Market Overview: Weekend Market Update

The Emini is in a strong rally on all time frames. Wednesday’s big outside down day in a parabolic wedge rally and the bear body on the weekly chart make a minor reversal likely soon. It might have begun on Wednesday.

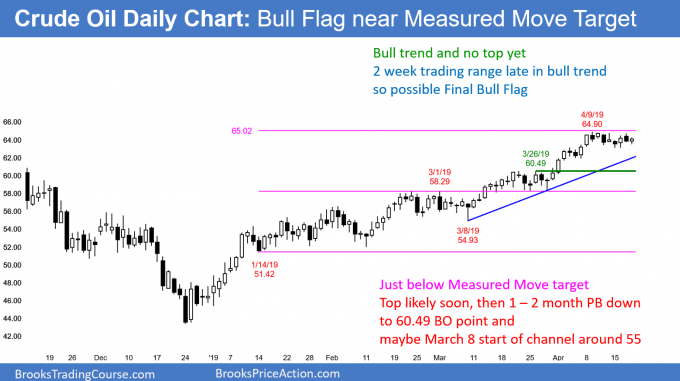

The crude oil rally is near a measured move target. Traders should expect that the two week tight trading range will probably be the Final Bull Flag before there is a pullback to around $60.

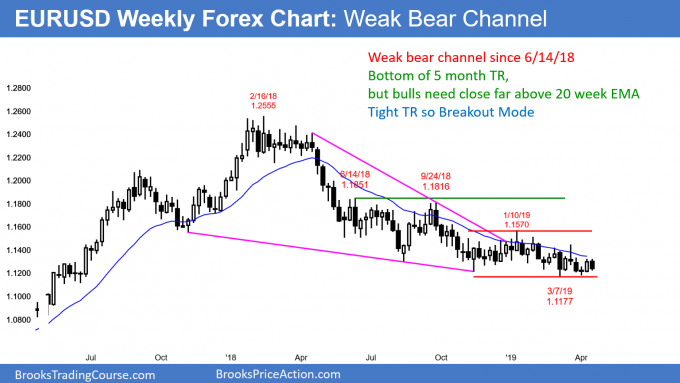

The EURUSD Forex market has been in a tight trading range for 5 months. However, since the bulls have been unable to get consecutive closes above the 20 week EMA, a bear breakout is slightly more likely than a bull breakout.

Crude oil Futures market:

Possible Final Bull Flag at Measured Move target

The crude oil futures market has been in a strong bull trend for 4 months. The daily chart has been sideways for 2 weeks. This is therefore a bull flag. With a measured move target just 26 cents above the top of the bull flag, crude oil will probably reach the target next week. But, what then?

A tight trading range late in a bull trend is often the Final Bull Flag. Because the market has been sideways, traders think that the current price is fair. If there is a bull breakout, crude oil will be above a fair price. Also, many bulls will take profits at the measured move target. Consequently, the small trading range is a good candidate for the Final Bull Flag.

Final Bull Flag

When looking at any bull trend of any market, once there is a trend reversal, look back at the final bull flag. It is often a tight trading range just below resistance. Therefore, when traders see a flag like this in a buy climax, they know that many bulls will take profits on a breakout above the bull flag. If there is heavy profit-taking, there will be a swing down.

It sometimes is the start of a bear trend. But, when the bull channel is tight, like the one in crude oil, a conversion into a trading range is more likely. As a result, traders will look for a reversal down from around 65.

If there is a big bear bar or several consecutive small bear bars, traders will conclude that strong profit-taking is underway. At a minimum, they will expect at least a couple legs down to support.

The first support is the March 21 high of 60.39. That is the breakout point of the current 3 week breakout. Traders should expect a test down to around 60 in the next couple of weeks.

If the reversal down is strong and falls far below 60, the next support is the March 1 high at 60.39. That is also a breakout point. Below that is the March 8 low just below 55.

How high can a buy climax go?

Suppose that the past 2 weeks is not the Final Bull Flag. How high can the rally go? There is no limit, but the current rally is extreme. That means that it will attract an increasing number of profit takers. Also, the bears will begin to bet on a reversal down from a buy climax.

That is why a pullback is likely soon. The pullback could simply be a tight trading range that lasts for a few weeks. More likely, it will test at least down to 60, just below the most recent breakout point.

When bulls take profits after a big rally, they are not looking to buy again a few bars later. They would simply hold long. Profit-takers want to wait to see how much profit-taking will take place. They typically will wait 10 or more bars and for at least a couple legs down.

At that point, if the selling is stopping, the bulls will buy above a bull bar and bet on a resumption of the rally. When a buy climax is as extreme as this one has been, the pullback will likely continue sideways to down for a month or more.

Until there is a clear top or a strong reversal down, the bulls will continue to buy. However, a potential Final Bull Flag just below a Measured Move target typically leads to profit taking. Consequently, traders will look for a short-term top within the next couple weeks.

EURUSD weekly Forex chart:

Tight trading range, but holding below 20 week EMA

The EURUSD daily Forex chart has been in a tight trading range for 5 months. It has reversed directions every 2- 3 weeks during that time. It is still in Breakout Mode.

Typically, the probability of the breakout for the bulls and for the bears is 50%. However, the chart continues to make at least slightly lower highs and lows. In addition, it has not had consecutive closes above the 20 week EMA in over a year. Consequently, the bears have a slightly higher chance of a downside breakout.

But, not much. If there was a clear consensus among traders that there would be a bear breakout, the breakout would be underway. The lack of a breakout indicates that the bulls have almost the same chance as the bears.

Traders need to see consecutive closes above or below the range before concluding that the trading range has converted into a trend. Until then, they will continue to look for reversals every 2 – 3 weeks.

Monthly S&P500 Emini futures chart:

Strong rally to the top of the 16 month trading range

The monthly S&P500 Emini futures chart has rallied for 4 months after reversing up from its bull trend line. However, it is now at the top of the 16 month trading range. It has sold off twice from here in the past 16 months. Consequently, traders are not yet convinced that the rally will break strongly above the September all-time high.

Prior to this month, the bodies of the past 3 months have been shrinking. This indicates a loss of momentum as the Emini gets higher. So far, April’s body is bigger than March’s. If it is this way at the end of the month, traders will conclude that the momentum up is resuming. It will make a new all-time high likely either in April or May.

But, the month is only half over. This month could look very different on April 30 once it closes.

For example, the open of the month is 2859.00. That is only about 50 points below this week’s close. A few bear days could easily drop the Emini back below the open of the month. That would increase the chance of a 1 – 2 month pullback before there is a new all-time high.

While the month is good for the bulls at this point, traders should reserve judgement until the month closes.

Can the rally fail?

Most breakout attempts fail. However, this rally might be a resumption of the 10 year bull trend after a couple legs down to the bull trend line.

If there is a strong breakout to a new high, traders would look for a measured move up based on the height of the 16 month trading range. The measured move target would be 3400 or 3600, depending on whether traders are looking at the February 2018 or December lows.

If there is not a strong breakout to a new high, traders will conclude that the 16 month trading range could last many more months. A reversal down from below the old high would be the right shoulder of a head and shoulders top. If there is a reversal down from above the September high, there would be an expanding triangle top.

Since trading ranges resist breaking out, if there is a reversal down, a bear leg in the 16 month range is more likely than a strong break below the December low.

The 4 month rally has been strong. Traders will expect at least a micro double top before there is a significant selloff. Consequently, the downside risk over the next couple of months is small. The best the bears will probably see is a test of 2700 before the bulls regain control.

Weekly S&P500 Emini futures chart:

Strong rally, but shrinking bodies and micro wedge

The weekly S&P500 Emini futures chart has been in an extremely strong bull trend for 4 months. There have only been 2 pullbacks and each lasted only one week.

A bull trend that is in a tight bull channel like this typically has to stop going up before it can reverse down. Therefore, the weekly chart will probably have to enter a trading range before the bears can get more than a few consecutive down weeks.

Surprise Bars trap both bulls and bears

The bears tried to get a top 5 weeks ago. After the sell signal trigger, the Emini reverse up surprisingly sharply for 4 weeks.

Bull Surprise Bars typically trap bulls out. They were not expecting such a strong rally and many missed the move. They now want a pullback since they expect at least a small 2nd leg up.

Bull Surprise Bar also trap bears. They sold 5 weeks ago, expecting at least a few weeks down. Instead, the Emini broke far above the high from 5 weeks ago. Many of these bears are now trapped into a bad short. They are hoping for a pullback so that they can buy back their shorts with a smaller loss.

With both bulls and bears eager to buy a pullback, the odds are against a bear trend reversal over the next several weeks. The best the bears can probably get is a few weeks down.

If they get it, they will then hope that the bull trend is converting into a trading range. Once it is in a trading range, they will have a better chance of a swing down.

Daily S&P500 Emini futures chart:

Emini minor reversal from April parabolic wedge buy climax

The daily S&P500 Emini futures chart has rallied in a tight bull channel for 4 months. The biggest pullback lasted 4 days. All of the other pullbacks ended after a day or two.

Wednesday formed a bear outside down day. It closed below Tuesday’s low. It also was the 3rd push up in a month-long wedge rally. Wednesday was a sell signal bar. When Thursday traded below Wednesday’s low, it triggered the minor sell signal.

However, instead of a 2nd consecutive big bear day, Thursday closed near its high. Not only is that a bad entry bar for the bears, it is now a High 1 bull flag for the bulls.

But, it had a bear body. In addition, it was the 4th consecutive bear day. It is therefore a weak buy signal bar in a weak buy setup. There are probably more sellers than buyers above its high.

Is a 50 – 100 point pullback underway?

The bears need a lower high or micro double top this week. They then need a strong break below this week’s low. If they get it, traders will conclude that a bigger pullback has begun.

The first target for the bears is the March 21 high of 2866. That is the most recent breakout point. There were pullbacks below the breakout points after both the March 4 and March 21 highs. Consequently, the odds are that this breakout will pull back as well.

The rally has had 3 legs up since March 4. Since it is in a tight bull channel, this is a parabolic wedge rally. That is a buy climax. If there is a reversal, it will likely have at least 2 small legs down.

There is currently a 40% chance of a selloff to the start of the wedge. That is the March 8 low of 2726.50

The bears have a credible start for the pullback. However, if the bulls break strong above Wednesday’s high, the Emini will probably continue up to the all-time high before the bears try again.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Looks like the micro products might be a great alternative to SPY for training since they avoid the pattern day trader SEC regulations.

Hi Al, some brokers have announced their commissions for the new CME micro products coming in May — e.g. Amp Clearing Commissions

The all in cost will be around 80 cents round turn. With the micro ES being $5 per point, would you agree that such commissions mean that, while 1 point scalps won’t be viable, trades of 2 points will be ?

Yes, I wrote about that recently, and I also talk about overhead in the course. It is not realistic to trade for a reward that is less than 10 times the overhead (commissions plus the spread).

Look at Las Vegas. The average overhead is about 10%. There are some professional gamblers who make a fortune, but they are rare.

I think the typical round turn commission will be about a dollar. That means a scalp would be $10 – 20, which is 2 – 4 points in the Micro S&P Emini. I think traders should be going for at least 4 points.