, there is a 50% chance of a bear breakout below a bull flag when the market is in breakout mode. The daily chart is in a 2 month trading range and therefore in breakout mode.