Market Overview: EURUSD Forex

The EURUSD Forex market formed an EURUSD inside bar on the Monthly chart and is in breakout mode. On the weekly chart, EURUSD is in a sideways to up pullback. This week traded lower but reversed back higher. Odds slightly favor the EURUSD to still be in the sideways to up pullback phase. Bears want a reversal lower from a double top or a wedge bear flag with Sept 12 high or Aug 10 or around the 20-week exponential moving average.

EURUSD Forex market

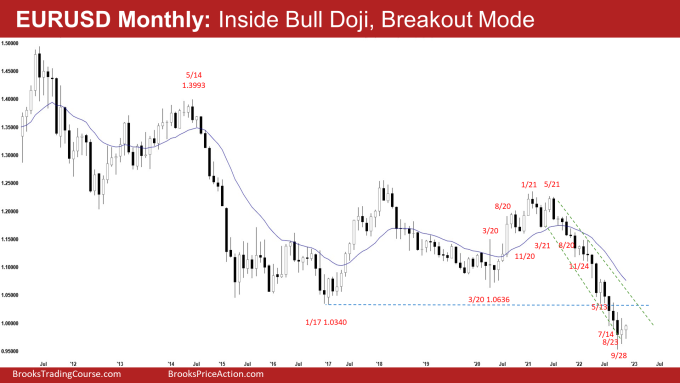

The Monthly EURUSD Forex chart

- The October Monthly EURUSD candlestick was an inside bull bar with a prominent tail above and below. It closed around the middle of September and October’s range.

- Last month, we said that the odds continue to slightly favor lower prices. However, the climactic selling increases the odds of at least a small sideways to up pullback, beginning within 1-2 months before the EURUSD continues lower.

- The bulls want a failed breakout below the 7-year trading range. They want a reversal up from a trend channel line overshoot and parabolic wedge (Nov 24, May 13 and Sept 28).

- They also have a micro wedge (July, Aug, September).

- However, the bulls have not been able to create strong consecutive bull bars since the selloff in 2021.

- The bulls want the EURUSD to break above the October inside bar.

- If there is a downside breakout, bulls hope that October inside bar is a one-bar final flag of the selloff and want a reversal higher from a double bottom with Sept low.

- Bears want a measured move down based on the height of the 7-year trading range, which will take them to the year 2000 low.

- The selloff since June 2021 is in a tight bear channel. That means persistent selling and strong bears.

- The bears got consecutive bears bars following the breakout below the 7-year trading range.

- However, the candlesticks (July, Aug, and September) have prominent tails below.

- The selling has also lasted a long time and is climactic.

- Since October was an inside bar, the EURUSD is in breakout mode.

- Breakout mode means there is a 50% chance of a bull and a bear breakout. The first breakout has a 50% chance of failing.

- The candlestick after an inside bar sometimes is another inside bar, forming an ii (inside-inside) pattern, which is also a breakout mode pattern.

- The trend channel line overshoot (September) and parabolic wedge bottom (Nov 24, May 13 and Sept 28), increase the odds of at least a small sideways to up pullback lasting a few months. It may have already started in October.

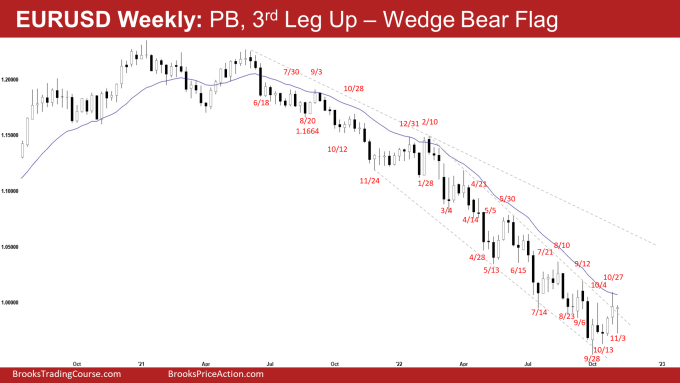

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bull doji closing near the high with a long tail below.

- Last week, we said that odds slightly favor the EURUSD to still be in the sideways to up pullback phase.

- This week broke far below last week’s low but reversed to close near the high of the week’s range.

- The bears want a strong breakout below the 2017 low, and a measured move down based on the height of the 7-year trading range. This will take them to the year 2000 low.

- The move down is in a tight bear channel. That means strong bears.

- However, the bear trend has also lasted a long time and is climactic.

- While the breakout below the July-August low in September was strong, the bears failed to get follow-through selling.

- The bears hope the last 6 weeks were simply a 2-legged sideways to up pullback and want at least a retest of Sept low.

- If next week trades higher, they want the EURUSD to stall and reverse lower again, forming a wedge bear flag with Sept 12 high or Aug 10 or around the 20-week exponential moving average.

- The bulls hope that the recent 10-week trading range (July to Sept) is the final flag of the move.

- They want a reversal higher from a wedge bottom (May 13, July 14 and Sept 28) and a trend channel line overshoot.

- The bulls triggered the second entry long (High 2) and got a weak follow-through bull bar.

- This week was a pullback from the second leg up. Bulls want another leg up forming the wedge bear flag with the first legs being Oct 4 and 27.

- The bulls kept failing to get sustained follow-through buying, a recurring theme since the selloff started in 2021.

- While the bulls manage to get some follow-through buying recently, the overlapping bars indicate that the bulls are not yet as strong as they would like to be.

- The bulls need to do more to convince traders that a larger sideways to up pullback may be underway.

- They need to create strong consecutive bull bars closing near their highs, breaking far above the bear trend line, 20-week exponential moving average and 1.00 Big Round Number to convince traders.

- Since this week was a bull doji closing near the high with a long tail below, it is a buy signal bar for next week.

- Odds slightly favor the EURUSD to still be in the sideways to up pullback phase.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.