The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi,

I have a question regarding the Z-Score: In the video, we learn that trading strategies that rely upon infrequent but big wins are not favorable to trade. Am I right when I think that with this, the "classical" trendfollowing is also criticised, since that strategy naturally relies on the one big win to offset the frequent but small losses? Or, is the difference, that most trendfollowing strategies are traded by funds / CTAs with computers, so that there is no possibility to miss a trade vs the retail investor that might miss a trade due to outside factors?

Thanks a lot!

Best regards

Kristof.

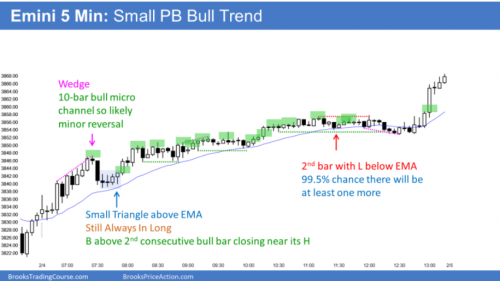

Using the PA concepts "trend following" is high probability and therefore you can both swing (mainly on the early stages of the trend) and scalp (all the way up). Yesterday's emini was the strongest type of trend and therefore a perfect example of that:

The day before had a trend for several hours as well, where you could both swing and scalp until the trend reversal took place: