Emini and Forex Trading Update:

Friday July 24, 2020

I will update again at the end of the day.

Pre-Open market analysis

The Emini yesterday formed a micro double top with Wednesday’s high. It was an outside down day and it is therefore a sell signal bar for today.

I have been warning that the Emini might sell off at the end of July because of the monthly chart. The bodies have been shrinking and June has a big tail on top. Also, the Emini has now tested the gap on the weekly chart. They therefore have achieved an important goal and many will start taking profits.

The bulls want the rally to close the gap on the weekly chart. But traders are wondering if yesterday the start of a reversal down to the middle of the 3 year trading range. If there are 2 or 3 big bear days over the next few days, then it probably is. If not, if there is going to be a selloff before a new high, it will likely start before the end of next week, which is the end of the month.

At support on the daily chart

Yesterday sold off and stopped at a cluster of support levels on the daily chart. It tested the June high, the open of the week, and the close of 2019. These are magnets and the Emini might remain stuck here all day.

The most important price is the open of the week. Will the Emini finally get a bear body on the weekly chart after 3 bull bodies? The past 2 weeks had small bull bodies. So far, this week is a 3rd consecutive small bull body. The bears want a bear body. Today would then be a better sell signal bar on the weekly chart.

Remember, the 4 month bull trend might be ending this month. The odds will go up if there are bear bodies on the weekly and daily charts.

Weekly support and resistance

Today is Friday so weekly support and resistance can be important, especially in the final hour. With yesterday’s selloff, the week is now the 3rd consecutive doji bar on the weekly chart. If today closes below the open of the week, the week will have a bear body. It would then be a more reliable sell signal bar for next week. That would increase the chance of lower prices for next week.

The bulls still want to close the gap on the weekly chart. If today reverses up strongly, they might have a chance next week.

Overnight Emini Globex trading

The Emini is down 11 points in the Globex session. It will open around yesterday’s low. If there is a small gap down, the gap will probably close in the 1st hour.

Yesterday ended with a trading range after a sell climax. That is an area of agreement. If there is a break below the trading range, the Emini will probably get drawn back into the range within a few hours. A trading range late in a bear trend is often the Final Bear Flag.

Every trading range has both a sell and a buy setup. The bulls want a major trend reversal up to undo yesterday’s sell climax. The bears want a double top bear flag and a 2nd consecutive big bear day.

Because yesterday collapsed but stopped abruptly at support, the Emini will probably stay around the support all day. That means a trading range day is more likely than a big trend day up or down.

There should be at least one swing up and one swing down today. If the Emini is within 20 points of the open of the week in the final hour, it will probably get drawn to it and then close either a little above or below it.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

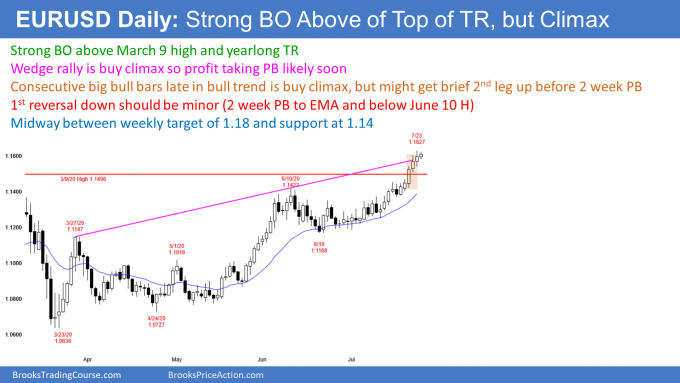

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has rallied strongly from the March low to a new 52 week high. However, the rally is climactic. That should attract profit taking within a week.

Also, it is now exactly midway between the breakout point above 1.14 and the 1.18 start of the bear channel on the weekly chart. Traders will start to wonder if the next 200 pips will be up or down. They probably will be down.

As strong as the trend is, this is probably a wedge buy climax. Traders should expect a pullback to below the June 10 high to begin within a week or two. The pullback will probably last a couple weeks and have at least a couple small legs down.

However, the trend on the daily chart is now up. Traders will buy around the June 10 high and the 20 day EMA, expecting at least a test back up to the high of the current buy climax. With 6 consecutive bull bars, the bears will probably need a micro double top before they can begin a pullback.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market has been in a 40 pip range overnight. Also, its high is below yesterday’s high and its low is above yesterday’s low. Today is therefore an inside day so far.

If this continues all day, today will be a buy signal bar on the daily chart. The bulls will try to resume the trend, but after the big bull bars on Tuesday and Wednesday on the daily chart, traders will probably start to sell a 1 – 2 day rally to above yesterday’s high.

Because today is a small trading range day, day traders are scalping for 10 pips. While there always can be a breakout, the bulls are exhausted on the daily chart. That reduces the chance of a big bull day today.

Also, the bears will probably need a micro double top with yesterday’s high. That will probably limit the downside today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

As expected, the Emini was a trading range day and it paid attention to the open of the week all day. Because today closed just below the open of the week, this week was a bear doji on the weekly chart. That is a weak sell signal bar for next week.

The bulls still have a 50% chance of a new high before pulling back to the middle of the 3 year trading range. But if next week sells off, the odds will favor the pullback.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Thanks Al for all the trading help. any plans for a bitcoin update? is it going to a million or will it stay below 10k for forever?

Bitcoin is at the apex of a triangle on the weekly and monthly charts so your assessment is correct. It could not be is a tight range for 3 months if either the bulls or bears had a significant advantage.

It’s biggest fundamental problem is that most people don’t trust it and do not see any reason to own it. The only people who speak well of it have a financial interest, and all of their talk is hyperbolic nonsense.

My personal belief is that it is taking too long to become popular with the public. If the public doesn’t trust it or the people who are hyping it after 3 years on the world stage, it has a terrible problem.

Also, I believe it is more likely than not that a trustworthy company or government with come up with an alternative with all of the same touted benefits but without the tainted reputation of the clowns who are pushing it.

If I were trading it on fundamentals, I would sell every rally. On technicals, there is a 50% chance of a breakout either way.

If I only look at it technically, I would say that it probably would get back to the all-time high within a year or two.

But right now, it has no more value than tulip bulbs.

All markets need a reason to exist. Bitcoin lacks that. At some point, either everyone will see that and it will go to zero, or the people behind it will change it enough so that it becomes competitive with Visa and MasterCard.

They can process thousands of transactions every second. Millions of people can use them every day without ever wondering if they will suddenly go away.

Bitcoin cannot even handle 10 transactions a second. It is useless. Since it is in the clouds, you cannot even find an alternate use for it, like a doorstop.

But as long as it is not zero, there is still time for the people behind it to change it enough so that it will have a reason to exist. Without that, the average person will never use it and it will fade away.

Thank you!

In crypto world, most people say bitcoin is not like cash for use, it’s like gold for reserve. Anyway, the risk is too big to trade., so most people should stay away from it.

I only trade bitcoin. Exact same price action patterns as ES.

“We are witnessing the Great Monetary Inflation, an unprecedented expansion of every form of money unlike anything the developed world has ever seen.” Paul Tudor Jones gets it.