BPA trading room Q&A: April 8, 2015

A lot of times that I’m in a trade at the end of a five-minute bar, especially at a pivotal moment, I find myself rooting and hoping for a great close for my side. Do you ever do that? Or if you overcame that for the most part, how did you do it?

Audio duration: 6min 30sec — Scroll down for images

Audio transcript

Hoping the trade goes your way

I used to have a lot of hope. I used to take trades and constantly hope that the bar was going to go my way, hope for another bar to go my way. And then I used to worry – the fear and greed thing. The reality is fear and greed is something that’s in the movies, not in the real world. Most professional traders do not think about fear and greed. If you watch Fast Money, you’ll hear them talk about fear and greed, but look at them and listen to what they’re saying. Do any of those traders look scared? Do any of those traders look like they’re really hopeful or greedy? No. It’s a job, and that’s not how you do your job.

You do your job by finding a comfort zone, and when you’re in your comfort zone, you don’t have a lot of emotion; you don’t have a lot of fear; you don’t have a lot of greed; you don’t have a lot of anything. And anytime you have a feeling, you think back to the last time you had the feeling, and you think about what you did and what the market did. And so I use feelings as radar, and the two feelings that come up most for me are confusion and disappointment. Instead of saying, “Oh, gosh, I’m confused and I’m disappointed,” I say, “Oh, I’m confused and disappointed, therefore it’s a trading range — I’m going to look to buy low, sell high, and scalp.”

Use your feelings to make money

So when I have feelings now — and usually the feelings are not much of anything — I try to use them to make money. And the two common feelings are fear and greed. I used to feel desperate years ago — who knows, pick a number, 15 years ago, 25 years ago. A lot of times when I was in trades, especially if I lost two or three bars (trades) in a row two or three times in a row, but not anymore. There are a lot of funny things that happen throughout life that I never could have imagined were possible. One is trading a five-minute chart. 25 years ago, 20 years ago, a lot of times I would trade a one-minute chart, a two-minute chart, a three-minute chart, and I used to think that the five-minute chart just moves too slow and it’s just too boring to sit there, and I just felt kinda scared and anxious. “My gosh, it’s just happening too slowly and I can—my mind is racing, my mind—my mind is just going really, really fast and the chart is just moving too slowly.”

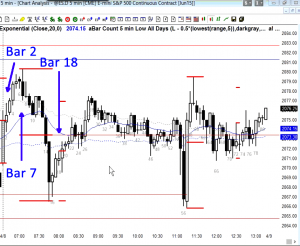

Over time, what changed for me was I started to notice that there was an incredible amount of information on that five-minute chart. So yes, each bar takes five minutes to complete, but as it’s forming I see stuff that’s happening. And for me, it’s fascinating to see what’s happening. Little things happen all day long, and I understand what’s going on – or at least I believe what’s going on, like the bulls taking control over a bar, the bears taking control. A bull bar and a bull trend not looking the way it should look; bar 7, it should not go above 6; the big tail on 2. There are all kinds of things. The L1 Low 1 short 18. All day long — yes, the five minute bar is forming slowly, but I keep getting engrossed in every little bar. Every little bar – it’s suspense. “I think I know what it’s gonna do,” and I’m just eager to see what takes place.

So somewhere along my career, I just started to realize how much information is on this screen, and there is an incredible amount of information on the screen. There is an amazing number of things happening constantly on every bar, and it’s all — it’s like a quilt; one bar’s where it’s past three bars, the past 10 bars, 20 bars. There’s just so much going on that I enjoy looking at it and trying to understand it. And so instead of feeling scared or panicked that I was boxed in or claustrophobic by being trapped in a market that was too slow for me, now I look at it and there’s just so much information. It’s just incredible. I just love looking at it and thinking about it.

If you take the trade, that’s where your stop goes

I’m constantly telling myself — every time I take a trade, I’m constantly telling myself, “Al, if you take this trade, that’s where your stop goes. If you’re not willing to use that stop, don’t take the trade, right?” And a lot of times it seems stupid — the stop was too far away — but if I’m taking a trade, that’s the stop I have to use, otherwise the trade does not make sense. So if I’m selling — even if I’m selling all the way down here (bars 20-22), my stop at a minimum has to go up here (above B12). And the bears who did put their stop one tick above 12, no matter where they shorted, they could have gotten out, break even at worst, and with a profit if they were comfortable scaling in higher.

I’m not being specific addressing the question, but there’s a transition that takes place. The single biggest transition I think in my trading career was realizing just how much information is on the five-minute chart. And as I began to pay attention to what is going on, I started to get very peaceful all the time because I felt like I understood what the market is doing every tick of the day. Now, I never get upset, I never get worried; I just look at it and accept it and try to understand what’s going on. I see the battles going on between the bulls and the bears. I’m always looking for ways to make money with those battles, and take as many trades as I can. But I don’t get really hopeful with a trade. If I win, I win; if I lose, who cares, right? There’s always gonna be another trade, there’s always gonna be 10 more trades that day, so I just don’t get emotionally attached.

Doing the right thing

To me, it’s just a question of do the right thing. Whatever I’m doing, does it make sense? And if I do something and I’ve decided that my plan really does not make sense, I get out. I don’t pretend that, “Oh, I just realized my plan is bad, therefore I’m gonna hope that it turns out okay.” No; if I decide that my plan is bad, I’m getting out, even if I have to lose two or three ticks, even if I have to lose a point or two, doesn’t matter. If what I’m doing is wrong, I got to get out. I don’t try to get cute and say, “Oh, my gosh, if I get out of here, I lose five ticks. Maybe I should try holding a little longer, maybe I can lose two ticks.” No; if I’m wrong, I get out, and then I start over again. For me, that’s the best process.

Back to the question about taking a trade. You have to decide what you premise is – a swing or scalp – your goal (swing or scalp). You have to decide where the stop belongs. And as long as the market is behaving in a way that is consistent with your premise, you just stick with your plan.

Al Brooks

Information on Al’s Online day trading room

Hi Al,

I’d like to ask you if you keep notes like low, hi, close of the previous day or any kind of daily notes? If yes, can you tell me about them?

Thank you in advance!

Al, I have a question for you. I’m taking your trading course and it’s excellent. Thank you. I’m wondering (not really confused) why on some of the stop loss placements you’ll put a stop one tick below the signal bar ( bull move) and on others you explain how traders that have gone short will be adding to their positions as the market continues up. Is this just a matter of personal preference and style? I haven’t completed the course and in all fairness it might be answered in a future video but I thought I’d ask. Thanks.

When talking about rallies, if the market is in a strong bull trend (bull breakout), traders should only buy. 90% of the time, it is not, and instead is in either a bull channel or a bull leg in a TR. When that is the case, traders who manage trades well can make money buying or selling. If a trader is buying a pullback in a bull trend, he often will put his stop below the bottom of the bull leg rather than below the buy signal bar in the bull flag. Some traders in fact will buy more below that buy signal bar. On a reversal up from a bear trend, if the context is good for the bulls, some bulls will buy more below the buy signal bar, even though the bear trend is still intact.

Most traders should put their stop below the signal bar if the signal bar and context are strong. With experience, many traders will use wider stops and add to their position on a test below the buy signal bar if they believe that their premise is still valid.

Thank you Al,

I have been fighting confirmation bias, where i would ignore most of the other side to favour my opinion in the market.Now unless if i am tired i rarely do make such mistakes, but it is hard fighting it. There is one problem that keep bothering me, overconfidence. The moment i spot a context i just want get in, without waiting for a second signal (if i am jumping before a strength) or even a good signal bar that could warrant an entry.

Mostly i am right but since the signal is not complete the market need to go sideway or a little bit lower/higher to form a good signal. In that process my stop would be hit and i had to re-inter on the good signal or even lose the movement. I

My thought about entering early, which I often do, is that a trader has a much better chance of success if he can trade small and add on. For example, if buying a bear leg in a trading range or a pullback in a bull, a trader can buy the first reasonable reversal up. If it works, he takes his profit. If the market instead turns back down, he can buy more at the bottom of the signal bar and more at a measured move down, IF he believes his premise is still valid. If instead there is a strong bear breakout with strong follow-through, he exits with a loss, and possibly ever shorts.

Al, I love scaling in when I trade but what you just said seems to be at odds with the premise that the winners should be bigger than losers, which you say is essential. Yet, if you’re scaling in like that, those losers are going to be bigger than most winners. How can we resolve this paradox?

Most traders should not scale in. When traders do it, they trade small, and they are making a trade-off. They are giving up some risk/reward to get more probability. If the probability becomes high enough, then it does not matter if the risk is greater than the reward. Most traders will not manage scaling in well and should not do it. Most who do are careful about when they do it. For example, on CNBC you will sometimes hear someone say that he does not know if the current low is the bottom, but he is confident that the bottom will be soon. He might then buy small and add on lower.