Emini exhaustion gap and double top but minor reversal

I will update again at the end of the day.

Pre-Open market analysis

The Emini sold off yesterday and closed the gap above the August 24 high. That is therefore now an exhaustion gap. If it gaps down any day within the next week, there will be an island top on the daily chart. However, the bull channel on the weekly chart is tight. Hence, this selloff will probably be minor, although it could last for 1 – 3 weeks.

The target for the bears is the bottom of the bull channel on the daily chart. There are 2 ways to draw it. Both bull trend lines are rising and currently are around 2860 and 2820. The bulls will buy a reversal up from either line.

By falling below last week’s low, the Emini triggered a minor weekly sell signal. Since today is Friday, the bears will try to make today close on its low. That would create a bear bar closing on its low on the weekly chart. It would make at least slightly lower prices likely next week.

The bulls always want the opposite. However, the 7 day bear micro channel will limit the upside over the next few days.

Overnight Emini Globex trading

The Emini is down 10 points in the Globex session. If it gaps down, there will be an 8 day island top on the daily chart. But, island tops and bottoms are minor reversals. In addition, if there is only a small gap down, it will probably close in the 1st hour.

There is a magnet at the bottom of the bull channel on the daily chart. In addition, there is a 7 day bear micro channel on the daily chart. Therefore, there is good momentum down. The odds are that traders will sell rallies until the chart reaches the bottom of the bull channel.

Because that bull trend line is so close, there is an increase chance of a sell vacuum down today. That simply means a quick bear breakout down to support. But, there will probably be buyers in that area.

Today will probably be the 6th day without a pullback. While the bear leg is not strong, it is enough selling for traders to sell above the prior day’s high. Therefore, the bulls will need at least a micro double bottom before they can rally to a new high. Traders will continue to sell rallies until then.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

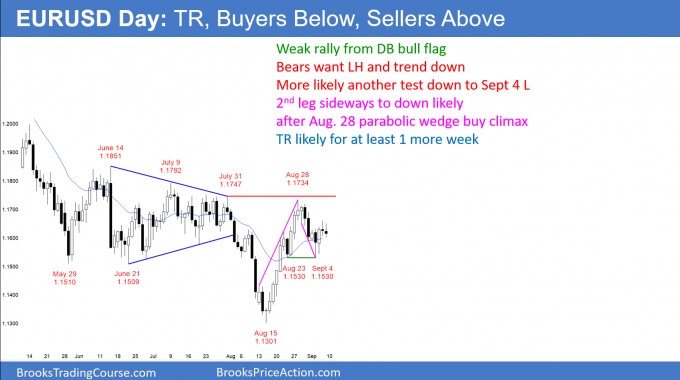

EURUSD Forex trading range with limit order buyers below and sellers above

The EURUSD daily Forex chart has been sideways for 5 days. A 2nd leg sideways to down is likely after the August 28 parabolic wedge buy climax.

The EURUSD daily Forex chart reversed up strongly from the August 15 failed breakout. However, it is back in its 5 month trading range and again going sideways. The August 28 parabolic wedge buy climax is likely to have a 2nd leg sideways to down. Therefore, there are probably sellers around the current level and up to 1.17.

But, the bull trend reversal was strong enough to end the bear trend. Consequently, there are probably buyers below, including below the September 4 low.

Since the chart is in a trading range, traders believe that there will not be protracted moves. They will therefore take quick profits. Because traders will scale into shorts above and scale into longs below, the daily chart will have a difficult time going more that a few days in one direction.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart sold off 70 pips over the past 4 hours. It will probably test the September 4 low early next week, and it might even fall below.

However, since the daily chart is in a trading range, it will be difficult for day traders to make more than 30 pips on any trade. The trading range on the daily chart is a sign that traders believe that the price is fair. If the price falls, traders see it as a discount and look to buy a reversal up. When it goes up, they see it as too expensive and look to sell a reversal down.

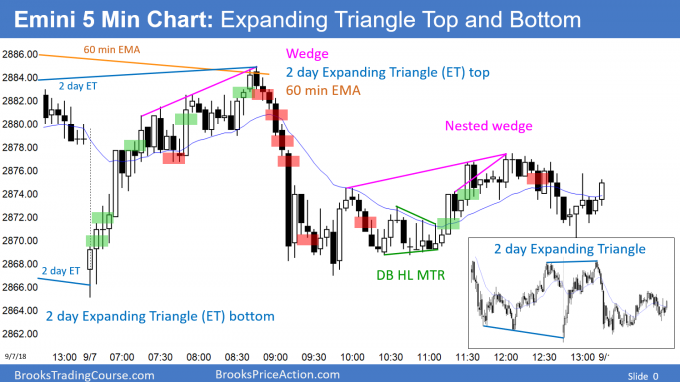

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

After an expanding triangle bottom on the open, the Emini rallied for 2 hours. It sold off from a wedge and expanding triangle top at the 60 minute EMA, the January high, and the top of the 7 day bear channel. The bull trend line on the daily chart is around 2860 and it will probably draw the Emini down to it next week.

Since there is a 7 day bear micro channel, traders will probably sell the 1st reversal up.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, a question about a trade I did today – I bought around the close of #31 for scalping and I put my stop below #7, I know the market is always in short after 5 bear bars at the time, but because the big bull bar #16 and #24, I was thinking there should be at least a bounce to the MA around the low of #31, but it didn’t come… After #31, #32 was so quick that it ran my stop so fast that I didn’t even see the bar growing down to my stop price on the chart when that happens!…. If I had a big account, I probably should have put my stop below #1 so at least #32 won’t run my stop, and I will probably wait until #32 closes and move my stop below it (even though I know that is going to be very difficult decision). But eventually, you can see #67 touches back to the low of #31, which I think it means it was a reasonable buy at the low of #31, do you agree?

If you bought at the low of #31, will you put initial stop below #7? and when you see #32 developing, what is the first thing comes to your mind? get out ASAP, or wait to see how it goes and scale in? (because when it closes it can be a big bear bar with big tail at bottom)

Hi Al, does a trader have to be a good swing trader first before he can become a good scalper? On average and in general, does scalpers make more money than swing traders after enough long period of time (say after 10,000 trades)?

If the only variable is a great scalper compared to great swing trader, then a great scalper is going to make more money. However, it is easier to be a successful swing trader, and most traders either cannot be consistently great scalpers, or they do not enjoy doing it.

Thanks Al. Just want to follow up on another question 🙂 – Do you think a trader have to be a good swing trader FIRST before he can become a good scalper?

I think everyone should start as a swing trader, and most should stay as swing traders. However, many swing traders will take some scalps every day.

That is great advice, currently I am doing it in a little similar way – scalp on Emini and swing on SPY, but now I think about it again, I probably is doing it wrong – I should probably swing on ES and practice scalping on SPY (so that I can scale in with relative smaller size)…. But on SPY there are too many false breakout as you pointed out before, and the tick size is too small, I found it is kind of hard to use stop orders to scalp, do you have any suggestions? (or any better idea to practice scalping? I don’t want to scalp on other stocks when I am swing on ES, because that can a distraction to me, I want to focus on one chart (SPY is almost same as ES))

Slippage is a problem for scalpers, especially on stocks and ETFs and when scalping for a small profit, like 10 ticks. I haven’t scalped the SPY in years. If a trader is getting any slippage on 20% or more of stop entries, I would not scalp for 10 ticks using stops. That is not a problem with limit orders entries or with scalping for 20 – 30 ticks.