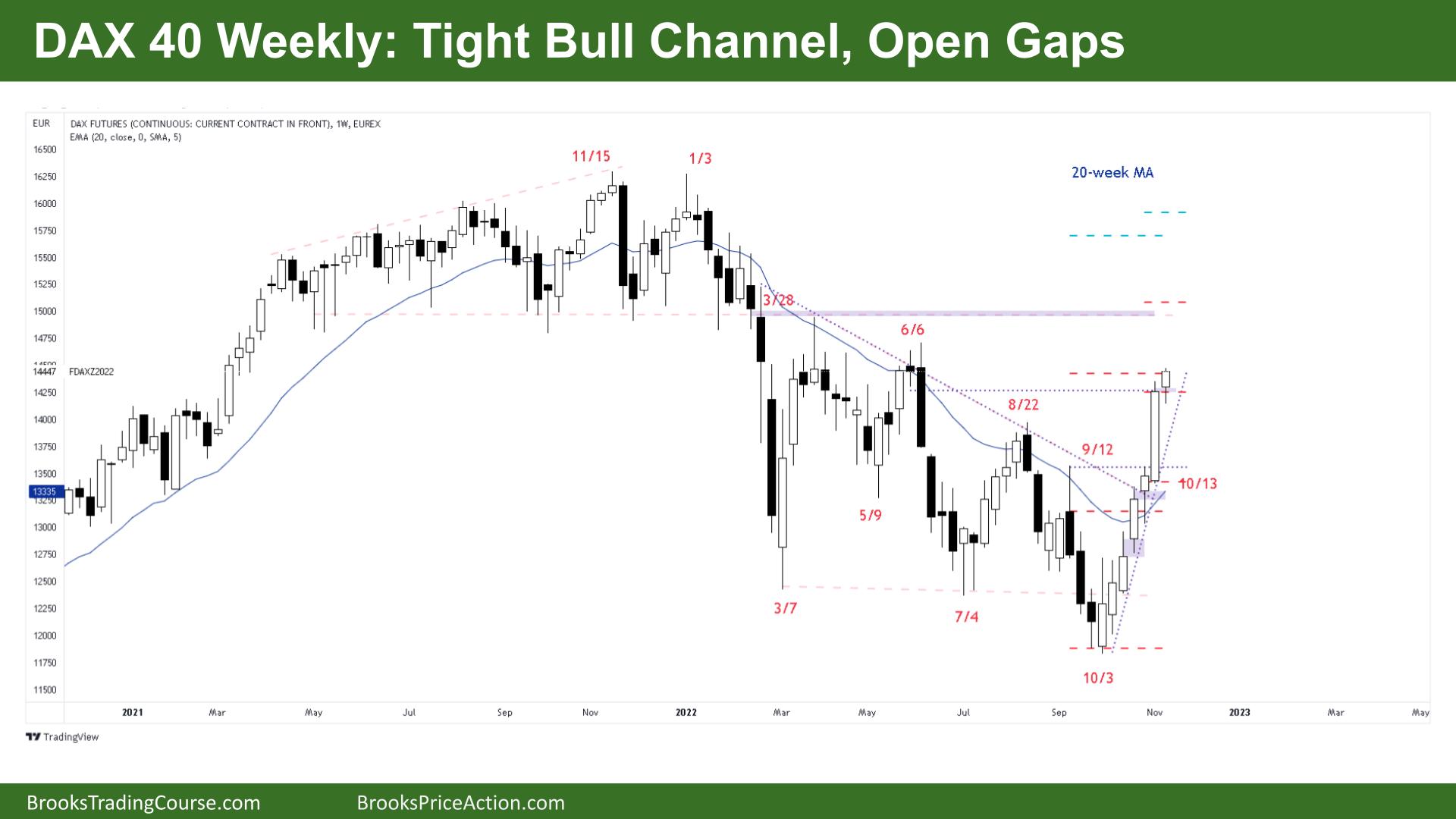

Market Overview: DAX 40 Futures

DAX futures moved higher again with a Dax 40 tight bull channel with open gaps. The bulls got follow-through buying high in a trading range and might get a second leg up to the top of the range above. The bears have controlled most of the year so they will look for swing sell setups to test back down in the coming weeks.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures last week was a small bull bar closing on its high It is a tight bull channel and we might gap up on Monday.

- It is a 7-bar bull micro channel, so traders expect the first reversal to be minor.

- It is climactic. The DAX has not had seven consecutive bull bars on the weekly chart since 2015, so it is reasonable to assume next week will be a bear bar.

- For the bulls, it is a tight bull channel. Traders will buy below the first bar to go below the low of a prior bar.

- The bulls also see a lower low major trend reversal but have not had a pullback.

- The bulls want to close the gap from March 28th, the break below the trading range above.

- It is unlikely we will reenter that trading range on the first try. So we can expect bears to sell strongly at the June 6th high.

- The bears see a broad bear channel, a break of a wedge bottom and a reversal for a measured move. We hit the first target on Friday so that we could see an exciting day on Monday.

- The bears need a sell signal. They thought last week was going to be a pullback from a breakout bar and an exhaustion gap, a sell climax. But now, the bulls got follow-through, so it is a higher probability to buy instead.

- The bears need a sell signal or a strong reversal bar. They want to get back to the breakout point from Oct 13th.

- Bull spikes look strongest near the top in trading ranges, and we are nearing the highs of an 8-month range. Most traders should wait for a second entry.

The Daily DAX chart

- The DAX 40 futures was a bull bar closing near its high. so that we might gap up on Monday.

- We moved sideways to up all week, but you can see the hesitation.

- For the bulls, it is a tight bull channel. Too strong for any real pullbacks. The bulls wanted to close the gaps and stop the bear trend from breaking below the yearly lows, and they succeeded.

- The best the bulls can get is a bull leg in a trading range, it is too climactic to continue for much longer. Overlapping bars and smaller bodies.

- Limit order traders are making money now, so we should see two legs sideways-to-down, back to the moving average. The first bar back to the moving average should be a buy signal.

- The bears see a bull leg in a trading range and a climactic rally. But for them, all it does is close some gaps.

- They want this to be a breakout test of the trading range above to set up a double top and a second entry sell back down to the lows of the range.

- There are several breakout points we sped through over the last two weeks, so we might need to test back to them before we can continue much higher.

- It was a tight trading range last week, and that will reduce the number of buyers above this week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

On the weekly I hope you are referring to Feb 28th gap not Mar 28th?.