Market Overview: DAX 40 Futures

DAX futures moved higher last week but was a pause at 20-Week Moving Average (MA) and ended as a bull doji at the MA. We have been trending down all year and the moving average has been resistance so we should expect bears to sell again above this week. But 3 consecutive bull weeks might mean a breakout higher to the top part of the range around the May 30th high. It’s not a great stop entry buy or sell, so expect limit order bulls to look to buy below and limit bears to sell above.

DAX 40 Futures

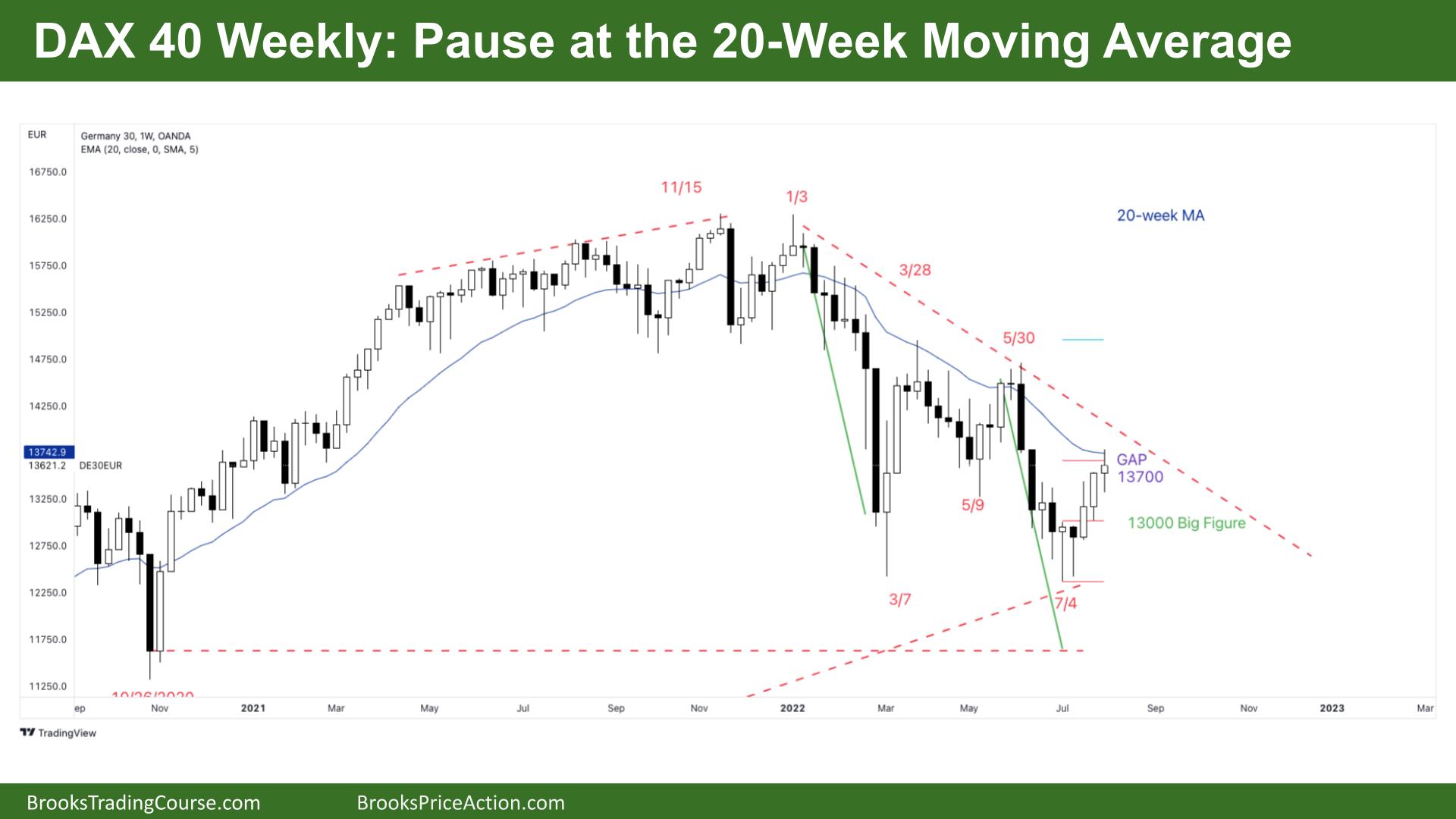

The Weekly DAX chart

- The Dax 40 futures was a small bull doji, a pause at the 20-week moving average (MA) and a measured move target.

- For the bulls, it’s three consecutive bull bars, two big and one ending on its high so we’re always in long. They want a good close above the moving average.

- It’s a reversal up from a lower low, double bottom with March 7th and a micro double bottom July 4th.

- It’s a doji so not a great stop entry buy above, nor a good stop entry sell below.

- Likely limit order traders above and below, so we will probably go sideways to up next week.

- So why the pause here? Location. Possible measured move target from the low probability reversal below and middle of a trading range.

- If you look left, most bars are under the moving average so traders will look to sell the first bar to close above it.

- For the bears it’s a bear trend since January and we are nearing the top third of the channel down.

- The bears see a pullback from a six-bar bear channel to a lower low and expect two legs sideways to up. If you’re a bear you’re looking for a good sell signal, a Low 1 but more likely a Low 2 near the moving average. But nothing to sell yet.

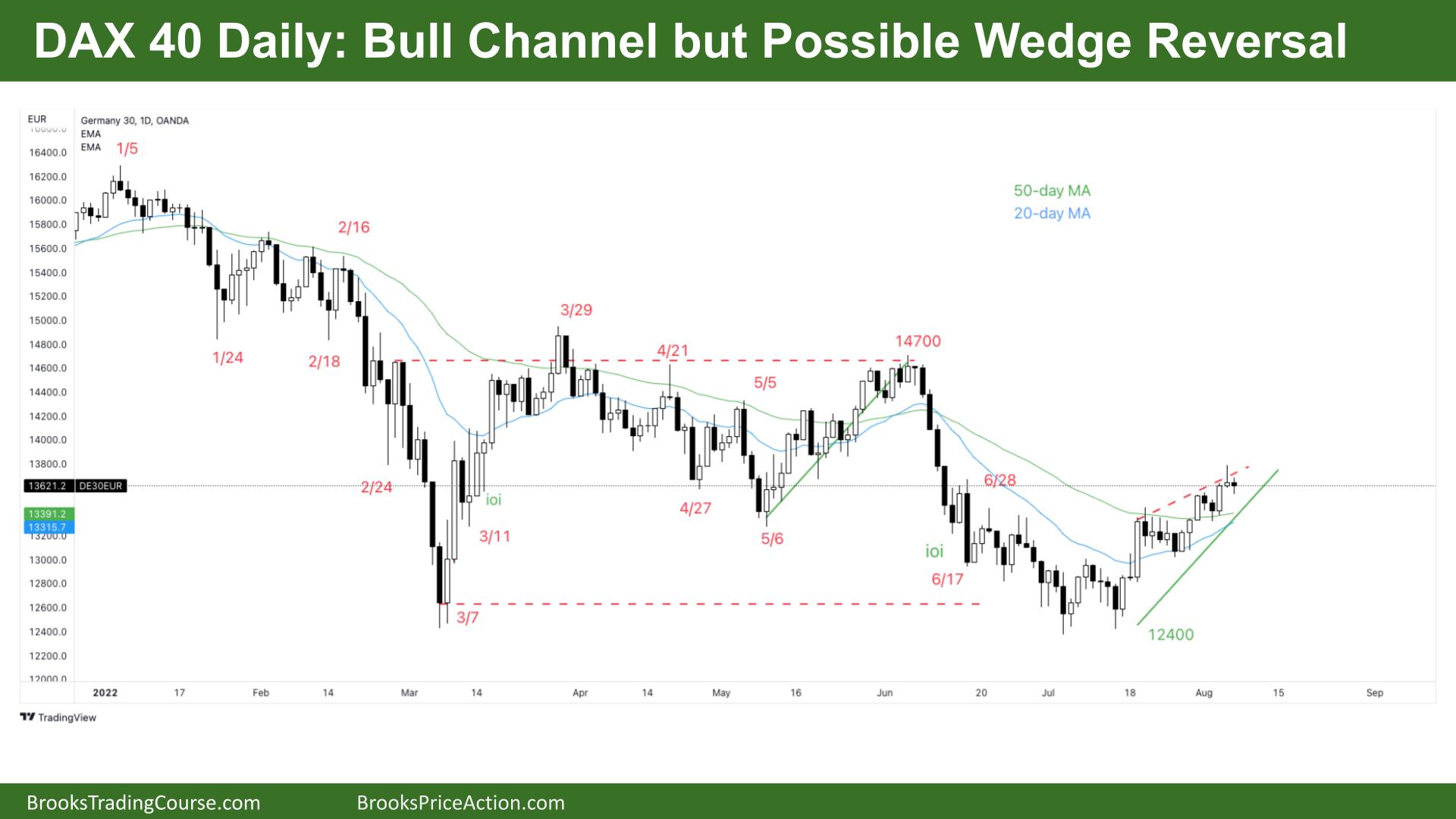

The Daily DAX chart

- The DAX 40 futures was a small bear doji on Friday. Consecutive dojis so a pause here while traders decide.

- For the bulls its a bull channel and the top of a wedge. We are always in long still so better to be long or flat.

- Bulls will look to buy below bars after 3 pushes up, perhaps closer to the moving average, a High 1 or High 2.

- The bulls want consecutive bull bars but we are in the middle of a trading range. The breakout above here will then be in a better place for the bears.

- The bears see a 50% retracement from June’s spike down and this is the top of a channel for another leg down. But it’s been sideways for many weeks. The bears want the middle of the range to be lower.

- The bears also see a harmonic retracement (green line) which is coming to an end and might scale in here for another move lower.

- The bears will sell a wedge top and want 2 legs down. But they see the consecutive bull bars, 2 big, 3 big, closing on their highs and are only scalping, selling new highs.

- The bears need consecutive large bear bars to get the trend to go sideways before they will likely get stop entry sells down.

- It’s a bear doji so not a great stop entry buy or sell.

- If you’re looking to sell, wait for a good-sized bear bar closing on its low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.