Market Overview: Weekend Market Update

The Emini had its 1st pullback on the weekly chart in 8 weeks. The selloff will probably last at least a couple more weeks and end between 2800 and 2900.

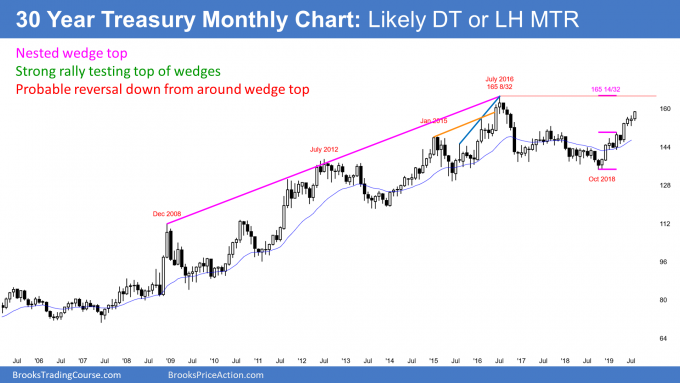

The 30 year Treasury Bond Futures market is continuing up from the October low. The rally is a test of the July 2016 nested wedge top. There will probably be a reversal down starting within 6 months and lasting at least 10 years.

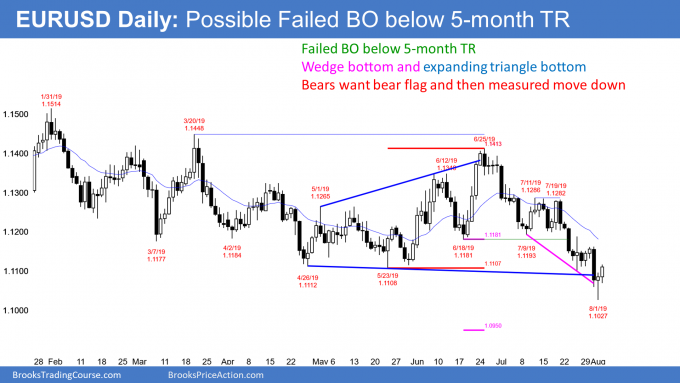

The EURUSD daily Forex chart broke strongly below its 5 month trading range. If there is no follow-through selling next week, this breakout will end up like all of the others over the past year. Traders will begin to look for a 3 week rally back into the 5 month range.

30 Year Treasury Bond Futures market:

Strong rally testing July 2016 nested wedge top

The 30 year Treasury Bond futures monthly chart has rallied strongly since the October low. The September 2017 high was the right shoulder of a head and shoulders top. Once May broke above that high, the top failed. May might now be a measuring gap. A measured move up from the October 9 low to the March high is 165 14/32.

Why is that important? Because the July 11, 2016 all-time high is 165 8/32. A measured move would be at a new all-time high.

Why does that matter? The monthly chart had nested wedge tops on July 11, 2016. There were several levels of nesting over the prior 9 years, and that increases the probability that it is a major top. Major trends in the bond market last 10 – 30 years. If this rally reaches its target, then the top will have failed.

What happens if the 2016 nested wedge top fails?

It is important to realize that trend reversals often fail, but then succeed after a 2nd attempt. The theoretical stop for the bears is 1 tick above that July 2016 high.

When a rally breaks above an obvious stop level, my general rule is that there is a 50% chance of a swing up. There is also a 50% chance of a failed breakout and a 2nd reversal down. I adjust the odds based on context.

Since the nested wedge top is so reliable, a breakout above it may only have a 40% chance of a strong move up from there. Consequently, if the bulls get their new high, traders will again look for another attempt at a major reversal down. That would be a higher high major trend reversal.

A major reversal down can also come from below the prior high. It would then be a lower high major trend reversal. While the 10 month rally is strong, traders will be looking for a major top within the next 6 months.

EURUSD daily Forex chart:

Strong bear breakout but weak follow-through

After Wednesday’s FOMC announcement, the EURUSD daily Forex chart broke strongly below the 5 month trading range. The bears wanted strong follow-through selling on Thursday. Instead, Thursday was a bull doji reversal day and Friday was a small bull trend day. That is a sign that the bear trend is not nearly as strong as it could have been had Thursday been a big bear bar closing on its low.

It is a reminder that the yearlong pattern of reversals up from new lows might still be intact. Traders will now look for a reversal back up over the next week. If the bulls can rally back above Wednesday’s high, traders will begin to believe that the bear breakout was just another leg in the yearlong bear channel.

The bears need big bear bars within the next week. They want a measured move down from the June/July head and shoulders top bear flag. That target is 1.0950. Furthermore, they are hoping that Wednesday’s break below the 5 month trading range will result in a measured move down to 1.0802.

But unless they get their strong follow-through selling over the next week, the bears will begin to take profits and the bulls will buy, expecting a 2 – 3 week, 200 – 300 pip bull leg in the bear channel. A rally from here would create an expanding triangle bottom with the April 26 and May 23 lows. In addition, there is a month-long wedge bottom. The first target would be the July 11/July 19 double top, which was the start of the wedge.

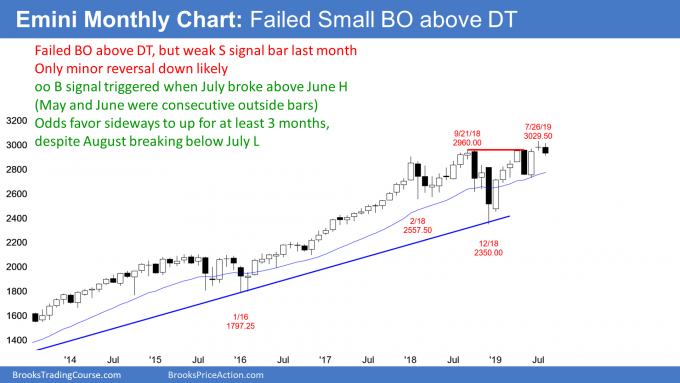

Monthly S&P500 Emini futures chart:

Expanding triangle top, but minor reversal down

The monthly S&P500 Emini futures chart broke above consecutive outside bars in July. That is a buy signal with a 60% chance of 3 months of sideways to up trading.

The bears see July as the 3rd leg up in a 19 month expanding triangle top. In addition, they hope that the breakout above the September/May double top is failing.

July was a small bar on the weekly chart. Because it closed below its midpoint, it is a sell signal bar for August. When Thursday, August 1, traded below the July low, it triggered the monthly sell signal.

But a small bear doji is a weak sell signal bar. Also, the context favors sideways to up trading into at least September. Consequently, there will probably be more buyers than sellers not too far below the July low.

What happens if August grows into a huge bear trend bar closing on its low? That would make a trend reversal more likely than simply a pullback in a bull trend.

What if August is a small bear bar and September trades below the August low? Unless either August or September is a big bear bar, the odds will still favor a new high within a few months.

Weekly S&P500 Emini futures chart:

Expanding triangle top

After 8 weeks in a bull micro channel, the weekly S&P500 Emini futures chart finally traded below the low of the prior week. That is a pullback and it ends the micro channel.

Eight weeks without a pullback is unsustainable. It it therefore a buy climax. Buy climaxes eventually attract profit-takers. This week’s big selloff was a sign that the bulls were finally taking some profits.

Eight weeks without a pullback is also a sign of strong bulls. Traders therefore expect the bulls to buy again soon.

Compare this 8 week bull micro channel with the one that began at Christmas. That one lasted 10 weeks and the pullback was only a single bar.

Will the Emini do the same this time? Probably not. There was a big bear bar 2 weeks ago and 2 small dojis a few weeks earlier. The current rally is not nearly as strong as the one from Christmas. Traders should therefore expect a deeper pullback and one that lasts longer.

The 8 week rally is strong enough to make a bear trend a low probability bet. But a 2 – 3 week pullback at a minimum is more likely than one that ends after only one week. The pullback might last longer. However, the bull trend is strong enough so that a bull flag or trading range is still more likely than a bear trend. This is true even if this pullback tests all of the day down to the June 2732.75 low.

When will the bulls buy?

The bulls will probably take control somewhere above the June low. Both legs up this year were strong enough to make at least one more leg up likely. If there is then a reversal down from a new high, there would be a wedge top in addition to an expanding triangle top. If the rally turns down from a lower high, there would be a head and shoulders top, which is a lower high major trend reversal. In either case, the bears would have a better chance of a deeper and more prolonged selloff at that point.

It is important to remember that the Emini has been in a trading range for 19 months. Markets have inertia and resist change. There is no credible evidence that there will be a successful breakout from the range any time soon.

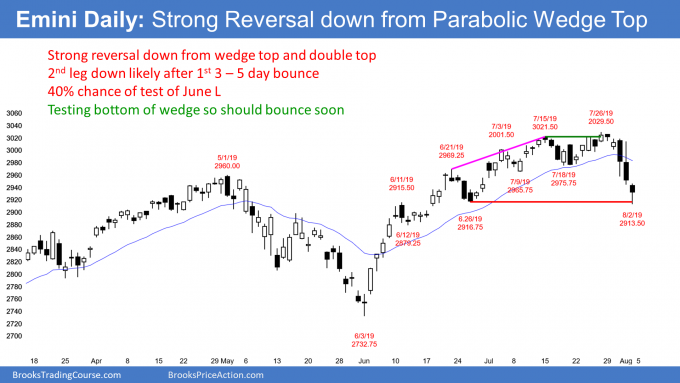

Daily S&P500 Emini futures chart:

Bear Surprise Bars so at least 2 legs down likely

The daily S&P500 Emini futures chart had surprisingly big bear bars on Wednesday and Thursday. Bear Surprises Bars trap bulls in and bears out. Both are hoping for a bounce. The bulls who are trapped into a bad long want to get out with a smaller loss. The bears who missed the short want a rally that will allow them to enter with less risk.

When both the bulls and bears are looking for a rally to sell, there will typically be at least a small 2nd leg sideways to down. That is the minimum objective. Sometimes the 2nd leg is just sideways. Sometimes there are many legs down. Since the weekly chart will probably pull back for at least 2 – 3 weeks, the daily chart should have at least 2 legs down.

Wedge tops

It is important to remember the consecutive wedge tops on the daily chart. I have been saying for 4 weeks that a wedge rally is a buy climax. A buy climax eventually attracts profit takers.

When the bulls take profits, they are not looking to buy again just a few days later. If that were the case, they would not take profits. Instead, they take profits because they are becoming increasingly concerned about a deep pullback or even a trend reversal. They do not want to buy again until they are confident that the selling will not be deep and not last a long time.

They want to see if the bears are strong enough to take control. This process usually takes at least a couple weeks. The bulls typically wait for a least a couple legs sideways to down before looking to buy again. They wait longer if the selling is still strong.

When will the pullback end?

Because the selloff on the weekly chart will probably last at least a couple more weeks, there is little incentive for the bulls to buy at the moment. Furthermore, the wedge top on the daily chart will probably have at least 2 legs sideways to down.

This week’s selloff is still only the 1st leg down. The bears will take some profits soon and the bull scalpers will buy. That will create a 2 – 5 day bounce. Then, the bull scalpers will take profits and the bears will sell again. This will create a lower high and begin a 2nd leg down.

What can go wrong with this scenario? Everything. The Emini could crash or quickly reverse back up to a new high. Neither is likely. A selloff down to 2800 – 2900 or lower over the next few weeks is what traders should expect. Then, there will probably be another new high in September or October.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.