Market Overview: FTSE 100 Futures

The FTSE futures market traded higher in a tight bull channel to a possible wedge top at the top of a trading range. The channel is tight enough to expect higher prices next week and any reversal to be minor. The bears will continue to sell new highs and scale in, expecting a failed breakout and return back into the range.

FTSE 100 Futures

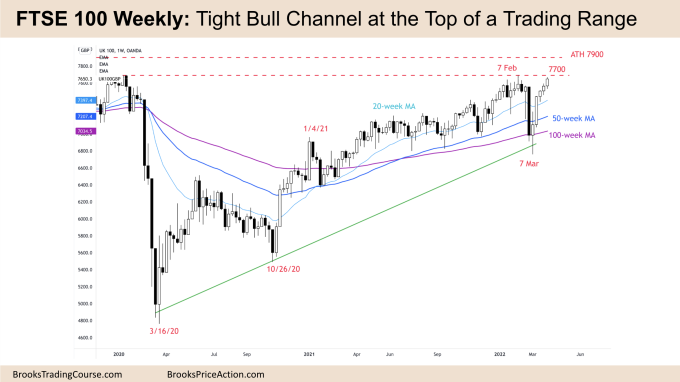

The Weekly FTSE chart

- The FTSE 100 Weekly bar was a bull bar with a small tail on top. It is the highest FTSE 100 close in over 2 years.

- It is the 5th bull bar in a row, the FTSE has not had 6 bull bars in a row since May 2018 so it is reasonable next week will be a bear bar.

- The bulls see a tight bull channel reversal up from the moving averages on March 7th to the top of the pre-COVID trading range.

- The bulls want a close above 7700 for another leg up to a new all-time high (ATH) and a measured move either from the March 7 low or possibly the COVID-crash lows of March 16, 2020.

- The bears see a strong bull leg at the top of trading range lasting either 3 months or 3 years. They see a return to a tighter trading range at a previous high which was a magnet. They know no matter how bullish it may seem, trading ranges disappoint traders.

- Both bulls and bears know we have not had a weekly bar trade lower than a prior bar in 5 weeks. So both bulls and bears expect the first pullback to be minor.

- If we are in a tight bull channel, a low 1 is a pullback buy signal. If we are at the top of a trading range, a low 1 is a reasonable sell signal. Because there are both reasonable buy and sell signals, we will likely go sideways to up, possibly an outside bar next week. That is the confusion found in trading ranges.

- If the bulls buy the low 1 and get an outside up, maybe a strong breakout close around 7700, 100 points higher. This may convince traders we will get a second leg. They will likely exit below a bear bar closing on its low as a pullback and look for a high 2 buy signal down lower around the moving average.

- If the bears sell the low 1 next week and we close below, traders may look to get short back to the moving average in the middle of this range. The bears will look to scale in with a low 2 and second entry short at the top of a trading range which is a reasonable sell.

- If you’re long, well done, that wasn’t an easy buy! Look to scale out at each new high.

- If you’re short, you probably traded small enough to ride the push up betting we would get back to the moving average.

- If you’re flat you need a very wide stop to get long. The math would be better but probability lower, for light positions selling new highs expecting two legs, failed breakout of a wedge reversal and move down to the moving averages. Perhaps wait for a convincing bar in each direction.

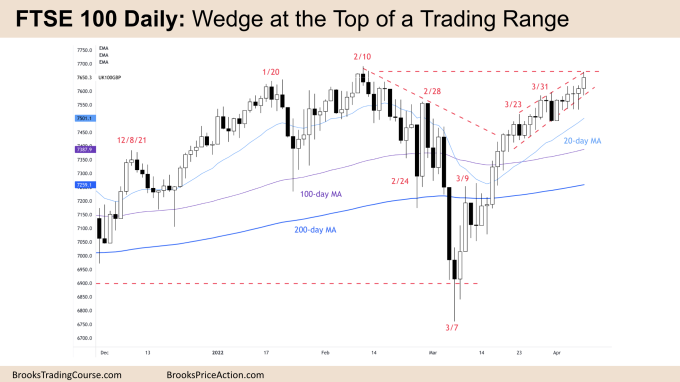

The Daily FTSE chart

- The FTSE 100 on Friday was a bull bar with tails above and below. Last week we traded sideways to up with dojis all week as traders decided where we are headed.

- The bulls see another bull bar in a tight bull channel. They are looking for a close above the recent high at February 10th.

- The bears see a failure to close above the several-month long trading range. They also see a possible wedge top and 3 pushes up from March 7th.

- It is reasonable to sell the wedge top for a possible MTR back down to the base of the range but bears will want to sell below a decent bear bar closing below its midpoint.

- It’s a tough buy signal because the stop is far away so bulls should trade small and scale in.

- If next week we get reasonable bear bars, a low 1 sell will likely take us back to the moving average, which is a reasonable target. Bulls will often buy the first moving average gap bar, especially after 17 bars above it in a bull channel.

- If next week we trade higher above 7700, the bulls might get a breakout for another leg up to the ATH at 7900.

- Trading ranges are full of disappointment and the math is usually 50% for both bulls and bears.

- No matter how strong the bull breakout is, 80% of breakouts fail and the bears could get a failed breakout at the top a trading range.

- Even if bears sell the wedge reversal, low 1 short, bulls will buy the first pullback expecting it to be minor so expect sideways to up trading next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Great analysis Tim!