Market Overview: DAX 40 Futures

DAX futures moved higher last month, with a Dax 40 outside up bull bar closing on its highs. It is a strong leg from the bulls, so it is still reasonable to make money buying closes and scaling in lower. But bears know we are in a tight trading range to the left, so there could be selling opportunities selling here and higher. We can expect sideways to up next month approaching both swing targets.

DAX 40 Futures

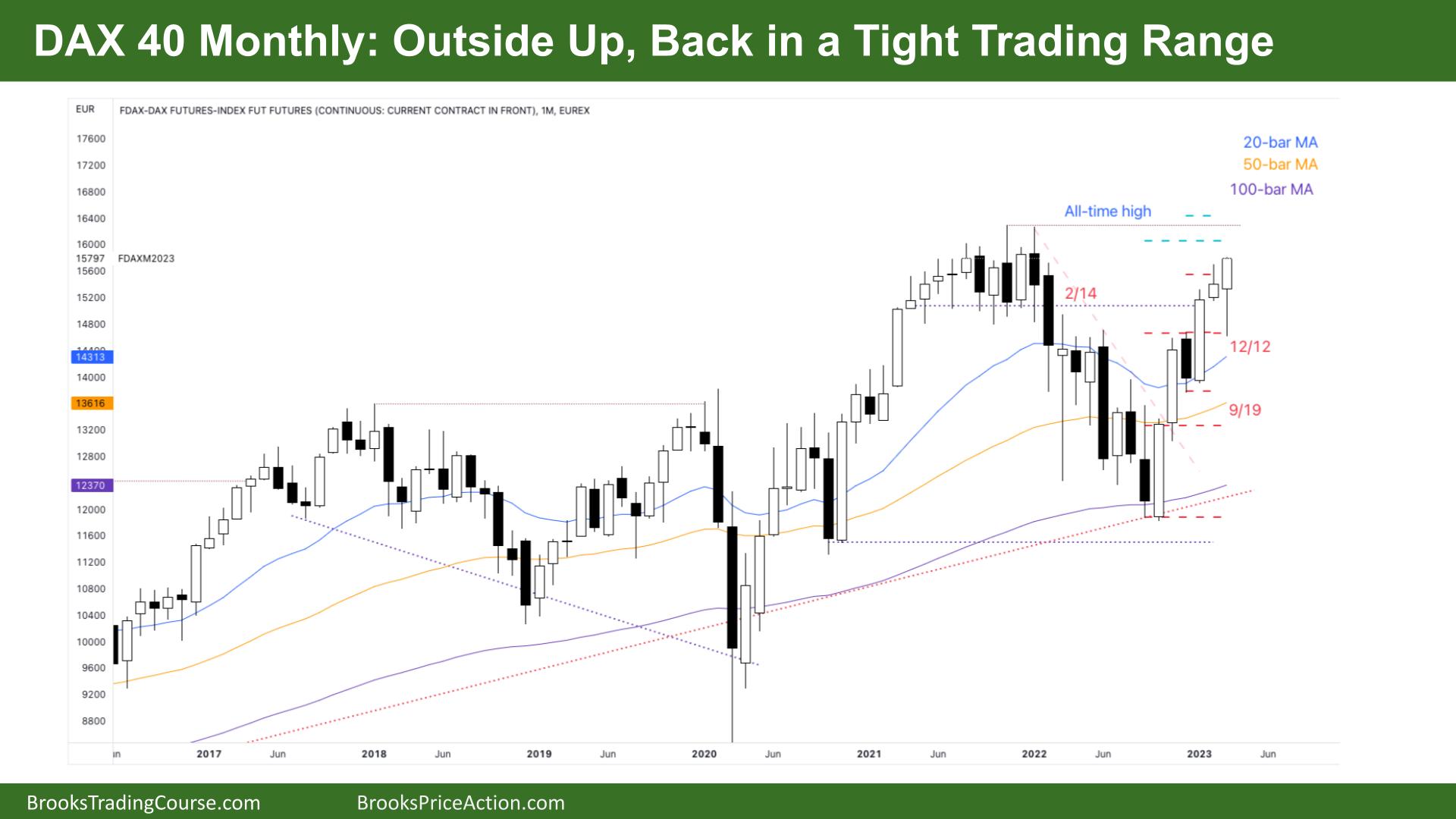

The Monthly DAX chart

- The DAX 40 futures was a bull outside up bar last month, closing on its high, so we might gap up on Monday.

- It is three consecutive bull bars, so a breakout and follow-through but with no gap.

- The bulls see a tight channel, and last month was the first bar to go below the low of a 5-bar bull micro channel. So it was reasonable to buy below last month.

- The bears see a trading range and a possible double top but don’t have a sell signal yet.

- The bulls see 2, maybe 3 pushes on this move, but it will likely be higher.

- You can see the bears selling above December got trapped and had to sell more to break even on their first entry. But they made money. So we are probably transitioning into a trading range.

- In fact, since June 2021, you could argue it has been a trading range. Even an outside up bar is a type of trading range.

- The tight trading range from 2 years ago was a magnet, and we expected to get back here.

- The bulls want a strong breakout here, close above the prior highs, and might get it. Trapped bears force the market higher.

- But 80% of breakouts in trading ranges fail so that limit-order bears will be waiting at the highs.

- There are two swing targets for the bulls above, so we might need to get there before going sideways or possibly down.

- The trouble for the bulls is location – bullish stop entries at the top of a trading range are generally traps.

- Expect sideways to up next week – the outside up bar is a reasonable buy signal, or at least a low probability sell signal.

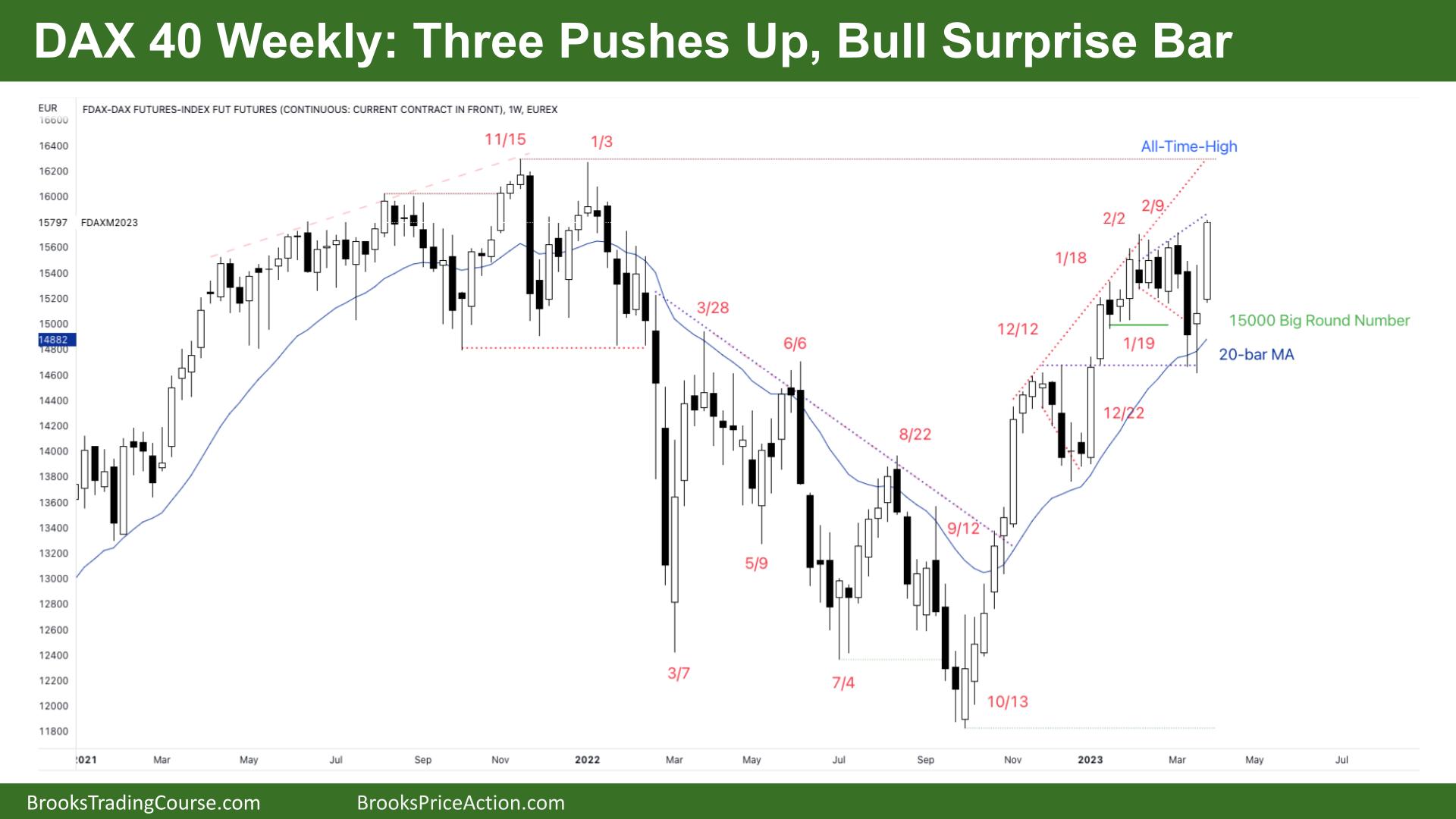

The Weekly DAX chart

- The DAX 40 futures was a big bull bar closing on its high so that we might gap up on Monday.

- It is three pushes up in the bull channel, and we are breaking above, closing above the prior high – so it is a buy signal.

- The third push often has a higher failure rate, but there is no sell signal yet for the bears.

- The bulls see a breakout and want follow-through for a test of the highs. And they might get it. There are two separate monthly swing targets above, so we might get there before we go sideways to down very far.

- The bears see an expanding triangle – a type of final flag before a reversal. It is reasonable for limit-entry bears to sell above the TTR, but most traders should wait.

- It is better to be long or flat as we are still always in long.

- The bulls right expect another week like this week because the bears could not even get the bars to close below the moving average – a sign of urgency and probably keeps the probability above 60% long.

- Bears need a bear bar closing on its low, but small – too big might not attract enough bears. Most traders should wait for the market to stop going up, and start to go sideways before shorting.

- Bulls can stay long and exit below a bear bar closing on their lows.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.