Market Overview: Crude Oil Futures

Crude oil futures weekly candlestick was a breakout below trading range and the bull trend line closing near its low. The bears want a measured move down using the height of the September to November trading range which will take them to around $56. The bulls want a failed breakout below the September low and the bull trend line. They want a reversal higher from a lower low major trend reversal.

Crude oil futures

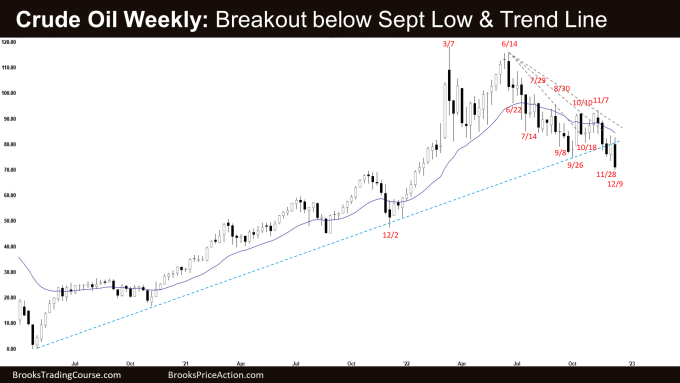

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a big bear bar breaking below the September low and the major bull trend line.

- Last week, we said that Crude Oil is in a trading range of around 74 and 94. Traders will BLSH (Buy Low, Sell High) until there is a strong breakout from either direction.

- The bears got a reversal lower from a double top bear flag (October 10 and November 7).

- They then got the second leg sideways to down retesting November 28 low and a breakout following last week’s pullback.

- The bears want a measured move down using the height of the September to November trading range which will take them to around $56.

- They need to create a consecutive bear bar next week to confirm the breakout below the trading range and the bull trend line.

- The bulls want a failed breakout below the September low and the bull trend line. They want a reversal higher from a lower low major trend reversal.

- They want next week to close with a bull body even though Crude Oil may trade slightly lower first.

- Since this week was a big bear bar closing near the low, it is a good sell signal bar for next week. It is a weak buy signal bar.

- Odds slightly favor Crude Oil to trade at least a little lower.

- Traders will see if the bears get follow-through selling or if next week trades lower first, but reverse to close with a bull body with a long tail below.

- If the bears get a follow-through bear bar especially if it is strong, the odds of a successful breakout increase.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) which will likely provide a floor on price at some point and prevent a catastrophic sharp crash. (Source: US to complete 180 million barrel drawdown…)

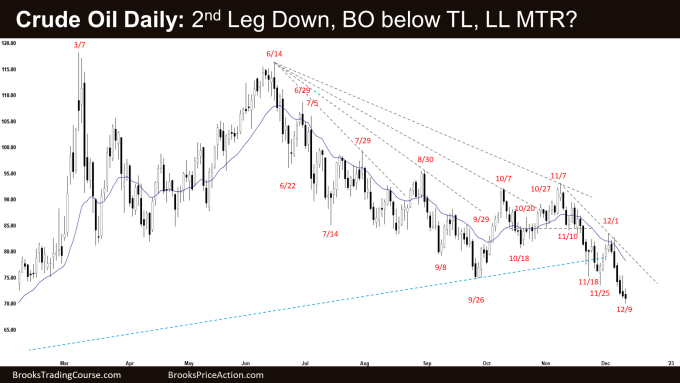

The Daily crude oil chart

- Crude Oil traded slightly higher on Monday but reversed into a big outside bear bar. It then traded lower for the rest of the week.

- It broke below the September low and the bull trend line with follow-through selling.

- The bears got a reversal lower from a double top bear flag with October 7 high.

- This week, the bears got the second leg sideways to down breaking far below the major bull trend line and September low.

- The bears got 6 consecutive bear bars since December 1. That means strong bears.

- That increases the odds of at least a small second leg sideways to down after a pullback.

- Bears want a measured move down based on the height of the trading range which will take them to around $56.

- The bulls want a failed breakout below trading range and the major bull trend line.

- They want a reversal higher from a lower low major trend reversal and a wedge bottom (Nov 18, Nov 25 and Dec 9).

- Because of the tight bear channel down, the bulls will need a strong bull reversal bar or at least a micro double bottom before they would be willing to buy aggressively.

- For now, odds slightly favor Crude Oil to trade at least a little lower.

- If there is a small pullback (bounce), odds favor at least a small second leg sideways to down after the pullback.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) which will likely provide a floor on price at some point and prevent a catastrophic sharp crash. (Source: US to complete 180 million barrel drawdown…)

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Good review Andrew. The mon,y suggests a price target of approx 63 (below Dec 21) but support at 74 so I expect a small bounce soon. I dont think leg 3 is complete on the weekly – approx 74. Daily I see what you mean on the wedge but I think only 2 legs done. Target is both lows Dec 21 – so ultimate approx 64 in cash mkt

Dear Tom,

A good day to you.

I agree.. so far it only looks like 2 legs overall..

The wedge I referred to was a weak wedge, but bulls still hope that would work..

A better looking wedge would have Nov 25 and Dec 19 for the first 2 legs..

Thanks for your input as usual.. have a blessed week ahead!

Best Regards,

Andrew

Looks like the bears lost quite a bit of momentum the last two days, especially Friday with that prominent tail below. Weekend short covering or perhaps that bounce is getting close?

Dear Andrew,

A good day to you again.

The second leg is climactic, but because the leg is also strong, the small pullback may be soon, but we will likely have a small second leg sideways to down after the pullback..

Let’s see how it plays out next week.

Take care and have a blessed week ahead!

Best Regards,

Andrew