Market Overview: DAX 40 Futures

DAX futures hit a new All Time High on Wednesday and then again on Friday. It’s strongly bullish but also at the top of an expanding triangle, so far away stop, traders should consider trading another timeframe where they can manage risk more easily. But until the bears do something, the bulls can keep buying and holding. Bulls need a follow-through close to make traders believe we can break out of this whole range above.

DAX 40 Futures

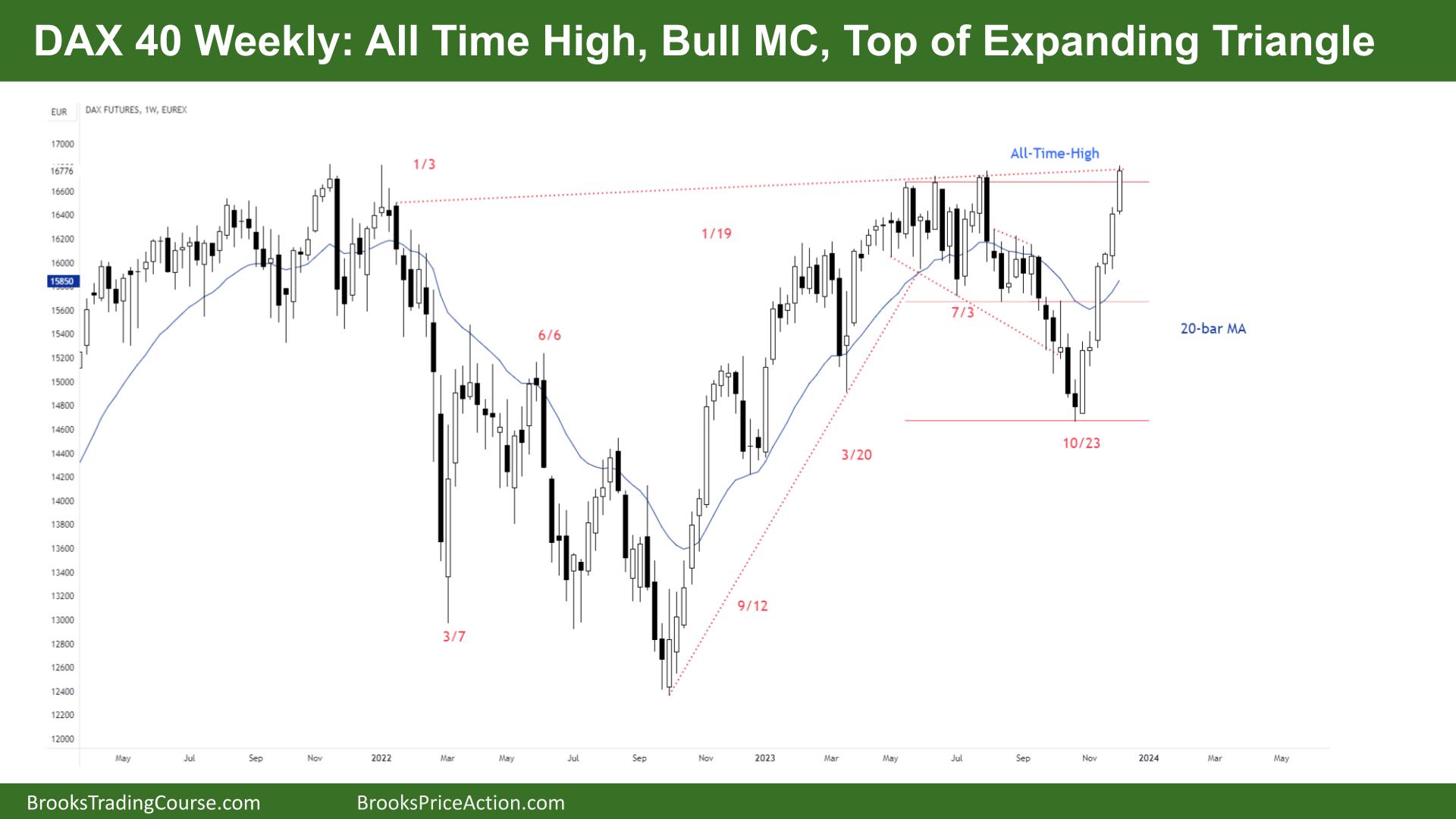

The Weekly DAX chart

- The DAX 40 futures was an All Time high, a big bull bar closing on its high, so we might gap up on Monday.

- Always in long and nothing to sell, so either long or flat.

- Good bull bar, so we trigger another buy signal when we trade above it next week.

- The bulls see a bull microchannel and expect the first pullback- a bar going below the low of a prior bar – to fail and become a buy setup.

- The bears know the first reversal is likely to be minor. But they see an expanding triangle and a deep pullback, so there are likely sellers above the highs.

- It was a wedge top and trapped stop entry bulls up here, so trapped traders have a chance to get out.

- Stop is far away, so the probability is up. Traders should expect some profit-taking in this area.

- Bulls want a follow-through bar to convince traders they should participate.

- Bears might wait for an overlap bar, a signal the spike has ended and a channel is forming.

- Six bars in a row is climactic, so there should be a pullback soon. See November 2022 for what happens after a 6-bar bull microchannel.

- Most traders would expect a second leg of some sort after this kind of strong move.

- Bears want the breakout to fail above this high, so by the end of the month, they want the monthly bar to have a big tail.

- Expect sideways to up next week.

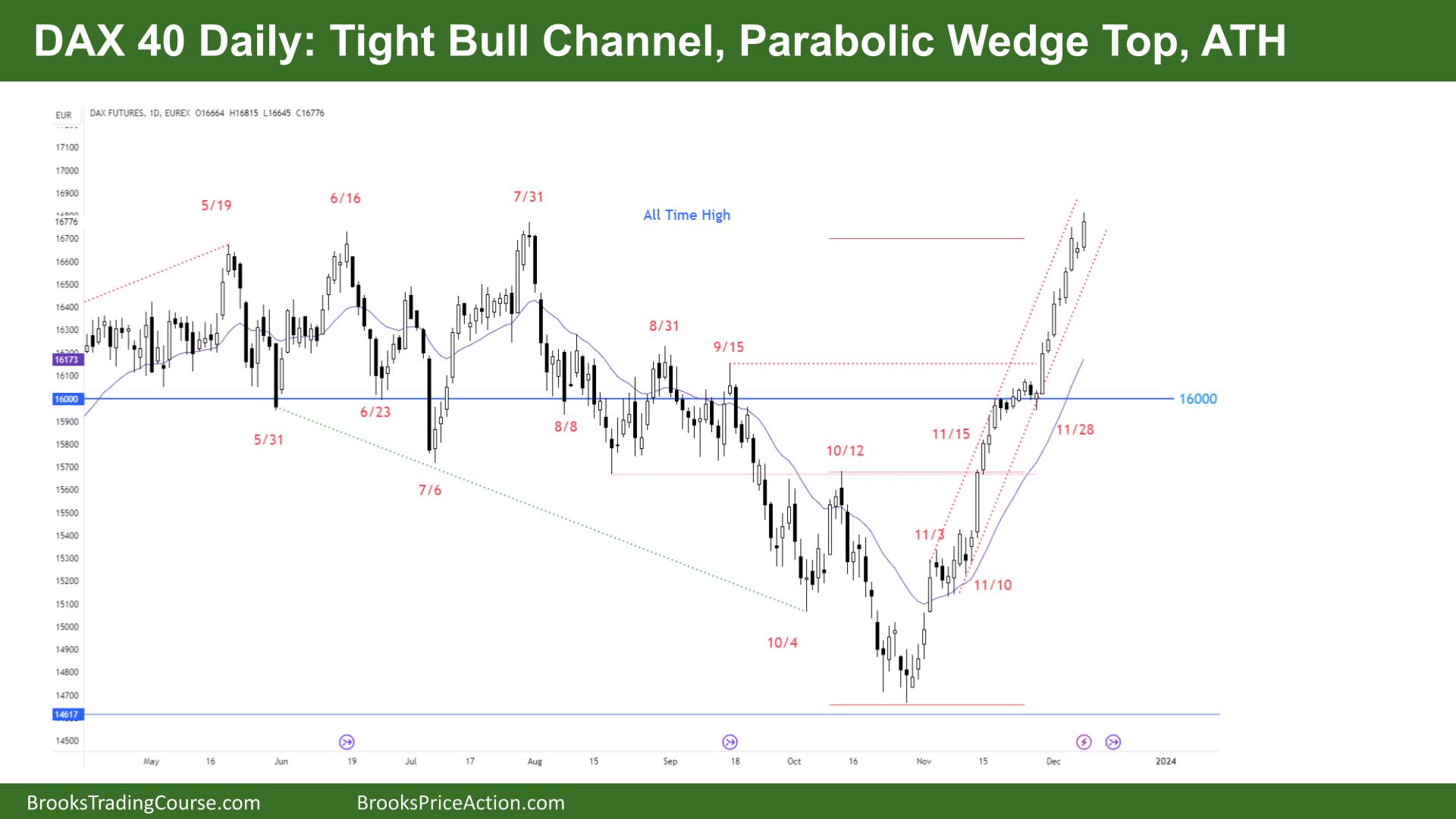

The Daily DAX chart

- The DAX 40 futures was a strong bull bar on Friday, a new ATH, so we might gap up on Monday.

- It’s a tight bull channel, so there’s nothing to sell and no bear bars in 9 bars – so climactic, and we should pull back soon.

- Bulls might get one more climax bar to hit a trendline for traders to take a profit.

- Some traders expect the first reversal to fail and won’t exit below a bear bar.

- Dojis are a sign of pauses, and the market has had several pushes, so traders will likely stop buying highs. We might need two legs sideways to down to the MA for bulls to buy again.

- The first time the bears do anything, they will likely be bought. First bear bar? Traders buy. Is it the first bear bar with a good close? Traders buy.

- There is nothing to sell for bears, but they might start scaling in after a bear bar gets a breakout, or they can get a scalp below.

- Limit order bulls have been unable to buy below a bar, which usually forces them to buy high or stall the trend. Traders should quickly get out below a bear bar closing below its midpoint.

- Another buy signal for Monday, and expect limit order traders to buy below the low of a prior bar. It will be interesting to see whether the bears can get one bear day next week.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.