Market Overview: Weekend Market Update

The Emini rally has been very strong. Traders expect a new all-time high this week. Even if there is profit-taking, the 1st reversal down will probably only be minor.

Crude oil finally reached its highest reasonable target this week. I have been writing every week for 4 months that higher prices are likely. Now, there will probably be at least a 2 week pullback to $60.

The EURUSD weekly Forex chart has been in a tight bear channel for 10 months. It also has been in a tight trading range for 5 months. This week broke below the range. Traders expect lower prices, even if there is a bounce for a week or two.

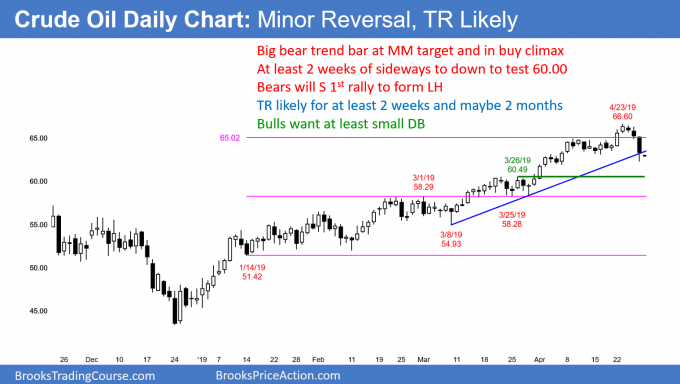

Crude oil Futures market:

Start of pullback to $60 breakout point

The crude oil futures turned down this week with a big bear trend bar on the daily chart. This will probably lead to at least a couple small legs down to 60.00 over the next 2 weeks.

Once there is profit taking after a buy climax, the chart usually enters a trading range. The pullback could last a couple of months. It might even test the start of the channel at the March 8 or January 14 lows.

In December, I said that the December trading range would probably be the Final Bear Flag. For the past 4 months, I wrote every week that there was no top, and that the rally would continue. Last week, I said that the rally would probably end around the 65 measured move target.

Friday’s big bear bar is a sign that the bulls are taking profits. Those who did not now expect a 2nd leg down. They will use a bounce to sell out of their longs.

Friday was a surprisingly big bear day in a buy climax. A Bear Surprise bar typically leads to at least 2 legs down. Traders will sell rallies for at least a couple weeks.

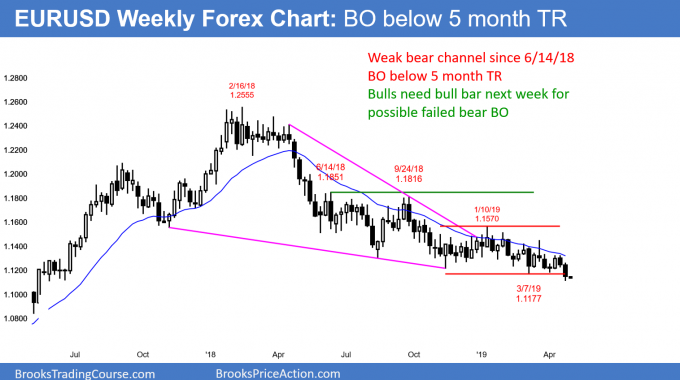

EURUSD weekly Forex chart:

Trading range breakout and 10 month tight bear channel

The EURUSD weekly Forex chart has been in a bear channel for 10 months. It has also been in a tight trading range for 5 months. This week broke below the bottom of the trading range. The odds favor lower prices.

However, if next week is a bull bar, there will probably be a 1 – 2 week bounce 1st. Every move up and down for 10 months has lasted only 1 – 3 weeks. This one might as well. But, because of the bear channel, traders will expect the sequence of lower highs and lows to continue. One caveat is Wednesday’s FOMC announcement could be a catalyst for a big move up or down.

On the daily chart, there were consecutive closes below the March low. That increases the chance of a swing down that has at least 2 small legs. The bears want a 400 pip measured move down over the next couple of months. This is based on the height of the 5 month trading range.

Monthly S&P500 Emini futures chart:

Emini testing all time high ahead of May FOMC announcement

The monthly S&P500 Emini futures chart has 2 trading days left in the month. April will probably remain as the 4th consecutive bull trend bar. The magnets above are the all-time high and the 3,000 Big Round Number. After 4 strong bull bars, the bears will probably need at least a micro double top before they can get more than a 1 – 2 month pullback.

It is important to realize that the 16 month trading range might be the Final Bull Flag. If the bulls get their breakout to a new all-time high, the bears will be ready to sell if they see aggressive profit taking by the bulls.

This is a monthly chart. Consequently, the several bars required for a reversal means the downside risk is small for the next couple months.

A reversal down from above the September high would form an Expanding Triangle top. The target for the bears is the bottom of the triangle, which is the December low. That is probably too far to reach in 2019. More likely, the bulls will buy and create a higher low after a 33 – 50% pullback.

The 4 month rally and the 10 year bull trend are strong. Consequently, the bears will probably need at least a micro double top before they can get a reversal down. Since this would take a few months, the downside risk is small for the next couple months.

Weekly S&P500 Emini futures chart:

Strong rally should test all-time high this week

The weekly S&P500 Emini futures chart had a couple reversal attempts in March. The bulls quickly bought them. With the pullbacks lasting only 1 bar, the best the bears can probably get over the next several weeks is a 3 week pullback.

Even then, the bulls will buy it. A strong trend typically needs at least a micro double top, like the September high, before there is a swing down. Less often, there will be a blow-off top like in January 2018.

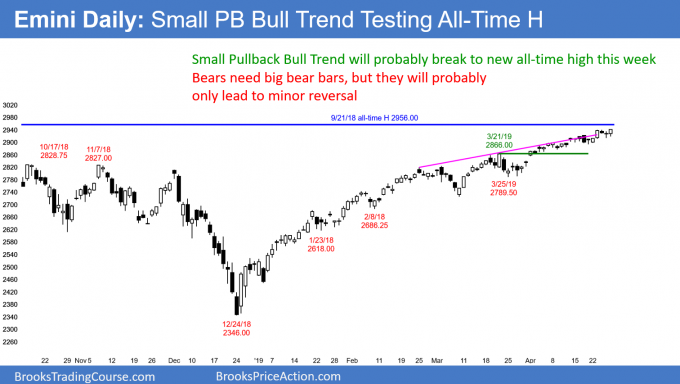

Daily S&P500 Emini futures chart:

Small Pullback Bull Trend ahead of May FOMC

The daily S&P500 Emini futures chart is in a Small Pullback Bull Trend. It will probably break to a new all-time high this week. However, if there is not a close far above the old high, the rally will probably attract some profit-taking. This could lead to a test of the March 21 high within a couple weeks.

Wednesday’s FOMC announcement always can lead to a surprisingly big move that can last for several days. The bulls hope for the rally to continue to above 3,000 before there is a pullback. However, the bears want a double top with the September high.

With the bull channel as tight as it is, the bulls will likely need at least a micro double top before there is a test back to 2800. In addition, when a channel is tight, the 1st reversal typically is minor. Consequently, the best the bears will probably get over the next few weeks is a trading range, not a bear swing.

Traders are aware of the adage, “Sell in May and go away.” There is a tendency for sideways to down trading in May and June. But, the 4 month rally has been extremely strong. Even if the bears were to get a 50% correction lasting several months, there will be eager bulls looking to buy it.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Reference the S&P weekly chart. With the price approaching the high of September, could this not be the Double top the bears have been waiting for with the collapse of price at this previous price level, and the current vacuum up to this level, could this not give the bears a stronger case.

Also at what point do you think the vacuum affect took affect ?

Kind regards

Simon

It could always be a double top. However, that would be unusual with such a persistent tight bull channel.

The vacuum effect has been clear since the March 25 low and then again after the April 17 top attempt.