Trading Update: Friday March 3, 2023

Emini pre-open market analysis

Emini daily chart

- The Emini bulls want outside up day follow-through from yesterday.

- The market tested the January 19th low for the second time and reversed up. Some bears got trapped selling the high of January 19th. Those bears sold the high of January 19th because it was a bad stop entry buy following a big bear bar closing on its low.

- Those bears will likely not be interested in selling again at the January 19th high during yesterday’s retest. The bulls know this, and they will also be aggressive in buying.

- Yesterday’s outside up bar is disappointing for the bears and increases the odds that the February selloff is a bear leg in a trading range. This means traders should expect open gaps, such as the February 10th low, to get retested and closed.

- When everyone agrees that the current leg, such as the February selloff down to yesterday, is in a trading range, the reversal can be very quick. This means traders should not be surprised if the Emini has a buy vacuum test of the February 10th low.

- The bears want to prevent the market from closing the February 10th breakout gap. However, the odds are against the gap staying open.

- Yesterday’s bull breakout bar is big enough that there are probably buyers below for at least a small second leg up. If today is a bear bar, it will form a Low 1 short. However, there will probably be buyers below.

- This means that traders selling yesterday’s close is not ideal and at scalp at best, which means the downside over the next day or two is probably limited.

- Overall, the daily chart will probably begin a two-legged rally over the next few days and test the February 10th low.

Emini 5-minute chart and what to expect today

- Emini is up 24 points in the overnight Globex session.

- The Globex market has been in a bull channel for most of the early morning hours.

- As of 5:50 AM PT, the bulls are making new highs in the Globex range.

- The bulls want follow-through on the daily chart. This means they want today to be a strong bull-trend day on the 5-minute chart.

- If today is going to be a strong bull trend day, there will be plenty of time to buy.

- The odds are something will be wrong with the bull case, and the follow-through on the daily chart will disappoint the bulls. This means that today will probably be a trading range day.

- As always, traders should expect the first 6-12 bars to have a lot of trading range price action. This means most traders should wait for at least 6 bars before placing a trade.

- Most traders would be better off trying to catch the opening swing trade. This usually forms before the end of the 2nd hour and often after a double top/bottom or a wedge top/bottom.

- Lastly, today is Friday, which means traders should be open to a surprise breakout in the final hours of the day as traders decide on the close of the weekly chart.

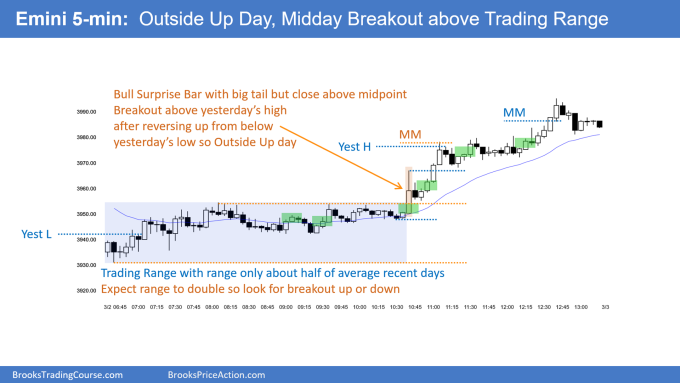

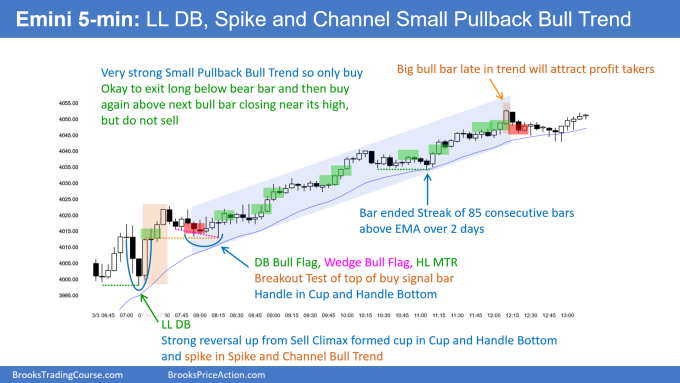

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current detailed setups.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD formed a bear bar yesterday following Wednesday’s outside up bar. This is a Low 2 short. However, the location is bad. It is at the bottom of a likely trading range.

- Low 2 shorts at the bottom of a trading range are lower probability. This increases the odds of a failed Low 2, a bull breakout of the bear flag, and a measured move up of the recent four-day range.

- If the bulls get a measured move up of the past four days, the target would be around the February 2nd bears signal bar low. Since the market is in a likely trading range, this is a reasonable target. Most breakout points close in trading ranges, which means bulls buying the February 2nd low and scaling in lower will probably make money.

- Overall, traders should expect yesterday’s Low 2 to have bad follow-through. The lower probability outcome would be a strong bear follow-through today and a breakout below the January 6th low.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day review

- Live stream video trial replacement of end of day review coming soon.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

I’ve got 10 years in and I still struggle with small PB bull trend days like Friday. Love trading range days. Love big bear days. Small PB bear trend days arn’t my favorite but because I like working the short side I can handle them. Small PB bull trend days are my nemisis. I usually take minimal and sometimes no trades these days and end up extremely frustrated. The buys never look good enough and I’ve got this conflict going on in my head. I see the possible buys but my mind says, “that’s not good enough.” The other part of my mind says, “Yes it is, its a small PB bull trend day and the signals don’t have to look as good on these types of days.

Good comment David. You need to find and nurture your leader part to manage those conflicting parts. Developing your warrior part to take those trades may help too. 🙂

Great response! I learned a lot from reading books on parts psychology, especially voice dialogue, when I was younger. I even took therapy sessions in that. I can see now how extremely valuable that is in developing my trading skills. Trading is not only about being aware of all the different scenario’s that could be play out, but also your own different ways of dealing with it, and indeed, how to manage those parts.