Market Overview: Weekend Market Update

The Emini reversed up sharply for 2 days after a sell climax down to around 2900. It will probably go sideways for a couple weeks.

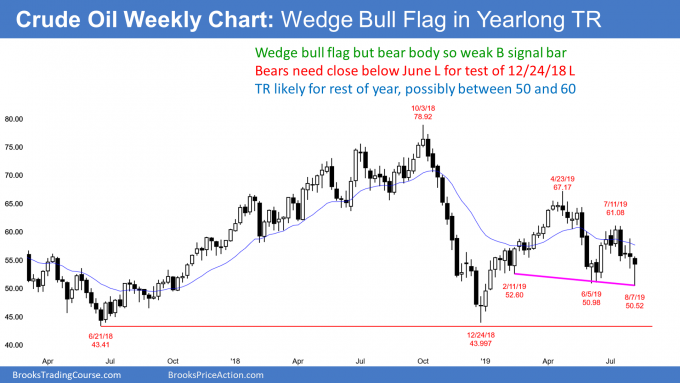

The weekly crude oil futures has a wedge bull flag. But the bear body and many recent dojis make a continuation of the yearlong trading range likely.

The EURUSD weekly Forex chart reversed up from below its 5 week trading range, but the reversal has been weak. Traders will continue to look for reversals every few weeks.

Crude oil Futures market:

Testing bottom of 7 month trading range

Crude oil futures reversed up this week from a breakout below the June low. It now has 2 legs down from the April high.

I have written several times that the December to April rally was a Spike and Channel bull trend. There typically is a break below the bull channel and then a test down to the start of the channel. That is the January 14 low on the daily chart (not highlighted on the weekly chart). At that point, the chart usually transitions into a trading range with that 1st pullback in January being the start of the range. Everything that has happened since the December low is consistent with this common pattern.

The bears want the leg down from the July 11 lower high to lead to a break below the December low. More likely, the chart will reverse up from somewhere above the bottom of the 7 month trading range. This week might be the start of a leg up.

Crude oil forming wedge bull flag

The bulls see the February 11 low on the weekly chart as the 1st leg down in a wedge bull flag. The June low is the 2nd leg down. They are hoping for a reversal up this month. There would then be 3 legs down in a trading range. That is a triangle. Since it is sloped down slightly, it is more precise to call it a wedge. You can call it a wedge bull flag since it might be a pullback in the bull trend that began at Christmas.

Since it is forming above the December low, there will probably be a reversal up within a couple weeks. It might have started this week. Traders see the July lower high as the 1st target.

Remember, all year I have been saying that crude oil would probably be in a trading range for all of 2019. Traders should expect reversals. They look to buy low, sell high, and take quick profits.

Crude oil is now low in the range. Since the July selloff was strong, the daily chart might have to go sideways for a couple weeks before traders believe that the selling has ended. Once they do, they will look to buy a reversal up.

EURUSD weekly Forex chart:

Failed breakout below 5 month trading range

The EURUSD weekly Forex chart reversed up strongly this week after a break below the 5 month trading range. That break was a reminder that the yearlong bear channel is still intact. The bulls need a strong breakout above the June high to make traders believe that the bear trend has finally ended. Without that, traders will continue to look for a reversal after every 2 – 3 week leg up or down.

This week’s reversal up on the daily chart (not shown) was strong enough to make a 2nd leg up likely. A reversal down from here will probably only last about a week before the bulls will buy again.

Reversal up from Spike and Channel Bear Trend

The selloff from the June high on the daily chart (not shown) formed a Spike and Channel Bear Trend. Traders see the July 11/July 19 double top as the start of the wedge bear channel. When a Spike and Channel Bear Trend reverses up, traders expect a test of the start of the channel. That means they will buy the 1st reversal down and look for a rally to around 1.1280.

If the current leg up continues to 1.1280 without more than a day or two pullback, traders will expect the 1st pullback to lead to a test of the next resistance. That is the June high of 1.1413.

Can this week’s high be a lower high that reverses down to below the August low? The momentum up this week makes it likely that bulls will buy the 1st 3 – 5 day reversal down. Consequently, a higher low and then a 2nd leg up is a more likely outcome.

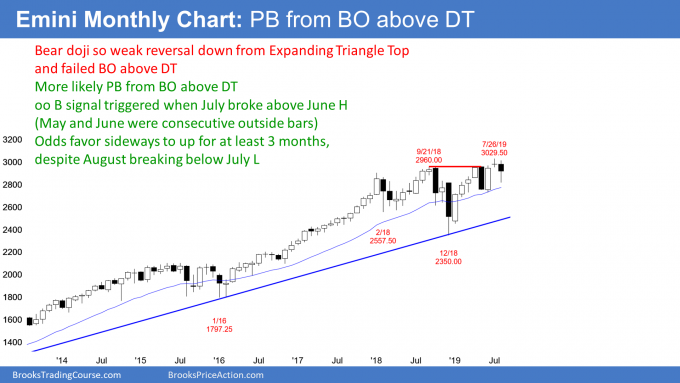

Monthly S&P500 Emini futures chart:

Minor reversal down from expanding triangle top

The monthly S&P500 Emini futures chart has a big range in August. There is currently a bear body, but a big tail below. August is not particular bearish at the moment on the monthly chart.

As strong as the selloff has been on the daily chart, it is still more likely to be a pullback in a bull trend than the start of a bear trend on the monthly chart. This is because July triggered an oo buy signal (consecutive outside months). May was an outside down month and June was an outside up month. Once July went above the June high, it triggered the buy signal.

I have been saying throughout July that there is a 60% chance of 3 months of sideways to up trading. I chose my words carefully. Sometimes the Emini will go sideways instead of up. With the August selloff as strong as it has been, the 3 months will probably not be strongly up.

What happens after September? The effect of the oo buy signal wanes and traders begin to look for the next pattern.

Expanding triangle top will probably lead to minor reversal

I have also written many times about the expanding triangle top on the weekly and monthly charts. That is a major trend reversal pattern. Like all major patterns, there is only a 40% chance of an actual major reversal from a bull trend into a bear trend. The majority of major tops and bottoms go mostly sideways. Traders then look for the next pattern to buy or sell.

There is still a 60% chance of a break below the December low within 3 years. But there is not much risk of that happening until at least after a test of the all-time high, and probably not for many more months.

Weekly S&P500 Emini futures chart:

Buy signal bar for higher low in bull channel

The weekly S&P500 Emini futures chart gapped down this week but reversed up strongly from far above the June low. It closed the big gap down and it is now a buy signal bar for next week.

But the tail on its top and the strong 2 week selloff weaken the buy setup. I said all through July that there would be at least a 2 – 3 week selloff. The size of the selloff makes 3 or more weeks of sideways trading likely.

Limit order, scale-in bears

In the 1st week of June, the Emini reversed up strongly with an outside up bar. The last week of May was a big bear bar closing on its low. It was reasonable for traders and algorithms to sell with a limit order at the top of that bear bar because it was a low probability buy signal bar.

In a situation like that, experienced traders know that some bears will sell more (scale-in bears) as the Emini goes higher. They are confident that if they do something reasonable, there is an 80% chance of avoiding a loss or making a profit. This type of scaling in often requires a wide stop. Traders expect an eventual pullback to below the top of the bear bar where they began to short.

This is what happened this week. The selloff to below the top of that May bear bar allowed the bears to buy back their 1st shorts at breakeven. They made a profit on their higher shorts. Remember, the bears are buying the selloff down to the top of that bear bar.

What do the bulls do? They buy as well. They know that the Emini rallied in early June once it broke above that bear bar’s high. Traders are betting that there will again be buyers at that price. If many bulls and bears buy at the top of that big bear bar, you get a week like this past week.

Probably sideways to up for a few weeks

Will this week be the end of the selloff? The Big Up in July has been followed by Big Down in August, and now by Big Up again. That typically creates Big Confusion. The surprisingly strong bears on the daily chart (see below) make traders wonder if the bears will sell again back around the September/May double top at 2960.

Bear surprises typically have at least a small 2nd leg sideways to down. Therefore, if this week is a rally in a developing trading range for the next few weeks, traders should expect it to fail around where the Emini sold off in September and again in May.

As strong as this week has been, there is currently only a 50% chance that the Emini will go straight up to a new high without at least a small 2nd leg sideways to down within the next couple weeks.

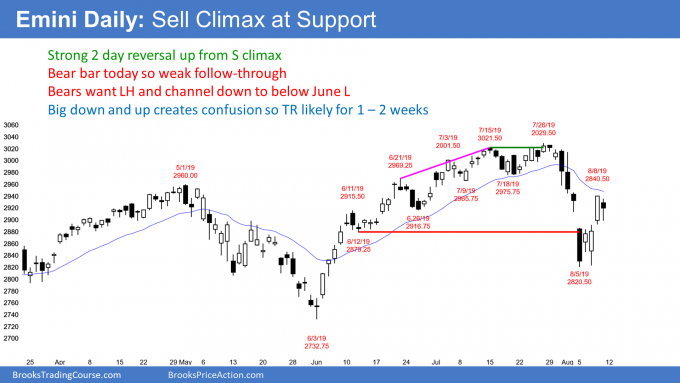

Daily S&P500 Emini futures chart:

Strong rally from micro double bottom might be end of pullback

The daily S&P500 Emini futures chart had a strong bull breakout in early June. A bull breakout is a Spike. Once there was a pullback, the breakout phase ended and a bull channel began. That happened on June 12.

A bull channel has a 75% chance of a bear breakout and then a transition into a trading range. I talked about this many times over the past month. This is how the Market Cycle typically behaves. That is why I said throughout July that a selloff was likely. A strong trend (breakout) weakens and becomes a channel. The chart then transitions into a trading range. At that point, the process starts over. Traders look for the next breakout up or down.

The bottom of the trading range is usually around the bottom of the 1st pullback. This week fell below that June 12 low and reversed up.

Wednesday formed a micro double bottom with Monday’s low. The reversal up this week was strong enough to make traders wonder if the selloff was just a brief, sharp pullback in the strong bull trend that began in December.

What do the bulls need?

A small double bottom after an extremely strong selloff is usually not enough of a foundation to support a bull trend. There typically will be at least one more leg sideways to down. If the bounce is weak, the 2nd leg down can fall far below the 1st. Also, there is often a 3rd leg down to a wedge bottom. That would be a Spike and Channel Bear Trend.

However, this week’s reversal up was as unusually strong as was the 2 week selloff. It makes it likely that the low is in or that there will be buyers not far below this week’s low. But there is only a 50% chance that this rally will go straight up to a new high.

Next week will be important. If the Emini hesitates for a few days, it will probably test back down and retrace about 50% of the reversal up. There was a 2 week sell climax and then a sharp reversal up this week. But this week was a buy climax and therefore there is a 50% chance of a test back down within a couple weeks.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.