Al Brooks’ live trading room

BPA trading room commentary: April 5, 2016

An extract from Al’s trading room today, in response to many requests for some insight into how room operates. You can find a one hour sample on the Learn to Trade/Trading room menu link above. A more recent sample of the room will be prepared in future to reflect Al’s evolving style. Let us know if you want more of these Ask Al room extracts. A longer extract is planned for this month or next.

Video duration: 5min 04sec

You can also view this video on Al’s YouTube Channel if needed.

Bear flag? Or not?

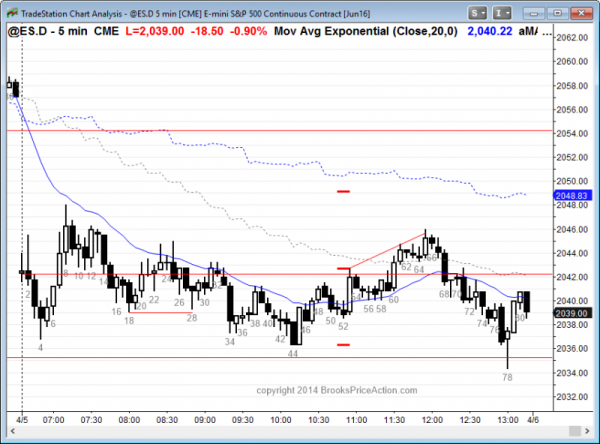

So what are the chances that this is simply a bear flag? Well, I think the chances are better than 50/50, the bear breakout has failed and we’re going to try again to get above the moving average. Bulls still have not yet done enough to convince traders that the bear trend , the bear channel has ended. But whenever the market tries 4 or 5 times to get above the moving average and every failure lasts only a bar, or 2 or 3, the odds are the bulls eventually will be successful. So I do think at this point—the bears had their chance, 34 failed, so I do think we will break above the moving average and stay above it for 10 bars or so.

The target, whenever you’re in a bear channel, is each prior lower high, 1, 2, 3. This is also a type of a wedge. You have a double bottom bear breakout, so 3 pushes down — 1, 2, 3. So the double bottom creates the first two pushes. Then the failed bear breakout, the third push. The reversals up have just not been strong. Bar 20, bar 29, 31, 38, the bars are just not big enough, and they have not yet had follow through.

Bear channel trading

Bears. When you’re in a bear channel, the bears sell every close of every big bull trend bar, right below the moving average, at least for a scalp. So the bears are selling this. I’m currently flat but I’m more inclined to buy because 38 is a good enough reversal to make me think the bears lost control. But the bulls really have got to get above the moving average. So buyers or sellers below 38, 39? For the bears, it’s a swing sell for the bear channel. The bears should not have allowed 35, and they then should not have allowed 4 bars up. They should not have allowed 38 to close above the 37 high. So this is interesting, 39. Will the bulls get a gap? 39 low, 37 high. If they do, it would be a subtle sign that the bulls are taking control.

Possible trading range day

The entire selloff does not look very strong. It’s probably a bear leg in a trading range. Trading range has to have at least one bear leg and one bull leg. We’ve had the bear leg. I don’t think this is enough of a bull leg so I think that we’re going to get a bull leg. But so far the bulls are continuing to fail to do what they need to do, to make traders believe that they have taken control. Would I buy or sell 39, a failure at the moving average? I would not sell it. The bears had terrible follow through, 35, and then they allowed the bull breakout 38. So all I would do here is buy or wait. We’re so close to the moving average, and the bulls have failed at the moving average for 3 hours. It makes me hesitant to buy this close to the moving average but I’m ready to buy if we start to break strongly above the moving average.

Bullish, bearish, bullish…

If you notice, I was starting to get a little bullish over here. And then I was bearish over here. And then bullish again. I don’t have any problems changing my mind. Sometimes I’ll change my mind several times, in the course of a minute. I just don’t have any difficulty with that at all. I just make an assessment of what is in front of me and then I decide whether it’s reliable enough for me to place a trade. If it’s not, I wait. Right now, I’m waiting. And I don’t view it as, “Oh Al. You’re so stupid! You thought it was becoming long on 31 and short on 34, and long on 38—you don’t know what you’re doing.” I don’t think of it that way. I think of it as the market is telling me it lacks direction.

If you notice, I was starting to get a little bullish over here. And then I was bearish over here. And then bullish again. I don’t have any problems changing my mind. Sometimes I’ll change my mind several times, in the course of a minute. I just don’t have any difficulty with that at all. I just make an assessment of what is in front of me and then I decide whether it’s reliable enough for me to place a trade. If it’s not, I wait. Right now, I’m waiting. And I don’t view it as, “Oh Al. You’re so stupid! You thought it was becoming long on 31 and short on 34, and long on 38—you don’t know what you’re doing.” I don’t think of it that way. I think of it as the market is telling me it lacks direction.

Most breakouts fail!

Everyone wants a trend. Most of the time you do not get a clear strong trend and a lot of times you get this: every 2 or 3 bars, it reverses. So I don’t view it as me being wrong, I just view it as the market unable to sustain a move, one way or the other. One of the attempts is going to be successful. Just like I’ve been saying for 2 years now, that one of the breakout attempts – here’s the weekly chart. One of the breakout attempts will be successful, but any one of them is probably going to fail – fail – fail – fail – fail!

How the day ended – A trading range day

Al Brooks

Information on Al’s Online day trading room

Clearly it would be nice to look at more of this stuff 😉 ..

Great video! Nice one Richard.

I agree, very helpful as are the new course previews.

thanks,

Same here, I would love to see more of this. Hearing Al explaining why he would not enter a trade is priceless information

I highly recommend recordings from Al’s trading room on his other website, they are available for download, at a very low price, and you can get hours and hours of this material to watch. It’s exactly what you see here and all of us can benefit from it.

I totally agree with you.

This is awesome. Thank you. Would love to see more of this…