Market Overview: Crude Oil Futures

Crude oil bear breakout below the inside bar on weekly chart. The odds slightly favor Crude Oil to trade at least a little lower, possibly testing near the 11-week trading range low. Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction from the trading range. For now, if there is a breakout, odds slightly favor a breakout below.

Crude oil futures

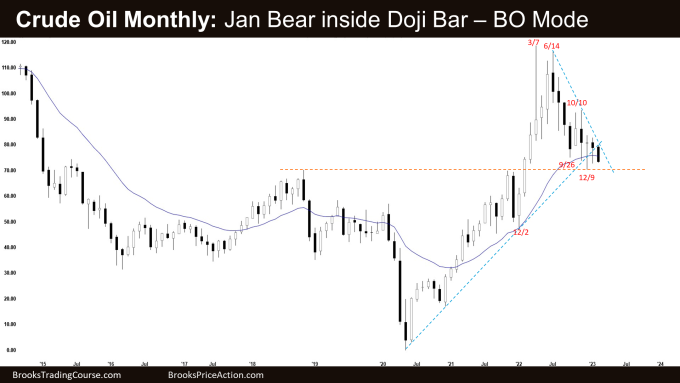

The Monthly crude oil chart

- The January monthly Crude Oil candlestick was a bear inside doji bar closing in the upper half of the range with a long tail below.

- Last month, we said that since the bears were not able to create follow-through selling in December, odds slightly favor crude oil to trade at least a little higher.

- January traded sideways around the 20-month exponential moving average.

- The bears got a strong reversal down in June 2022 followed by a sideways trading range around the 20-month moving average.

- They want a breakout below the 5-month trading range, completing the wedge pattern with the first 2 legs being September 26 and December 9.

- The move down since June is in a tight channel, which means the bears are stronger. The bears currently have a 3-bar bear micro channel.

- The last 3 candlesticks had prominent tails below. The bears will need to create consecutive bear bars closing near their lows to increase the odds of lower prices.

- The bulls want a reversal higher from a lower low major trend reversal (Dec).

- They see the move down since June simply as a deep pullback following the buy climax and want a retest of the June high.

- However, they have not yet been able to create credible buying pressure.

- Since January was a bear inside doji bar, Crude Oil is in breakout mode. The bulls want a breakout above its high while the bears want a breakout below it.

- The first breakout from an inside bar can fail 50% of the time.

- Sometimes, the bar after an inside bar is another inside bar, forming an ii (inside inside), which is also a breakout mode pattern.

- For now, because of the tight channel down and the lack of buying pressure, odds slightly favor Crude Oil to trade at least a little lower.

- Traders will see if the bears can create a strong breakout below January and December low, or if the Crude Oil trades slightly lower, but reverses back into the 5-month trading range.

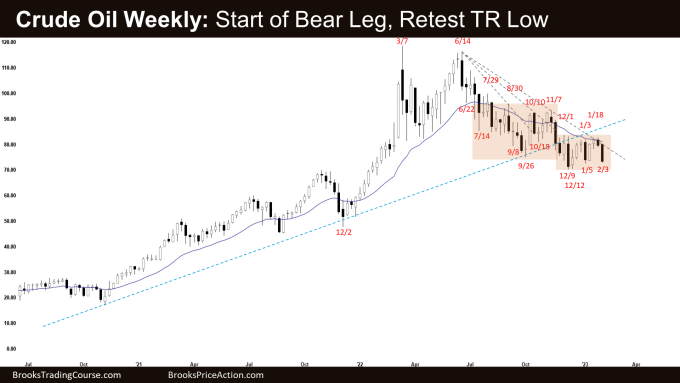

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a big bear bar closing near its low.

- Last week, we said that the odds slightly favor a breakout below the bear inside bar. If the bears create a consecutive bear bar, it could be the start of the bear leg to test the bottom of the 10-week trading range.

- The bears manage to get a strong breakout below the inside bar.

- Previously, the bears got a reversal lower from a double top bear flag (October 10 and November 7) breaking below the September low. However, they failed to get follow-through selling.

- The bears want another leg down breaking below the December low, and completing the wedge pattern (the first two legs being Sept 26 and Dec 9).

- This week, they got a reversal down from a double-top bear flag (Dec 1 and Jan 18).

- The bottom of the 11-week trading range is close enough and may be tested in the next couple of weeks.

- The bulls want a failed breakout below the September low and the bull trend line.

- They got another leg higher to retest the December high from a higher low major trend reversal (Jan 5).

- However, the bulls were not able to break above the 11-week trading range high, the 20-week exponential moving average and the bear trend line.

- The bulls hope that this week was simply a deep pullback and wants a reversal higher from a double bottom bull flag (Jan 5 and Feb 3).

- Since this week was a big bear bar closing near its low, it is a good sell signal bar for next week. It is a weak buy signal bar.

- The odds slightly favor Crude Oil to trade at least a little lower, possibly testing near the 11-week trading range low.

- The last 11 candlesticks are overlapping sideways. That means Crude Oil is in a small trading range.

- Poor follow-through and reversals are more likely within a trading range. Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- For now, if there is a breakout, odds slightly favor a breakout below.

- Crude Oil could be forming a trending trading range. This remains true.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

I just saw that you do this post on crude oil. I never knew. I trade crude exclusively. Hope you guys keep it up!

Dear Chris,

A good day to you.. looking forward to hear your input too..

Take care and wishing a great week ahead to you..

Best Regards,

Andrew

Hi Andrew, great analysis. I like the wedge idea and esp seeing it’s on the monthly and weekly. Leg 3 may aim at the Jan 21 low (double bottom) at circa 67. Lower then we’re in a monthly downtrend. Other that could be the low of a trading range 65 to 120. Daily 3rd attempt to go lower and chances are high of success this time.

Dear Tom,

A good day to you. Thanks for going through the report..

Yeah.. if the bears manage to get another leg down, could go reach those areas..

Let’s continue to monitor and see if the bears can get another leg down, and if yes, whether it turns into another small trading range below..

Wishing a blessed week ahead to you Tom!

Best Regards,

Andrew