Emini and Forex Trading Update:

Friday September 20, 2019

I will update again at the end of the day.

Pre-Open market analysis

Yesterday rallied to a wedge top that reversed down from above last week’s high. The rally got to within 7 points of the all-time high. Yesterday closed near its low and it is a sell signal bar for today. The bears now have a double top with last week’s high and a bigger double top with the July high.

But the momentum up still favors the bulls. A reversal down today will probably become a 1 – 3 day pullback. The bears need several bear days before traders will conclude that a move down to the 2940 ledge top is underway.

The bears want the week to close below the open. This week would then have a bear body and increase the chance of lower prices next week.

Today is Friday and therefore weekly support and resistance can be important. This is especially true in the final hour. The weekly targets are last week’s high, the all-time high, and this week’s open.

Overnight Emini Globex trading

The Emini is up 4 points in the Globex session. Even though yesterday traded down in a bear channel for 5 hours, the bulls see the channel as a pullback from Wednesday’s strong reversal up. It is therefore a bull flag. They hope to break above the channel today and rally back up to the high of the week. They would like the week to close at a new high.

The bears want a strong break below yesterday’s low, which would trigger the sell signal on the daily chart. However, the bull case is better and the odds are therefore against a bear trend today.

Most days over the past 3 weeks have had reversals and a lot of trading range trading. Day traders expect more of that price action again today. But since the chart is testing the all-time high, they will be ready to swing trade if there is an early strong breakout up or down.

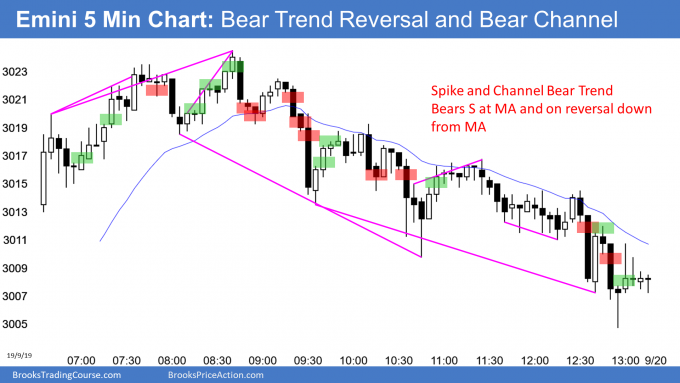

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has an inside day today after yesterday’s inside day. That is an ii Breakout Mode pattern. It is nested within a 5 day tight trading range that is within a 3 week tight trading range.

There will probably be a breakout within a few days. When there is an intensely balanced pattern like this, there is always both a sell and buy signal. Each has a 50% chance of success. Also, the 1st breakout up or down has a 50% chance of reversing.

The bears see the trading range just below the EMA as a bear flag. There are measured move targets down around 1.08.

For the bulls, this week has been a pullback from a 2 week double bottom. They want a reversal up from the bottom of the bear channel to the August 26 lower high over the next several weeks.

The most important rule when there is a Breakout Mode pattern is that there is no breakout until there clearly is a breakout. In the meantime, control alternates between the bulls and bears every day or two.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has sold off in a tight bear channel for the past 5 hours. It could not get above yesterday’s high and it reversed down. It is now testing yesterday’s low.

Because the channel is tight, day traders have only been selling. Now that it is near yesterday’s lows, the bears will probably begin to take profits and look to sell rallies instead of at the market.

If there is a 20 pip bounce from the short covering, the bulls will begin to buy reversals up from the low. This will convert the bear trend into a trading range. Then both the bulls and bears will scalp.

Can the overnight bear trend break below the bottom of the 5 day trading range? Unlikely, since tight trading ranges resist breaking out. There will probably be buyers around yesterday’s low. That means a break below yesterday’s low will probably not get far.

Today is Friday and this week is a small inside bar on the weekly chart. The bears are trying to get the week to close on its low. This week would then be a credible sell signal bar for next week. The bulls always want the opposite and will try to prevent the week from closing on its low.

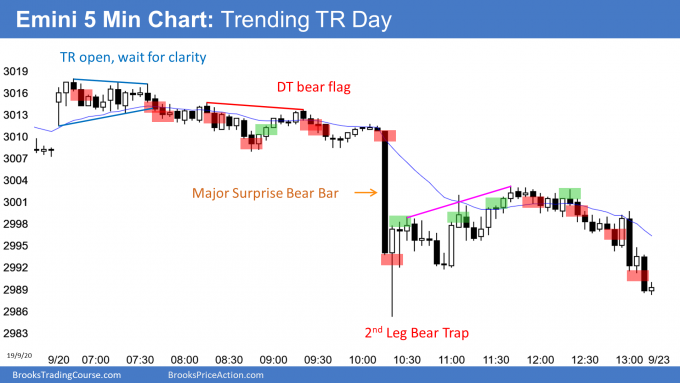

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini was in a weak bear channel for the 1st half of the day. It had a Bear Major Surprise bar in the middle of the day. After a wedge rally, the bears got a 2nd leg down.

By trading below yesterday’s low, the Emini triggered a daily sell signal. This week closed below the open. There is now a bear bar on the weekly chart. That increases the chance of at least slightly lower prices next week. The top of the wedge at 2940 is a magnet below.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

FYI, today was “Quadruple Witching”. Explains some of the volatility on the close.

Hi Al, a bit frustration today I sold below 71, then got out above 77. Any tips to stay in the trade and not get faked out. I tried to re-enter but the bar was moving too fast near the end of the day.

thank you

My opinion and interpretation of what professor Al Brooks is teaching it is explained as follows:

Profitable traders lose money too. When Al Brooks teach us to stay within an Always In perspective, it is because doing so we are able to identify quickly when a trade it is not doing what we expected. So, in your example, supposing that your entry was correct and you were Always In Short, then you can close the position before your stop loss gets hit once the perspective changes to Always In Long (and of course start placing long trades).

Trading small will give you the opportunity to make several entries during the day. The maximum loss/risk per day is 3% of your account (as per AlBrooks).

go watch the webnar vedio “trade the final hours”, Al mentioned some tips trading the final hours. It’s ok to be trapped out.