Market Overview: DAX 40 Futures

DAX 40 bull breakout at the moving average (MA) so traders will decide next week where we go from here. The bears have been selling the MA since January and making money, and markets have inertia so we should expect selling above this week’s bar. But has the context changed? A 4-bull bar tight channel could be what the bulls need to get another leg above this range.

DAX 40 Futures

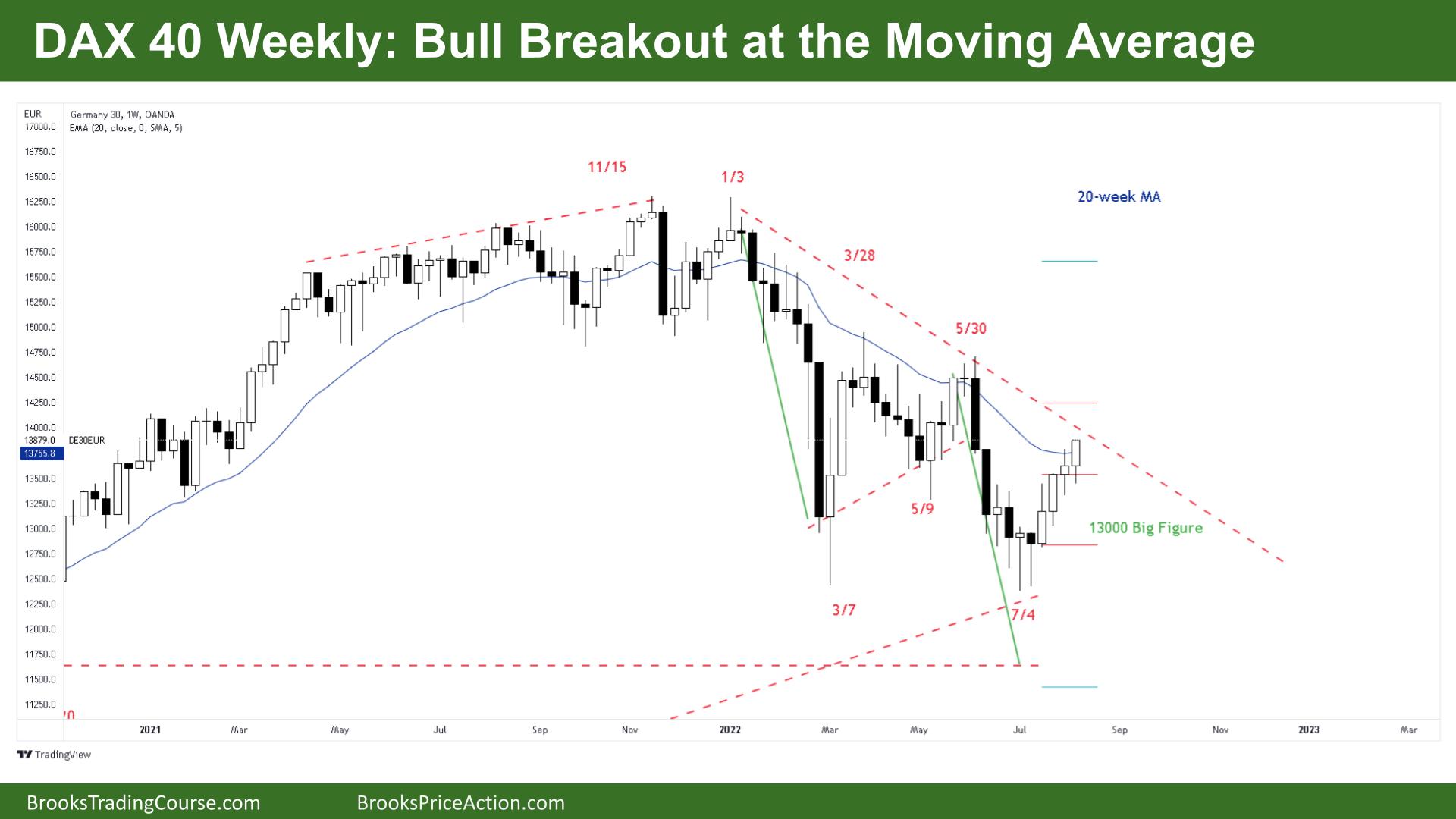

The Weekly DAX chart

- The DAX 40 futures was a bull bar closing on it’s high so we might gap up next week.

- For the bulls its a bull breakout, a 4-bar tight bull channel at the moving average. It’s been 5 bars since we went below the low of a prior bar so traders will likely buy the first reversal down.

- The bulls saw the double bottom, the higher low major trend reversal and expect 2 legs up, so they want another leg after this.

- Bears see a 50% pullback from a tight bear channel in June and will look to sell around the moving average like a Low 1 or Low 2 short, or a moving average gap bar sell.

- They see the 2 pushes in this current leg and might look to sell a third push as a possible wedge reversal.

- But its a trading range so likely traders will be disappointed. It could be another strong bull bar and collapse. Or a strong bear bar and no follow-through. We are in the middle of what could be the trading range for the next few months.

- Bulls need a follow-through breakout up to the top of the range before the Low 1 to have a chance of a breakout.

- The bears want a sideways bar to sell above to get a measured move to a new low.

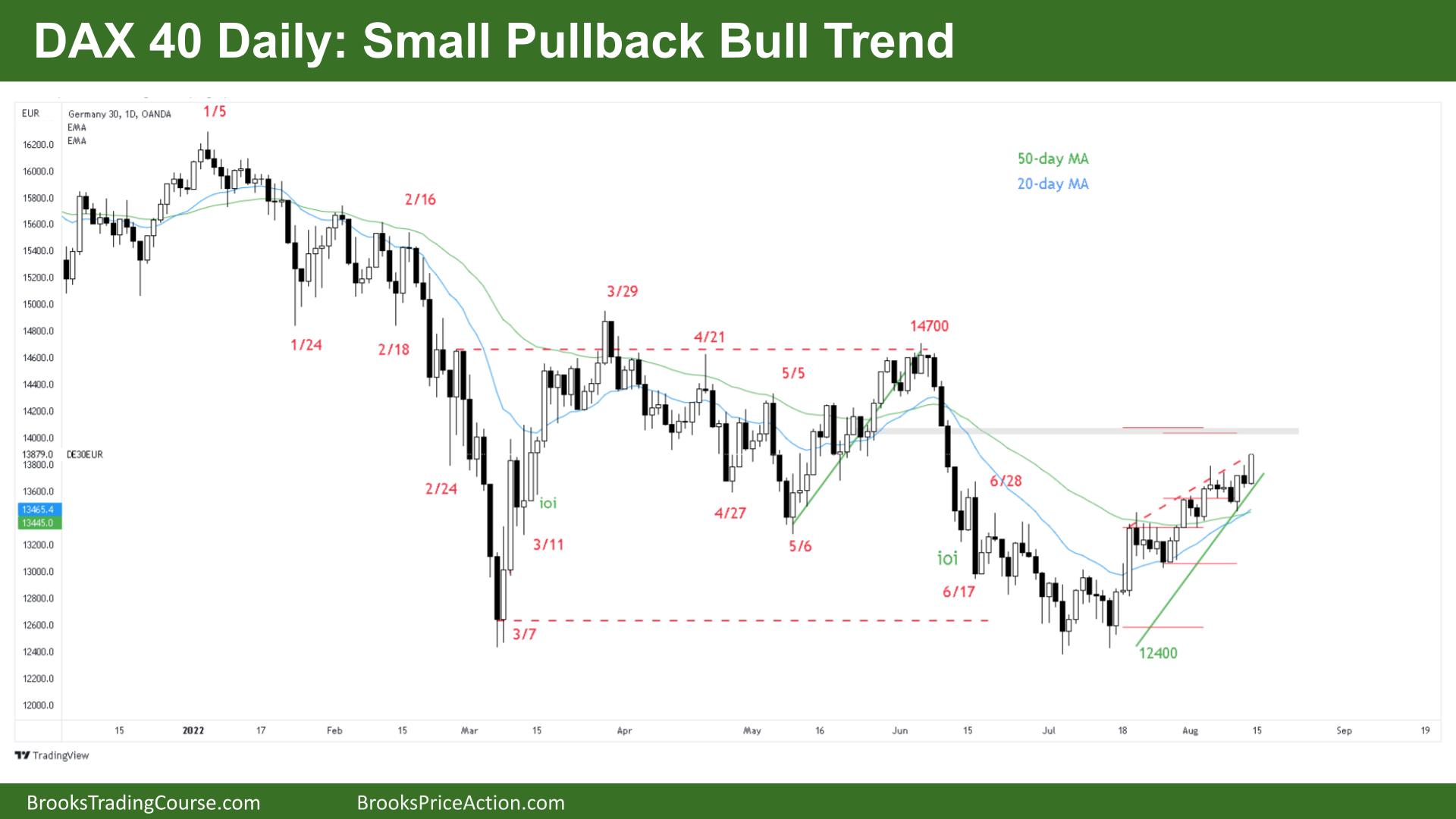

The Daily DAX chart

- The DAX 40 futures was a bull bar closing on its high so we might gap up on Monday.

- For the bulls it’s a bull breakout on a higher time frame and a small pullback bull trend so traders should only look to buy.

- The bulls have 2 measured move targets above and we are currently forming a breakout of a wedge.

- It’s been many bars above the moving average so we can expect traders, who have been buying above for many bars to buy there as well.

- Bears see a deep pullback from a bear spike from May and expect a further channel down.

- But its a trading range. The bears want a reversal above and successful Low 1 or Low 2 sell, but so far each of those has failed. The higher we get in the range the better math is for selling and bulls will look to take profits.

- The bears want a failed breakout above this wedge and two legs down for a lower-high and continuation of the bear channel.

- The bulls will want consecutive big bull bars closing on their highs which they have had for nearly 2 weeks. It could be exhaustion and a buy climax before selling begins.

- We are also at the harmonic retracement of the down move so bears might look to sell above this week, betting on a buy climax and good risk/reward/probabiility trade back down to the lows of the range.

- If you’re long, get out below a bear bar closing on its low. If you’re short, scale in at the measured move target betting on profit-taking.

- If you’re flat, wait for consecutive bars in either direction before looking for a trade that makes sense mathematically.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.