How to trade July FOMC report

Updated 6:55 a.m.

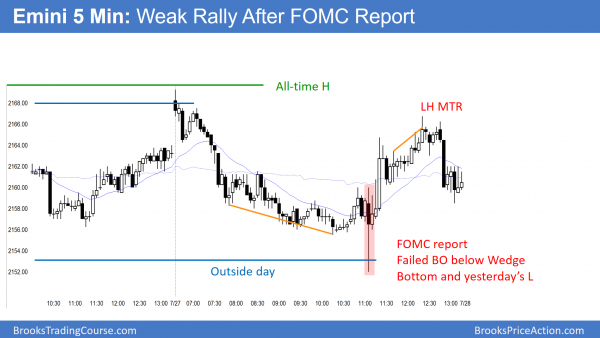

The Emini reversed down from above yesterday’s high and from 2 ticks below last’s week’s all-time high. However, the selloff had bull bars after bear bars. This is more typical of a weak bear trend, a trading range, or an Opening Reversal. Since the Emini is at the top of its 9 day trading range, the odds are against a strong bull trend before the 11 a.m. report. However, the lack of follow-through selling and the 9 sideways days make a strong bear trend also unlikely.

This is a trading range open. While it can lead to a swing up or down, or even a weak trend, it usually does not lead to a strong, relentless trend.

As I am writing, the Emini is creating an Opening Reversal up from yesterday’s double top, yesterday’s close, and both the 5 minute and 60 minute moving averages. However, without consecutive strong trend bars up or down, the odds favor an early trading range and a limit order market.

Pre-Open Market Analysis

Yesterday was the 9th day in a tight trading range. Hence, the Emini is neutral going into today’s report. While the 1st few hours will probably behave like any other day, the FOMC report will change the price action. As I have been saying for 2 weeks, the upside is probably limited over the next 2 weeks, and there is a 60% chance of at least a 30 – 40 point correction.

The July rally is a Spike and Channel bull trend, and the pullback that began the channel was the July 6 low of 2065.75. Hence, traders have to be aware that the Emini might selloff all of the way down to that low.

FOMC report

Most FOMC reports lead to big moves. There is a 50% chance that the 1st move will quickly reverse. Therefore, most traders should not enter until at least after the close of the 2nd bar following the report (the close of the 11:10 a.m. PST bar).

In half of cases, the report leads to at least one swing that lasts at least 5 bars. The other half of days have trading range price action with multiple reversals and and briefer legs.

The bars are usually big. Hence, the market is moving fast and can quickly test multiple support and resistance levels. This reduces the time traders have to make decisions, and it increases the risk of making a mistake. Also, as a result of big bars, stops are far away. Traders therefore usually have to trade smaller positions to reduce this risk.

In addition to the 1st move on the 5 minute chart failing 50% of the time, the same is true on the daily chart. If there is a breakout up or down, it could also fail within a couple of days and lead to a big move in the opposite direction. Because of the buy climax, a downside move is more likely over the next few weeks.

Globex Emini Session

The Emini is up 4 points in the Globex session, yet the range is only 5 points. This is a continuation of the intense breakout mode of the 9 day tight trading range.

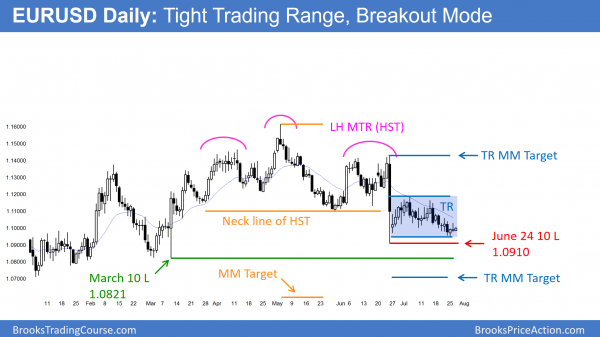

Forex: Best trading strategies

The EURUSD Forex daily chart has had a weak selloff after the July 5 pullback from the bear breakout. Traders see the overlapping bars with big tails and an absence of consecutive big bear bars, and conclude that the selloff is weak. This is more common in a trading range and less common in a bear trend.

The daily chart is near the bottom of its month-long trading range. Hence, it is at support. This is an inflection point and today’s report is a catalyst. As a result, the odds of either a reversal up or a bear breakout are higher today. Since most trading range breakouts fail, the odds slightly favor the bulls. Yet, traders believe that the EURUSD became neutral going into the report. Therefore, the odds are very close to 50-50 for the bulls and bears.

The day will probably trade like any other day for the 1st several hours. Given that so much trading over the past month has been trading range scalping, this is most likely today. The market usually will enter a tight trading range about an hour before the report.

FOMC report

The FOMC report comes out today at 11 a.m. PST. There is a 50% chance that the breakout after the report will reverse in the 1st 10 minute. Therefore most day traders should wait at least 10 minutes before taking a trade after the report.

The report usually leads to big bars. This means that the market is moving quickly and it forces traders to make quick decisions. As a result, this adds to the risk because traders can make more mistakes. Because the bars are big, stops are far. Therefore, traders should reduce their positions size.

Because the U.S. stock market will probably correct at least 30 – 40 points over the next few weeks, and possibly 5%, all financial markets will probably have strong breakouts up or down. The EURUSD could go either way. Today’s report will probably begin the process. Yet, the first breakout, which might last a few days, has a 50% chance of failing. If it does, it might lead to an even bigger opposite breakout.

European EURUSD Forex session

The EURUSD Forex market has been in an exceptionally tight 25 pip range overnight. Most traders should wait for bigger legs before resuming trading. That will come today, but it might wait for the 11 a.m. FOMC report.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off in an outside down day going into the FOMC report. It reversed up, but ended the day with a Lower High Major Trend Reversal.

Today was the 10th day in the tight trading range. While the Emini reversed up on the FOMC report, if the bulls get a breakout tomorrow, it probably will last only a few days. While today ended with a Lower High Major Trend Reversal, there is little to reverse because of the 10 day trading range.

Because of the July buy climax, there is a 60% chance of at least a 40 point pullback beginning within the next few days. The selloff might even reach the July 6 pullback low, which is about 100 points below.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.