Market Overview: S&P 500 Emini Futures

The weekly chart was a strong bull bar and the bulls hope that the S&P 500 Emini futures market is forming a higher low followed by another strong leg up. The bulls will need to create strong follow-through buying to increase the odds of a retest of the February 2 high. The bears hope that the Emini is simply retesting the February 2 high and want a reversal down from a lower high major trend reversal or a double top.

S&P500 Emini futures

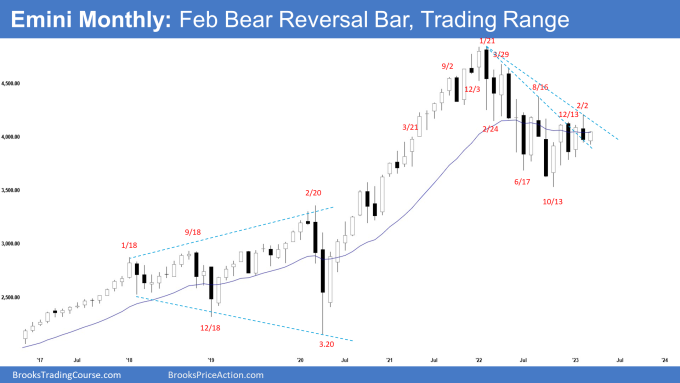

The Monthly Emini chart

- The February monthly Emini candlestick was a bear reversal bar closing below the 20-month exponential moving average.

- Last month, we said that the odds favor an upside breakout above January and traders will see if the bulls can create a follow-through bull bar. Or if the Emini trades slightly higher, but reverses to close as a bear bar below the 20-month exponential moving average.

- The bulls see the selloff from January 2022 as a wedge bull flag (February 24, June 17 and October 13).

- They got a second leg sideways to up in February, but it reversed into a bear bar.

- They failed to get a follow-through bull bar and the Emini is stalling around the 20-month exponential moving average.

- The bulls want March to close with a bull body closing near its high.

- They have a 5-bar bull microchannel. Often, there are buyers below the first pullback below such a strong microchannel.

- The move down since January 2022 had a lot of overlapping bars. The bears are not yet as strong as they hope to be.

- They see the move down from January 2022 as a broad bear channel, with the August 2022 high as the last lower high.

- While the bulls have broken the bear trend line, the bears hope that the recent move up is simply forming another lower high (to Aug 2022) with a flatter trend line.

- If the Emini trades higher, they want a reversal lower from a double top bear flag with August 2022 high and a lower high major trend reversal.

- While March has traded slightly below the February low, some bears may feel that the February low may not have been adequately tested.

- The bears want a retest of the March low after the current pullback (bounce).

- The candlesticks in the last 9 months are overlapping which means the Emini likely has transitioned into a trading range phase between 4300 and 3500.

- The last 4 candlesticks had overlapping bodies with alternating bull and bear bodies. The Emini is in a tight trading range.

- Poor follow-through and reversals are more likely within a trading range.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- Until the bulls can break far above the August 2022 high, the broad bear channel may still be in play.

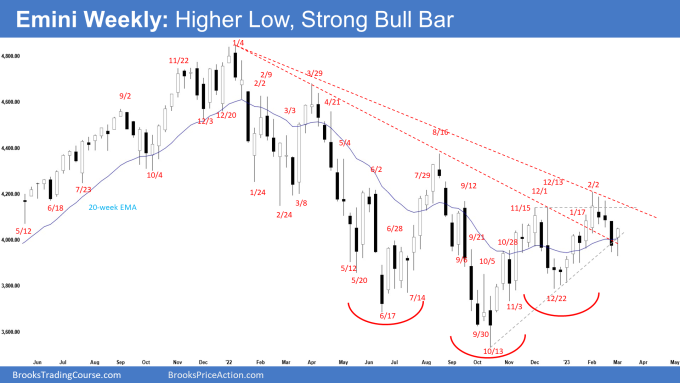

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a strong bull bar reversal closing near its high with a long tail below.

- Last week, we said that odds slightly favor the Emini to trade at least a little lower and traders will see if the bears can continue to create strong bear bars, or will the Emini stall at a higher low potentially setting up another third leg up.

- This week broke below last week’s low but reversed to close as a bull reversal bar.

- The bears see the move up to February 2 high simply as a two-legged swing up.

- They want a reversal down from a higher high major trend reversal.

- If the Emini trades higher, they want a reversal down from a lower high major trend reversal or a double top with February 2 high.

- While some traders may view December high as a major lower high, the bears want a break above the August high to be sure of the end of the bear trend.

- The bears want a retest of the October low followed by a strong breakout and a continuation of the bear trend.

- The bulls see the last 8 months as forming an inverted head and shoulders, with the December low being the right shoulder.

- However, an inverted head and shoulders pattern often ends up as a bear flag instead of a reversal pattern.

- The bulls hope that the current pullback will form a higher low, followed by another leg up forming a wedge pattern with the first two legs being December 1 and February 2.

- By breaking above the December high, they hope the bear trend of successively lower highs and lower lows has ended.

- They need to break far above the December high and August high to signal the end of the selloff.

- After the spike and broad channel down from January 2022, the Emini may have transitioned into a trading range phase between 4300 and 3500.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- The move up from October 2022 may simply be a bull leg within a trading range.

- Since this week was a bull bar closing near the high, odds favor the Emini to trade at least a little higher.

- Traders will see if the bulls can create a strong follow-through bull bar or if next week trades slightly higher but stalls and closes as a bear bar or a doji with a long tail above.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hey Andrew! Been following your blog posts pre market since I signed up a year ago, and just wanted to say thanks. Your insights and suggestions are always great, I really appreciate your thoroughness and educational approach.

Dear Donald,

A good day to you..

Appreciate your comments..

Al said to write what the reader will see on the chart.. like:

“consecutive bull bars closing near their highs”, instead of, “bull spike”,

That would help the readers understand better..

Once again, thank you for your kind words.. wishing a blessed week ahead to you..

Best Regards,

Andrew

Hey Andrew, Thanks for the report. I believe you have meant to say bulls want a break above the August high no?. “While some traders may view December high as a major lower high, the bears want a break above the August high to be sure of the end of the bear trend.”

Dear Eli,

A good day to you.. thanks for going through the report..

The statement is correct.. It should have been better written..

What I meant was, the bears want to see a break above August, before they will admit the bear trend has ended..

I did not mean they hope the market will rally..

Hope this clarifies..

Have a blessed week ahead..

Best Regards,

Andrew