The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

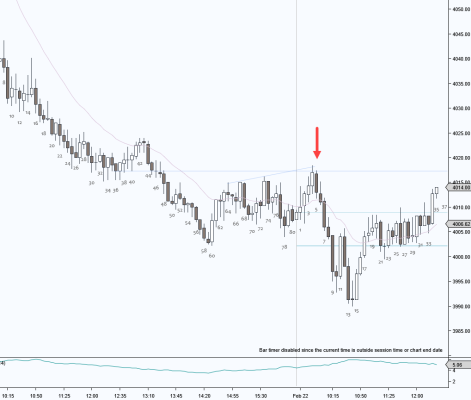

There's often questions about how much of previous day's PA to use for next day session analysis. Al says the last hour is often a good indicator of what's to come the next day (unless there's a big gap up/down). Here's a good example (RTH) of a wedge during the last hour of Y influencing the open. If anyone else is keeping track of these please post here so we can build a collection of such examples.

----------

BPA Telegram Group

Is this last hour only or anything prior day

I should hope that it is anything prior day(s). As I understand, Al has mentioned a few times that the markets are fractal. He even mentions in the encyclopedia that a Broad Channel on a 5 minute lasts for days sometimes.

I should hope that it is anything prior day(s). As I understand, Al has mentioned a few times that the markets are fractal. He even mentions in the encyclopedia that a Broad Channel on a 5 minute lasts for days sometimes.

Yes, exactly. Going back any number of days, weeks, months to find prior levels is just standard BPA so that's always going to be in play. But the last hour of Y seems to have added significance being the most recent. For example, if prior day ended in TR and today opens inside it then the market is likely to continue in TR breakout mode testing its highs and lows. If Y closed as small pullback trend into EOD then today is likely to have at least some FT on the open. I believe Al mentioned often buying calls or puts and holding them overnight and exiting on the open the next day as a way to play this.

Thank you for adding the charts. Would you mind adding comments with the charts too to make it easier to see exactly what to look for? Thanks!

Another example where there was no gap on the open and formed a wedge with yesterday's price action for a sell setup on bar 5 or 6 at resistance.

________________________________________________

BPA Telegram Chat

Thank you Mr. Carpet. I appreciate your words.