Market Overview: FTSE 100 Futures

The FTSE futures market reversed up strongly with a bull surprise bar at support. It was the end of a measured move for the bears and you can see how quickly they exited. We said last week we would end up back at this magnet of a tight trading range, so we might go sideways to up while the computers have a bit of fun with the day traders. The math is 50% either way here so most traders should wait. And the bars are big, as is the risk, so trade small.

FTSE 100 Futures

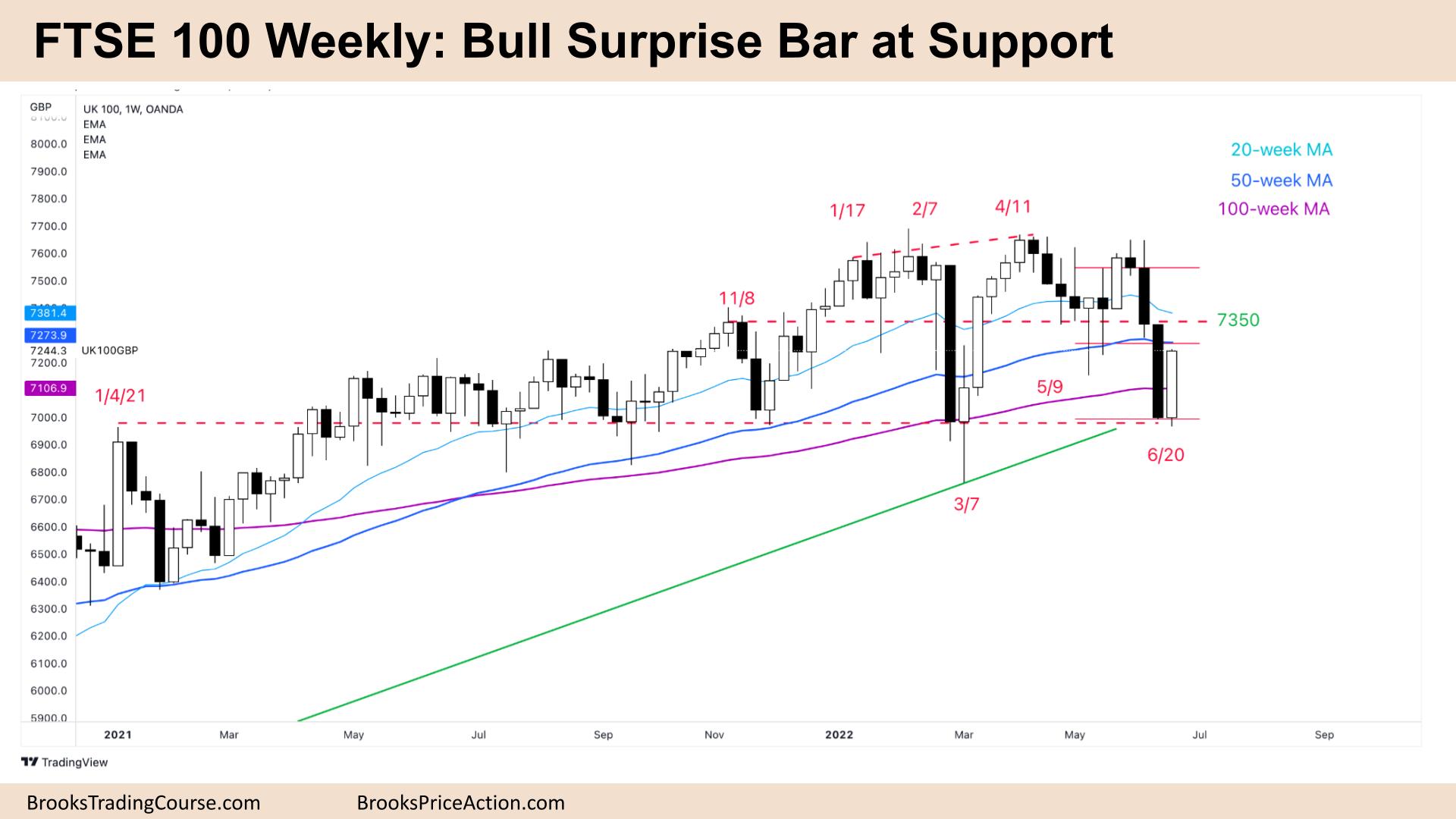

The Weekly FTSE chart

- The FTSE 100 futures was a large bull surprise bar closing on its high so we might gap up next week.

- It was a reversal at support, the prior breakout point from January 2021 and the bottom of an 18-month trading range.

- It was a measured move target like we said last week and we were waiting to see whether bears stayed short.They did not.

- We said last week, that after a tight trading range, and barbwire pattern for several weeks, we might breakout and fail before we move from this price area. They did.

- The bears had 3 consecutive bear bars closing on their lows but it still reversed.

- The bulls see a double bottom, bull surprise off the moving averages and are looking to test the top of the range.

- They even bought after 3 bear bars which shows the lack of bear conviction. They are likely to keep pressing next week long. Even though the math isn’t great. The middle of a trading range is no better than 50% either way.

- The bears see a pullback after a bear breakout and expect a second leg so will start to scale in above bars. They might wait until the tight trading range above as it’s a magnet.

- The bears expected bulls to buy below the moving average. That was the 3rd time in 6 months they got a bar completely below the moving average so they will likely keep buying low, selling high and scalping (BLSHS.)

- The bears want to stop going back to that range and create a gap for a possible measured move down, but they might have to settle for a bear leg in a trading range.

- The bulls want a follow-through bar, but if they can’t get a close back into that range, they will likely take profits and buy back lower down.

The Daily FTSE chart

- The FTSE 100 futures on Friday was a bull surprise bar closing on its high so we might gap up on Monday.

- The bulls see a double bottom and the High 2 buy setup at the bottom of a trading range was a high probability trade.

- Bulls want a follow-through bar to move back up to the upper part of the range. They look left and see the strong bull reversals from these prices and will expect another push-up. But did we switch to always in long?

- The size of the bar suggests that bears were buying back shorts as well as bulls buying so they might sell right away.

- So even though always in traders exited, they will likely still look to get short unless there is follow-through long.

- The bulls know we are still below the moving average and after so many bars below the average bears will sell above there.

- The bears see the tight bear channel and expect it to turn into a broad channel before going sideways. They see a second-leg trap and will wait for a pause.

- The bull surprise bar was large enough to catch the weak/late bears off-guard and they will look to scale in higher above the moving average.

- They want a Low 1, or a moving average gap bar to sell below.

- But trading ranges are disappointing and so we might get follow-through back to at least the middle of the range, before strong bears will scale in again, knowing the math is better there.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.