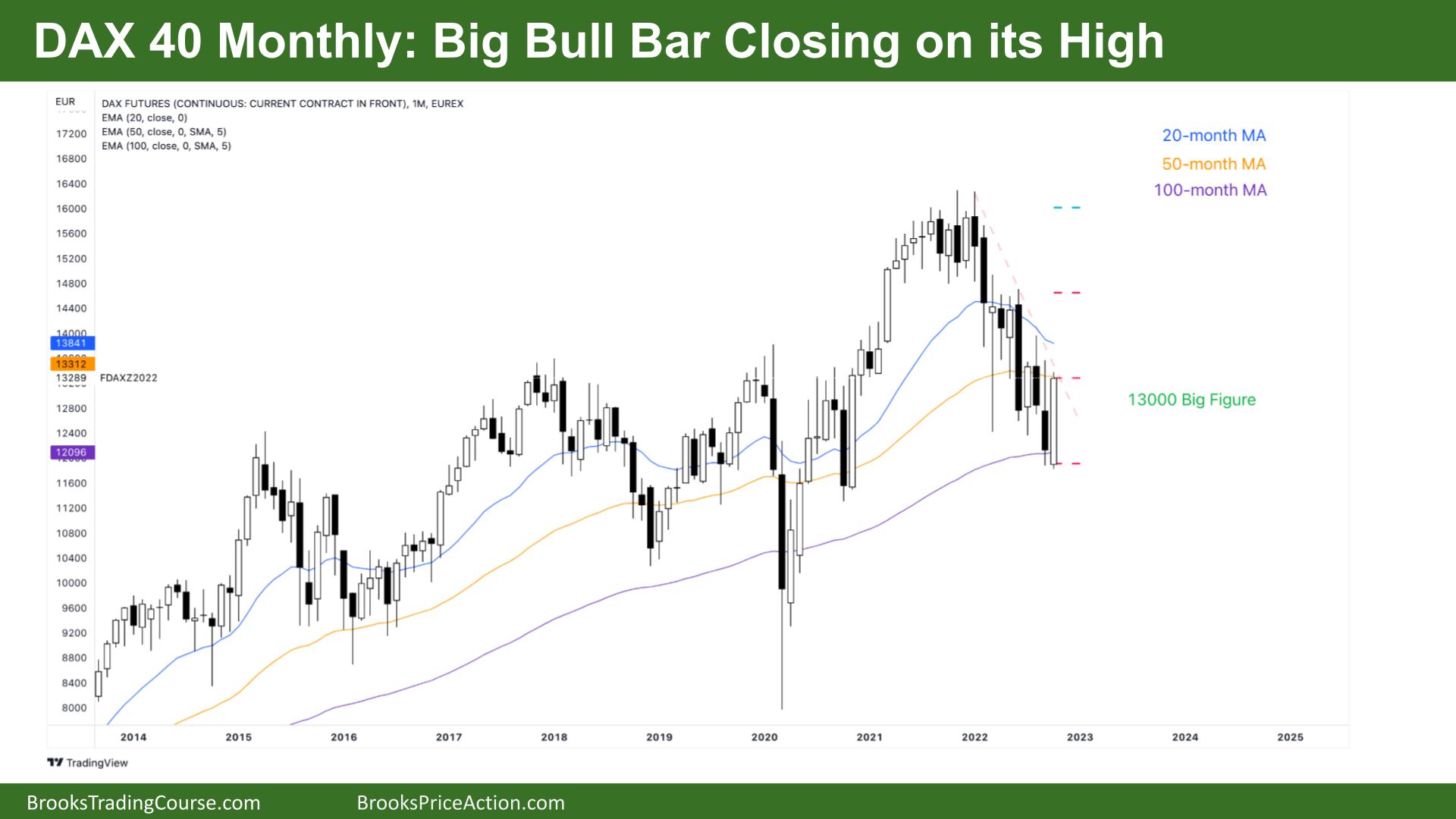

Market Overview: DAX 40 Futures

DAX futures moved higher last month with a Dax 40 big bull bar strong reversal closing on its high. The bulls see a pullback on the longer term timeframe and a second reasonable buy setup. The bears see a tight bear channel and are looking to sell again, seeing this as the first of two legs. Expect sideways to up next month.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a big bull bar closing on its high last month so that we might gap up.

- For the bulls, it is a second entry buy setup. A second entry is a higher probability signal.

- The bulls want a High 1 buy, a follow-through bar and many bulls will wait to see how next month closes before buying above. The bulls see a bull channel and a pullback, and a trend resumption.

- The bulls also see a possible parabolic wedge down and will look to buy lows betting it won’t go much lower.

- The bears see a tight bear channel and see last month as a pullback. They are selling above the highs of bars, but after such a strong bar, they might see the next bar before scaling in short.

- The bears expect the first reversal to be minor.

- Stop bulls are waiting; limit bulls were buying the lows of bars and will look to buy a 50% pullback or even below this bar if they get a chance.

- Stop-entry bears were on a swing down but might exit above this month’s bars. Limit bears will sell new highs.

- Price has been going sideways for a few months here at the 13000 Big Round Number, and that might be a magnet for traders going forward.

- Bears should exit above this month’s bar, and bulls can get long, although, with the moving average above, it might be better to wait for a follow-through bar and look to buy above that or below the low of any prior bar as it goes up.

The Weekly DAX chart

- The DAX 40 futures was a big bull bar with a small tail above and a large below, so it is a weak buy signal for next week.

- It is the fifth consecutive bull bar and a 5-bar micro channel, so traders will buy the first reversal down and likely the first bar to trade below the low of a prior bar, expecting a second leg.

- The bulls see we are always in long after a lower low major trend reversal, a trendline break, and want a higher low to buy for a measured move up.

- The bears see a broad bear channel and expect the bull legs to be strong enough to switch to always in, although most traders should only trade in the direction of the trend.

- The bears hit their measured move target and exited and put in a new low of the year. As long as the bears keep getting new lows, traders will not expect a bull trend rather than a trading range.

- This means traders will sell new highs and buy new lows – so should we.

- The bulls know 6 bars is climactic and will look to take profits above bars instead of using stop entries to enter. Bears will look to sell highs, but there is no sell signal for most traders to short.

- The bears see a possible double top, but in a spike, most resistance is broken through.

- The bears need either a bull climax bar or a bear bar closing below its midpoint, even then better to wait for consecutive bear bars before selling. It could be strong enough for 3 pushes up.

- Better to be long or flat. Bulls exit below a bear bar, closing below its midpoint.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.