Market Overview: DAX 40 Futures

DAX futures was a Dax bear inside bar at the 13000 big round number. Although the bear trend is still in effect we have been going sideways for a few weeks now. The bulls are starting to get daily consecutive bull bars so we might see a break next week. The bears will sell it as a bear trap, but the late bears buying back shorts might give the bulls momentum to get up to the June 28th high.

DAX 40 Futures

The Weekly DAX chart

- The Dax 40 futures weekly chart was a Dax bear inside bar at the 13000 big round number.

- It is the fourth consecutive bar with long tails below so we are likely transitioning into a trading range.

- The bulls see a lower low, double bottom major trend reversal with March 7th. They want a bull bar to setup a High 1 buy at the bottom of a trading range.

- It’s a tight channel down so it might be the second entry that works.

- The bulls know it has been a long-term bull trend and the lower we move is just the edge of a longer-term channel. The bears will give up soon, and they might be starting to do so now.

- They want consecutive bull bars and a move back up to the moving average.

- The bears see a broad bear channel and possibly completion of a measured move, harmonic down to 11500. Each week we have said it looks far away but we are still working towards it.

- They see a 6-bar tight bear channel and so expect the first reversal to be minor. The bears will also sell the first bar to go above a prior bar as a reasonable pullback.

- It’s a trading range so it’s confusing. The bull trap could have follow-through only to fail at the moving average. A bear break below might reverse like last week.

- Expect sideways to down next week.

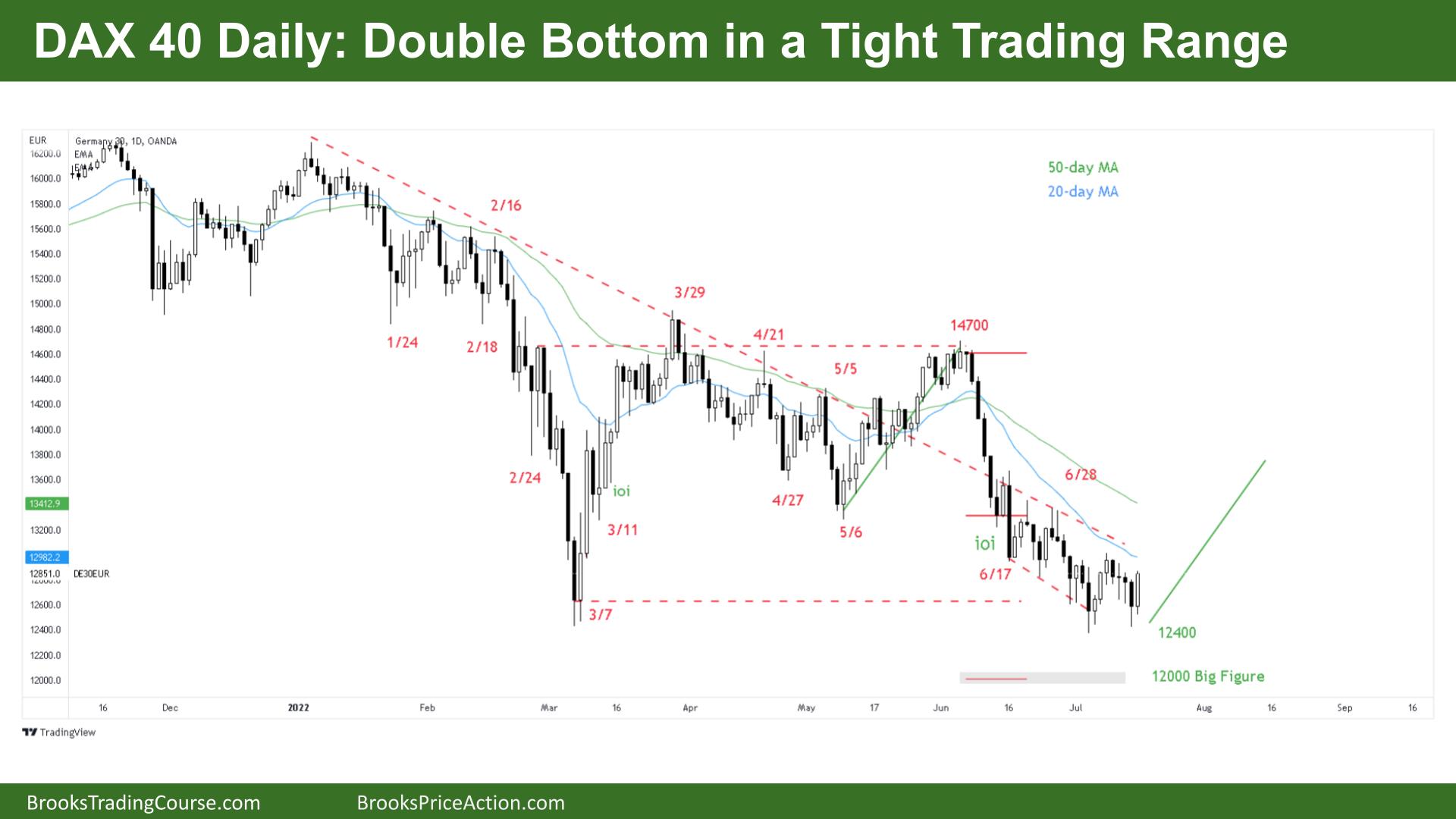

The Daily DAX chart

- The Dax 40 futures daily chart was a bull bar on Friday closing on its high so we might gap up on Monday.

- For the bulls, it’s the second reversal up and a possible double bottom with March 7th.

- Last week’s wedge overshoot played out for a scalp for the bulls, so a second entry buy low in a trading range is a reasonable buy setup

- They want a break above last week for a measured move-up. I’ve drawn the harmonic move possible which still keeps the overall bear trend and assumes a moving average gap bar sell.

- For the bears, it is a small pullback bear trend with 20+ bars below the moving average, we can expect sellers above and at the average.

- They see 4 consecutive bear bars last week so Friday is a pullback for a leg to continue lower.

- The bears are running out of steam and might need a move higher to attract more sellers. We have been sideways for a few weeks now and the tails above and below show unwillingness to sell far below.

- If the bulls can get consecutive bull bars early next week they might get a second leg up to the 50-day MA. We can expect more sellers up there.

- If the bears get another leg it will make a triple bottom and wedge low in a trading range, so they will either need to get follow-through or give up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Timothy

Nice analysis report especially covering both bull and bear perspective following Friday big bull bar.

Cheers

NK