Trading Update: Friday January 20, 2023

Emini pre-open market analysis

Emini daily chart

- The Emini gapped down yesterday and closed as a bear bar. This is a follow-through after the January 18th outside down bar.

- The January 18th bear breakout is enough of a surprise with minimum follow-through to have a second leg down likely.

- Some bulls bought during the pullback of January 18th and are currently trapped and likely disappointed. Some of those bulls would have bought around the January 13th low and are likely willing to scale in lower.

- These scale-in bulls will likely exit on a bounce breakeven on the entire trade or at their original entry.,

- The bears want to squeeze the scale in bulls. The bears would need more selling pressure in the form of strong trend bars to convince the bulls to take a loss and exit their longs.

- More likely, the downside will be limited here, and the market will go sideways over the next couple of days, allowing the bulls out.

- The bears will see January 18th as the start of the second leg down from the December 20th bear breakout. Low probability, but if the bears can get a strong downside breakout, they can get a Leg 1 = Leg 2 move, down to the December 21st bottom of the channel.

- The December 20th bear breakout was strong enough to get a second leg down. However, a bear breakout within an overall trading range was testing the 50% pullback of the October – December 2022 rally, which was likely to act as support.

- There will likely be disappointed bears who will be interested in buying back shorts not much lower. These bears sold late during the December selloff and scaled in during the January rally, confident that the upside is limited. These bears decide if they should exit breakeven on the entire trade or try to exit around the December 28th low.

- Overall, traders will pay close attention to the next couple of days to see if they can gain selling pressure or if the market will begin to stall, increasing the odds of more trading range price action.

- The bulls will try and form a double bottom over the next couple of days. If they are successful, the next goal would be a test of the January 18th high.

Emini 5-minute chart and what to expect today

- Emini is up 8 points in the overnight Globex session.

- The Globex market has been going sideways for most of the overnight session.

- The bears got a small second leg down following yesterday’s U.S. Session late selloff. However, the market quickly reversed back into the open of the Globex session.

- Traders should expect a trading range open and consider not trading for the first 6-12 bars unless they are comfortable with limit order trading.

- Most traders should focus on trying to catch the opening swing trade. The market will often form a double top/bottom or a wedge top/bottom within the first two hours, leading to a credible stop entry for a swing trade.

- The Globex market (15-minute chart) is currently forming a triangle which is a breakout mode pattern. The bears want trend resumption down and a second leg down from the January 18th selloff. The bulls want a trend reversal and a major trend reversal.

- At the moment, the probability slightly favors a trend resumption. However, the bears are not clearly in control. The market would not be sideways for over 24 hours if one side were clearly in control.

- Traders that want higher probability can wait for a clear breakout with follow-through and enter in the direction of the breakout for the second leg.

- Today is Friday, so that the weekly chart will influence the market, especially later in the day. This happens frequently enough and is due to the institutions deciding the fate of the weekly chart close. Traders should be prepared for a surprise breakout up or down late final 1-2 hours of the U.S. session.

- The most important thing to remember is that “Price is Trust” as Al Brooks often says. This means that a trader must be emotionally detached from the market and see the chart as their only source of truth about what the market is doing. This means that if the market. If it does not matter what a trader wants the market to do, what matters is what the market is doing, and a trader must always be willing to adjust the analysis at any given moment.

Emini intraday market update

- Today formed, a big bear bar on bar one and has been in a bull trend from the open since bar 2.

- The bull channel for the first two hours has been tight, forming gaps. This increases the odds of the downside is limited.

- At the time of writing this, 8:50 AM PT, the market has not touched the moving average since bar 6. This increases the odds that the market will have to go sideways and get down to the moving average soon.

- There is a 60% chance that the market will form a trading range soon. Most trends from the open bulls become trading ranges, and the small pullback trend does not last all day.

- The downside is probably limited until the bulls can get more selling pressure. This means the bulls will buy and buy lower, betting on a trading range, not a bear trend.

- Overall, most traders should consider waiting and looking to buy a pullback to the moving average. A trading range is also likely for several hours, which will probably limit the upside for some time.

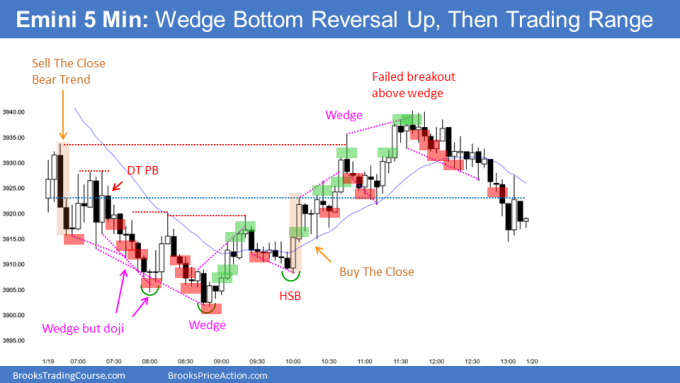

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD continues to go sideways in a tight trading range above the January 2nd high.

- The bears want the market to form a micro double top and get a downside breakout below January 18th. Next, those bears want a measured move down of the five-day tight trading range, which would take the market back down to the middle of the December trading range.

- The bulls are hopeful that the breakout above the January 2nd high will lead to a measuring gap and measured move from the January 6th low to the January 2nd high. More likely, this measuring gap will fail, and the market will get sucked back into the expanding triangle that formed over the past month and a half.

- I have said a couple of times that the higher time frame charts, such as the weekly chart had a tight bear channel since the middle of 2021, and the rally from October 2022 was the first breakout of the bear trend.

- Tight bear channels typically do not reverse into bull trends without forming a trading range first. The market will probably need a higher low major trend reversal. At a minimum, traders will likely want to see a 33% from the January 2022 rally. This would create a minimum pullback of the 1.044 price level. This is because most valid higher low major trend reversals have a minimum pullback of 33%.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day review

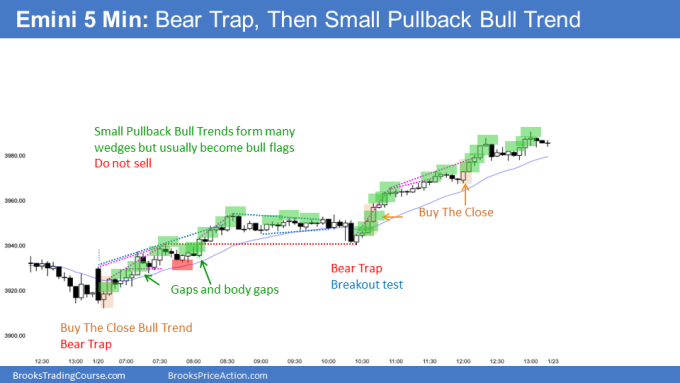

- Today was a bear trap that led to a small pullback bull trend day.

- The bulls formed an early negative gap about the bar 1 high and a later negative gap in the middle of the day (at the red line where the chart says “Bear Trap”).

- When a leg in what appears to be a trading range is forming gaps, especially when it is tight, traders must wonder about the possibility of a small pullback bull trend at play instead of a leg in a trading range.

- The single most important thing in a small pullback bull trend is not to sell for any reason until there is a clear trendline break and a retest of the extreme with credible selling pressure.

- Most small pullback trends last a very long time and typically go sideways for several bars and build up selling pressure before a reversal. Again, most reversal attempts fail and lead to sideways trading.

- The market formed a trend from the open of bar 2. Typically, when you get a trend from the open, there is a 60% chance the market will form a trading range for the rest of the day.

- The bulls ended up getting a strong upside breakout around 10:30 AM PT, which led to a surprise breakout and a new spike and channel bull trend for the rest of the day.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Hey, Brad do you use yesterdays day and current day chart together to find a wedge ? for Example, On 19th Jan bar 56, 78 and on 20th Jan bar 2 are making a wedge and market did reverse afterwards ? It was because of a wedge or because was prior low ?

I would not view this as a wedge. Bars January 19 56, and January 20th, bar 78 have too many bars in between them to be considered a wedge.

I would see the open of Jan 20th as a failed breakout below the prior day, 78. Also, bar 1 on the 20th was a bear trap and bar 2 created a small pullback bull trend.

I do pay attention to yesterday’s price action and how it influences today’s price action. However, I typically want a wedge to have symmetry with each leg, or else it will lower the probability.

Brad I have been learning so much through your analysis and the course. Thank you! I am curious, why above bar two would be a buy? Yes there is a tail, but with such a strong bear bar, could this not just be a normal pullback?

Bar 1 could be a test of the prior low and along with bar 2 a LL DB. Bar 2 ended up being a good looking reversal bar and the risk/reward to buying above it made it a great swing trade to catch the LOD.

Thank you Andrew!

As you know, bar 2 is the reversal attempt of bar 1. When you get a big bear bar, you expect a small second leg down. However, the problem with bar 1 is the lack of follow-through on bar 2. On the open, there is always an increased risk of a sell vacuum test of support or a buy vacuum test of resistance.

In general, the rule I use is that I need two consecutive trend bars with at least one closing near its high to buy the close if bull trend bars or sell the close if bear trend bars.

Lastly, consider the risk/reward of selling bar 1. Bar 1 is big, so the risk is big, and most opens are going sideways. Bar 1 has a 16-point body which is climactic relative to the bars to the left. Just look back on days when the first bar was significantly larger than most bars, and you will see it often leads to sideways trading. Some bears would sell above bar 2, though, and when bar 3 closed, bears were trapped and started buying back shorts. Bulls began buying aggressively, forcing the bears out of the trade.

Very Helpful Brad! Thanks.

Thanks so much for your great well-structured updates every day Brad

You are welcome Daryoush. Glad it is helpful.