Emini and Forex Trading Update:

Friday August 14, 2020

I will update again at the end of the day.

Pre-Open market analysis

The S&P500 cash index yesterday and Wednesday poked above the all-time high close from February. It again reversed down. The Emini yesterday was an inside day and it closed around the open. It was therefore a doji bar on the daily chart, which is a sign of neutrality.

The bulls want a strong breakout above that highest close on the cash index. They also want the week to close on its high and for the cash index to close at a new all-time high on the weekly chart.

The Emini is a derivative of the cash index and it moves almost identically with it. This would result in a bull day and a strong weekly close in the Emini as well

Today is Friday and weekly support and resistance can be important. This is especially true in the final hour. The bulls want the cash index to close at a new all-time high.

It is important to note that 5 of the past 6 weeks gapped up on the weekly chart. Therefore, the bulls will try to get the week to close near the high again. That would increase the chance of another gap up on Monday.

The bears know that the Emini will probably not close at the low of the week on the weekly chart because it is far below. However, they would like the week to close below the February high and preferably below the open of the week.

Since the cash index is at a critical price, there is an increased chance of a big breakout or a big reversal down. With so much sideways trading around the February highest close on the cash index, today will probably be mostly sideways. Traders should expect a 10% correction to begin by the end of the month.

Overnight Emini Globex trading

The Emini is up one point in the Globex session. Yesterday was sideways within 2 trading ranges.

There was a higher low major trend reversal in the final hour. The bulls want a reversal up from there and then another test of the all-time high on the cash index.

If the week closes on its high, there will be an increased chance of higher prices next week. Remember, 4 of the past weeks gapped on on the weekly chart. A strong close this week would increase the chance of a gap up to a new all-time high next week

The bears want a series of lower highs and therefore a bear trend. Also, they want the week to close below the open. That would create a bear body on the weekly chart.

With 2 days of sideways trading at the resistance of the February high, the Emini will most likely have a lot of trading range trading again today. Day traders expect at least one swing up and one swing down. Because of the location at major resistance, there is a slightly increased chance of a big trend up or down.

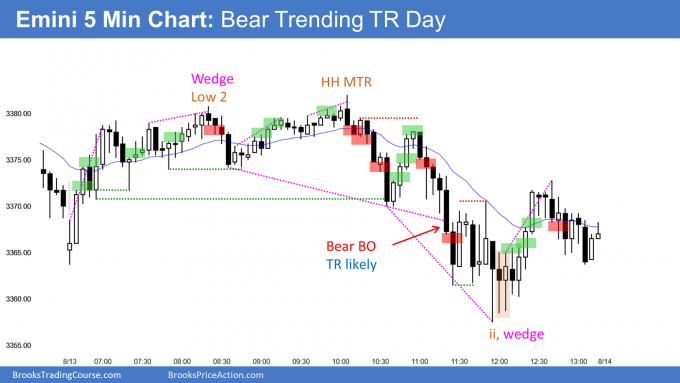

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

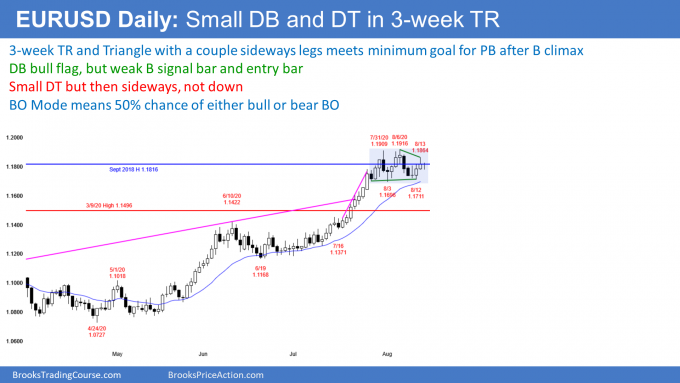

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has been sideways for 3 weeks, reversing every couple days. This trading range is currently also a triangle. There is a double top and a double bottom, but no sign of an imminent breakout.

A trading range is a Breakout Mode pattern. There is a 50% chance of a successful breakout in either direction. Furthermore, there is a 50% chance of the 1st breakout failing.

Finally, in this particular case, it is in a buy climax in a strong bull trend. If there is a bear breakout down to support, there will probably be buyers below and then a test back up.

If there is a bull breakout, the bulls will probably be exhausted. Traders will expect a reversal back down to the triangle within a few weeks.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market dipped below yesterday’s low and reversed back up. The range is only 35 pips and the EURUSD is in the middle of the 3 week triangle. Traders expect the trading range trading to continue. Day traders have been scalping for 10 – 20 pips.

Today is Friday so there is an increased chance of a move toward weekly support and resistance. The bulls want today to close on the high and the high of the week is therefore a magnet. That would increase the chance of higher prices next week. However, that is 50 pips above the current price and probably out of reach today.

The week is a doji bar so far on the weekly chart. The bears want the week to have a bear body. So that too is a magnet today. It is only 20 pips below the current price and therefore within reach.

This week is currently the 8th consecutive week on the weekly chart with a bull body. That is unusual and therefore extreme and a buy climax. With the open of the week only 20 pips below, there is an increased chance of a bear body this week, despite the overnight reversal up.

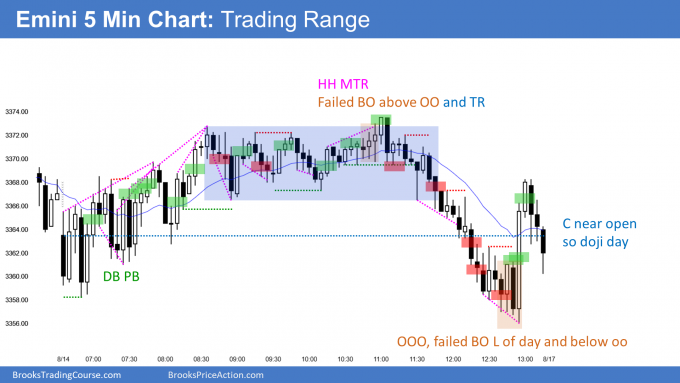

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

The Emini began with a micro double bottom just above yesterday’s low. It then rallied in a weak bull channel but reversed down from the February high.

It traded below yesterday’s low at the end of the day. This triggered a sell signal on the daily chart, but yesterday was a bull doji and therefore a weak sell signal bar. There were more buyers than sellers below yesterday’s low.

There was violent profit taking reversal up in the final minutes. It is still likely that the cash index will make a new closing high next week. But, after 9 consecutive bull days, traders should expect a 10% pullback to begin by the end of the month.

Five of the past 6 weeks gapped up on the monthly chart. Therefore the bulls might get another gap up on the weekly chart on Monday.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Al,

When day trading Crude Oil and Bonds, do you ever look at the economic news calendar incase of something big gets in the way of the trade? If so, is there anything to actually look for in the news to stay away?

I ask because I’m just day trading them and looking for the patterns. I’m not concerned with the news but wonder if I should be aware of anything big that may affect those markets in particular.

Thanks

I think a day trader will make more money only looking at the charts and letting institutions worry about the news. You can see on the charts what the majority of them think, and I want to trade in that direction.

The only news events that alters my trading are the FOMC announcements. I go flat ahead of the announcements and wait 10 or more minute afterwards before resuming day trading.

Thanks!

Hi Eric,

I do not trade Crude Oil or Bonds but the same process many of us use should work Ok. Some, not all news reports are important and in your case Crude Oil inventories, FOMC reports, and possibly the monthly non-farm payroll reports would be of interest. For the FOMC Statement, Al will advise traders to be out of positions and not trade until at least 10-15 minutes after report due to the potential volatility. Not sure how this affects Crude Oil and Bonds but you can assess effects yourself.

A good news service is available on Forex Factory. Just register free for access:

Forex Factory Calendar

Hope that helps.

Thanks for the link!