Emini and Forex Trading Update:

Tuesday November 5, 2019

I will update again at the end of the day.

Pre-Open market analysis

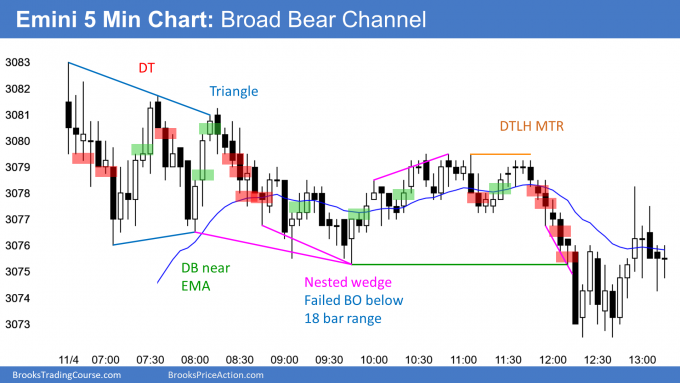

The Emini gapped up again yesterday but traded in a small trading range. It was sloped downward and it was also a broad bear channel. Traders are still debating when and if Friday’s gap up on the monthly chart will close. There has been a 1 – 2 day pullback every 3 – 5 days for a month. Traders should see another one this week.

But there are 4 consecutive bull bars on the weekly chart. That represents sustained buying. Consequently, the bulls will buy the 1st 1 – 3 day selloff. Therefore the down side risk is small this week.

There is a seasonally bullish tendency at the end of October into November 5 and another one that starts on November 11. Placing trades based on seasonal behavior is a losing strategy. I mention it because it can be fun to see if it holds true this year. Remember, November through May is already a seasonally bullish time, and all time frames are currently in bull trends. The seasonal windows add nothing other than entertainment.

Overnight Emini Globex trading

The Emini is up 7 points in the Globex session. Traders are wondering if the rally will reach 3100 before there is a pullback. Whether or not it does, they expect a 1 – 3 day pullback beginning today or tomorrow. This is because there has been a pullback after every few days in this 5 week rally. Also, the past 3 days have been climactic. Finally, yesterday was a bear day on the daily chart.

The Emini might gap above yesterday’s high. But if it does, the gap will likely be small. Small gaps typically close in the 1st hour. Furthermore, yesterday’s range was small. If there is an early selloff, there is an increased chance of an outside down day, especially since a pullback is likely this week.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

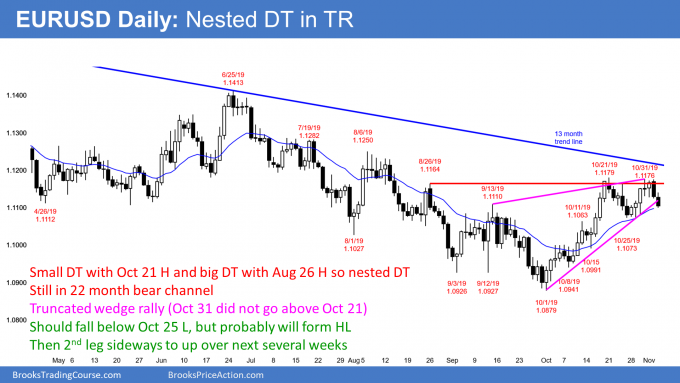

The EURUSD daily Forex chart is turning down from a small double top with the October 21 high. This small double top is nested within a bigger double top with the August 26 high. Also, the rally is a truncated wedge, which means the 3rd leg up did not go above the 2nd. It began with the September 13 high. Traders expect 2 legs sideways to down over the next couple weeks.

Most traders believe that the October 25 low was not a deep enough test of the October 1 low. Consequently, the developing selloff will likely fall below the October 25 neck line of the small double top.

But this rally was the strongest one on the weekly chart in almost 2 years. Therefore, the selloff should form a higher low and lead to one more test up. The target is another test of the August 26 high and a test of the 13 month bear trend line.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart continued yesterday’s selloff overnight. It fell 40 pips in a tight bear channel.

While the bars were not big and the bear trend did not fall far, the bear channel is still tight. Therefore, the bulls will need to stop the selling and then create a trading range before day traders will begin to buy. Also, a tight bear channel usually evolves into a trading range before it can reverse into a bull trend. Consequently, the bulls will only look for scalps today.

While the selloff has been relentless, it is not particularly strong. Also, the EURUSD is reaching the support of the October 25 low. Traders know that there will probably be a bounce around that level.

That is only 27 pips below the overnight low. As a result, while the bears will continue to sell 10 pip rallies, they will start to scalp for 10 pips. They do not believe that the selloff will accelerate down strongly through that support. The bounces will probably increase to 20 pips as the weak bear trend transitions into a trading range today.

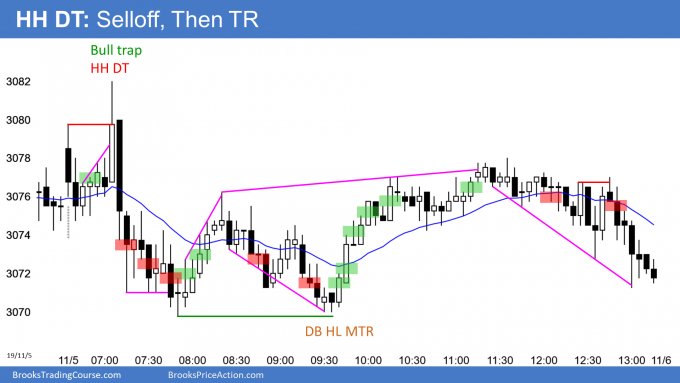

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

By trading below yesterday’s low, the Emini today formed a 1 day pullback. The last 2 pullbacks in the 5 week rally lasted 2 days. Consequently, this pullback will either continue tomorrow for a 2nd day or there will be a 1 – 3 day rally and then a 2 – 3 day pullback. With today closing near its low, tomorrow will probably trade below today’s low. There would then be a 2nd pullback day.

The downside risk this week is small because the 5 week rally has been so strong.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Al,

did you hold any trade today for swing?

And if you did, can you pls write why?

thank you

Hi Al, if you sold the 58 H for a scalp, does it make sense to swing part of your position because it is the 3rd push up and potential for a 2 leg correction. At the time I was fearful of a BO to the upside. What would you say the probability of an upside BO was at around 11:30. Sometime I feel I am paranoid of lower probability events.

thank you!

The huge bear bar early in the day was a Bear Major Surprise Bar. It was likely to affect the rest of the day. That made a bull trend unlikely. Any rally was then going to be a bull leg in a trading range. However, the end of legs in a trading range are often not clear.