Trading Update: Tuesday March 15, 2022

Emini pre-open market analysis

Emini daily chart

- Emini double bottom reversal up from March 8 low after bears close tested the low.

- The bulls hope yesterday’s selloff will form a double bottom with the March 8 low and lead to a reversal.

- Currently, the market is in a triangle which is breakout mode. This means the probability for both the bulls and the bears has to be close to 50%.

- The odds are the market will probably bounce soon at this price level. The bulls hope the bounce will lead to a strong rally testing the 4,400 price level and lead to a strong bull breakout and trend up to the all-time high.

- More likely, any bounce will lead to a few legs sideways to up that end up disappointing the bulls.

- It is important to remember that the market would not be going sideways here if the bulls were indeed in control. Sideways market means uncertainty which means the probability is neutral. This means that the bear’s break below the February 24 low is a reasonable chance.

- The market has formed a wedge bottom with December, January, and February 24. The January selloff may have reset the wedge, and now the count is January, February 24. If this is the case, the wedge bottom might be so evident that traders are buying aggressively (yesterday and March 8) just in case the market forms a higher low at this price level (Al calls this a truncated wedge).

- Overall, bulls need a strong signal bar or a strong bull breakout with follow-through before they likely buy for a swing; otherwise, traders should expect more sideways and possibly down.

Emini 5-minute chart and what to expect today

- Emini is up 20 points in the overnight Globex session.

- Bulls went below the March 8 low during the Globex hours and reversed up.

- This increases the odds that today will have a bull close.

- On the Globex chart, the bulls reversed up from a bear breakout below a trading range that lasted longer than 12 hours (final flag setup). The reversal up was strong, increasing the odds of more up and today being a bull close on the day session.

- Overall, traders should expect a bull close today; however, the daily chart is in a trading range, so traders should expect there to be something wrong with today’s close. An example would be a selloff late in the day, making the bull close weak disappointing the bulls.

- Traders should expect the open to be a limit order market and wait for a strong breakout with follow-through or credible stop entry before looking to buy.

- Credible stop entries could be a double top, wedge top, double bottom, or a wedge bottom.

- Also, traders should remember that 50% of the time, the market will have a major reversal after any strong rally. An example of this happened yesterday around 8:00am PST.

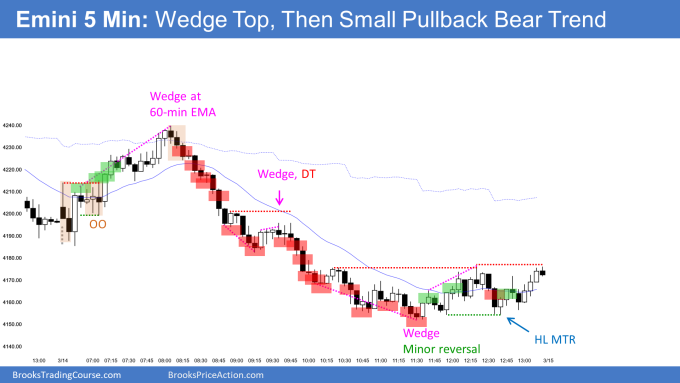

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

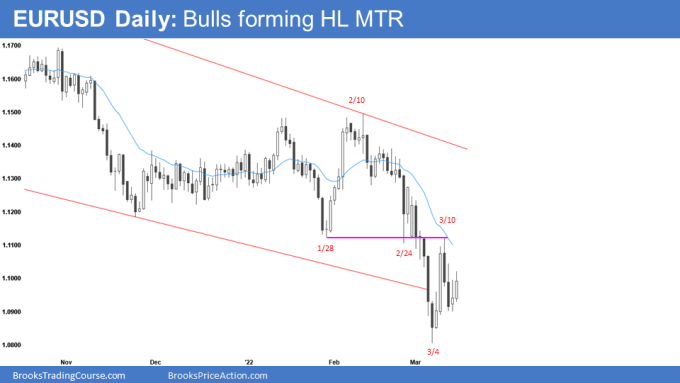

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The bulls want today to be a strong entry bar for the higher low major trend reversal signal bar (yesterday). Since yesterday’s signal bar was weak, the odds are the reversal will be minor and lead to more sideways.

- The bulls hope that the last two consecutive bear bars (March 10-11) are a pullback from the rally last week that will lead to a second test of the 3-month trading range low.

- The bulls see the 3-month trading range as a final flag and expect the price to reverse back into the range and ultimately test the February high.

- The bulls hope that the test of the February high will look similar to the bull breakout that happened during January 31- February 4.

- The bears want the market to form a measuring gap with the 3-month trading range, trapping scale-in bulls and leading to more down and possibly a test of the 2020 price level.

- Since the market was able to go sideways in a broad trading range for 3 months and it was late in a year-long selloff, that increases the odds that the market will reach the middle of the 3-month trading range.

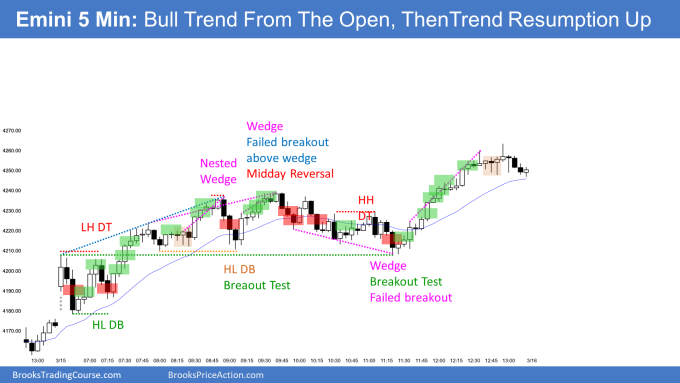

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

- Today was a bull trend from the open that led to trend resumption up after sideways for several hours.

- The market gapped up on the open and went sideways, testing the moving average.

- The bulls formed a double bottom around bar 10 and broke out to the upside without ever reaching the moving average.

- Often, traders want to buy around the moving average when the market gaps up, and the price action is not as strong on the open as today (market went sideways). When the price reverses just above the moving average, traders will expect to have to reach the moving average soon. This caused traders to hesitate to buy around 8:00 AM PT when the market went sideways.

- Also, the market had a wedge top which was consecutive buy climaxes around 9:00 PT. Traders were confident that the consecutive buy climaxes would lead to a test of the moving average as it did with the three large consecutive bear bars around 9:00 PT.

- AT this point, the market had a big up, big down, so the odds favored a trading range. Bulls wanted trend resumption, and bears wanted trend reversal.

- The bear tried to breakout to the downside around 11:00 am PST and failed, leading to a reversal up, and a buy the close finish.

- Often, when you buy the close rally before 12:30 PT, it usually does not last all the way into the close. This would make traders hesitate to buy closes, especially after the big buy climax bar around 12:20 PT.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Thanks for the report once again Brad. To my newbie fresh perspective I deduced in the process a Broad Channel / Trading Range from bar 18 to around 66 (also a Head and Shoulders, around the midday reversal hours), until way too late only then I realized there was something wrong with the close, as you mentioned (it went up instead of down). (btw, bar 64/65 showed in several charts an actual gap leading to a perfect measured move to bar 77). My question: from which rally (bar 59) could I have surmised follow through to a bull’s close (i.e. at which point was the probability going up higher than 50%)? Thanks in advance!

That is the challenge of a day like today. As you said, bars 18 -66 are a trading range. You can call it a bear channel but look to the left; it is around a 50% pullback of the bull rally.

The challenging part about trading ranges is that they often look like the bear breakout will succeed at the bottom of the range, only to fail the next bar (11:25 PST Bar 59).

As far as probability, it was close to 50% on bar 59 for the bulls, and that is because the market is in a trading range, so the probability cannot be that bad for the bulls, and the market is forming a double bottom with prior lows. Also, in a bull trend, a trading range, in general, has a higher probability of trend resumption.

So when did the market become 60%? Probably around 11:45 or 11:50 PST.

Much appreciated for your clear explanation, Brad, that makes sense all! Great!

Interested in better understanding the context on why bar 4 would be a reasonable long given bar 1 had a tail on top and bars 2 and 3 were consecutive bear bars. Would bar 3 be considered climatic given a bullish bar 4 closing near its high? Also would bar 1 being a bull gap bar also add to the bullish bias?

Hi

Al explains this in his other websote in his bar-by-bar analysis, whereon he says:

SX(Sell Climax, one or more big bear bars closing near their lows), COH(Close On or near High of bar), PL(Possible Low of day or swing low, reasonable buy setup. Since it is a reversal trade, it is not high probability so it is a swing setup), BRE(Bears exit above, even if not strong buy signal), but room to MGB(Magnet Below), NS(Not high enough probability for stop entry traders to scalp, but reward can be big enough compared to risk to offset low probability so ok swing trade. Most often will not get strong move, and disappointed traders will scalp out.), PP(Probably or probable) MRV(Minor Trend Reversal so trading range or pullback more likely than opposite trend. Switch to scalp if disappointed by weak reversal.). BL(Bull or Bulls) need strong BO(Breakout means close beyond support or resistance, like high or low of prior bar or bars, or EMA. Bulls want big bull bar closing on its high and far above resistance. Bears want big bear bar closing on its low and far below support.) above 60MA(60 minute 20 bar Exponential Moving Average).

Hi BTC Admin,

Is Al or anyone else writing the end of the day summary?

The end-of-day summary is posted after the close. Some days will have a delay on when it is released but it is same day.

Thanks for info Brad. But who is writing the end of day summary?

The author of the blog post will generally write the end-of-day summary. At this moment I am writing the summary and Al is creating/uploading the end-of-day chart.

Thanks. It is a very nice summary. Well structured and written.