Market Overview: Bitcoin Futures

Bitcoin futures 1st leg up loss of momentum. During July, the value of a Bitcoin decreased 4.22%. Traders wonder if this is the start of a retracement. A 1st leg up loss of momentum normally anticipates a retracement.

Bitcoin futures

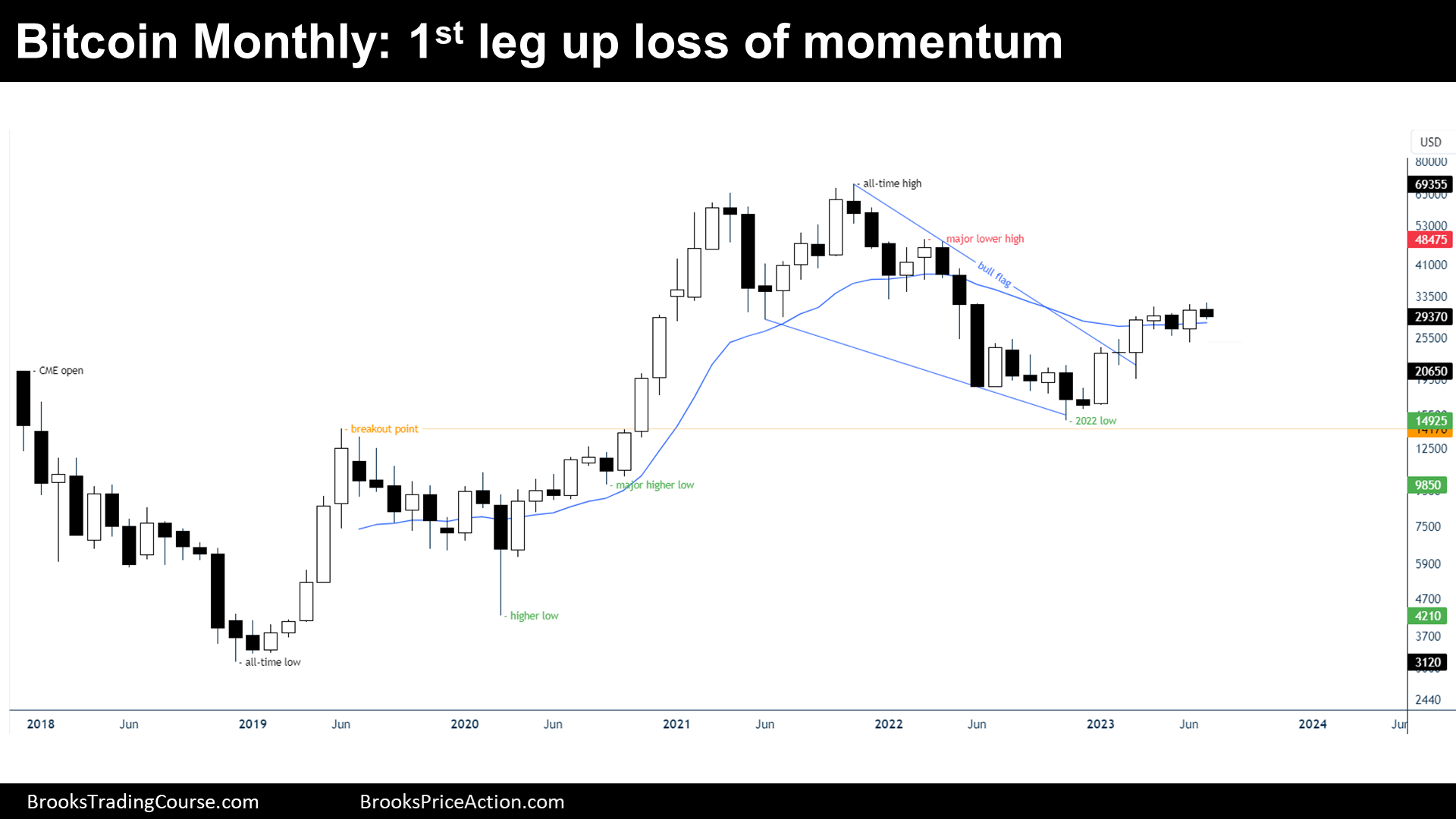

The logarithmic Monthly chart of Bitcoin futures

Analysis

- July’s candlestick is a small bear reversal bar. It is the follow through bar of a bull outside up bar buy signal bar.

- The context is the following:

- A major bull flag followed the late 2020 bull breakout. The bull flag was also a tight bear channel.

- After a Wedge Bull Flag, there normally comes two legs sideways to up. But, the bull flag was tight enough to expect, with high chances, that the 1st leg up will fail.

- The 2nd leg up will have a 40% chance of reverse up towards, at least, the major lower high.

- The price is currently doing the 1st leg up after a Wedge Bull Flag.

- Presently, the bulls look not strong.

- Bars are tight and bull bars are not followed by bull bars.

- The conclusion is that there is a 1st leg up that is losing momentum.

- A 1st leg up loss of momentum, normally suggests that a retracement of the leg is underway.

- Moreover, price is within a sell zone trying to reverse down from a 50% retracement of the 2022’s tight bear channel.

- But before the bear channel (major bull flag), there was a fair and strong bull trend, that achieved a Measured Move up based upon the size of the prior trading range between 2017 and 2020.

- A bull trend that achieves the prior range’s measured move it is considered fair and strong, the chances that the next market cycle will be a trading range instead of a bear trend are reasonably high.

- Conclusion:

- The price is probably within a trading range, the low being the 2022’s low and the high is to be determined, but might be $40000 big round number, the major lower high or the all-time high.

- Bulls:

- They want the 1st leg to go up as far as possible before there is a retracement.

- But they were unable to create good consecutive bull bars during the 1st leg up and hence, the probability of a price correction is increasing.

- The bulls hope that when the correction comes, the bears will fail to trade below the 2022’s low, and that the price will create a higher low major trend reversal.

- Bears:

- They are within a short-term sell zone, and they want to bet that the price will trade below the 2022 at some point.

- The problem for the bears is that the price is probably at a buy zone of a major trading range (based upon the size of the bull flag).

Trading

- Bulls:

- A bear bar following a bull signal bar, it is not a good buy signal bar.

- Bulls who bought June’s bull outside bar will be disappointed by the follow through bar and exit their positions below a bear bar.

- Many bulls are waiting for the higher low bull major trend reversal setup to develop before placing entries.

- Bears:

- July’s candlestick, it is not a good sell signal bar.

- Bears want a stronger bear bar or a low 2 setup.

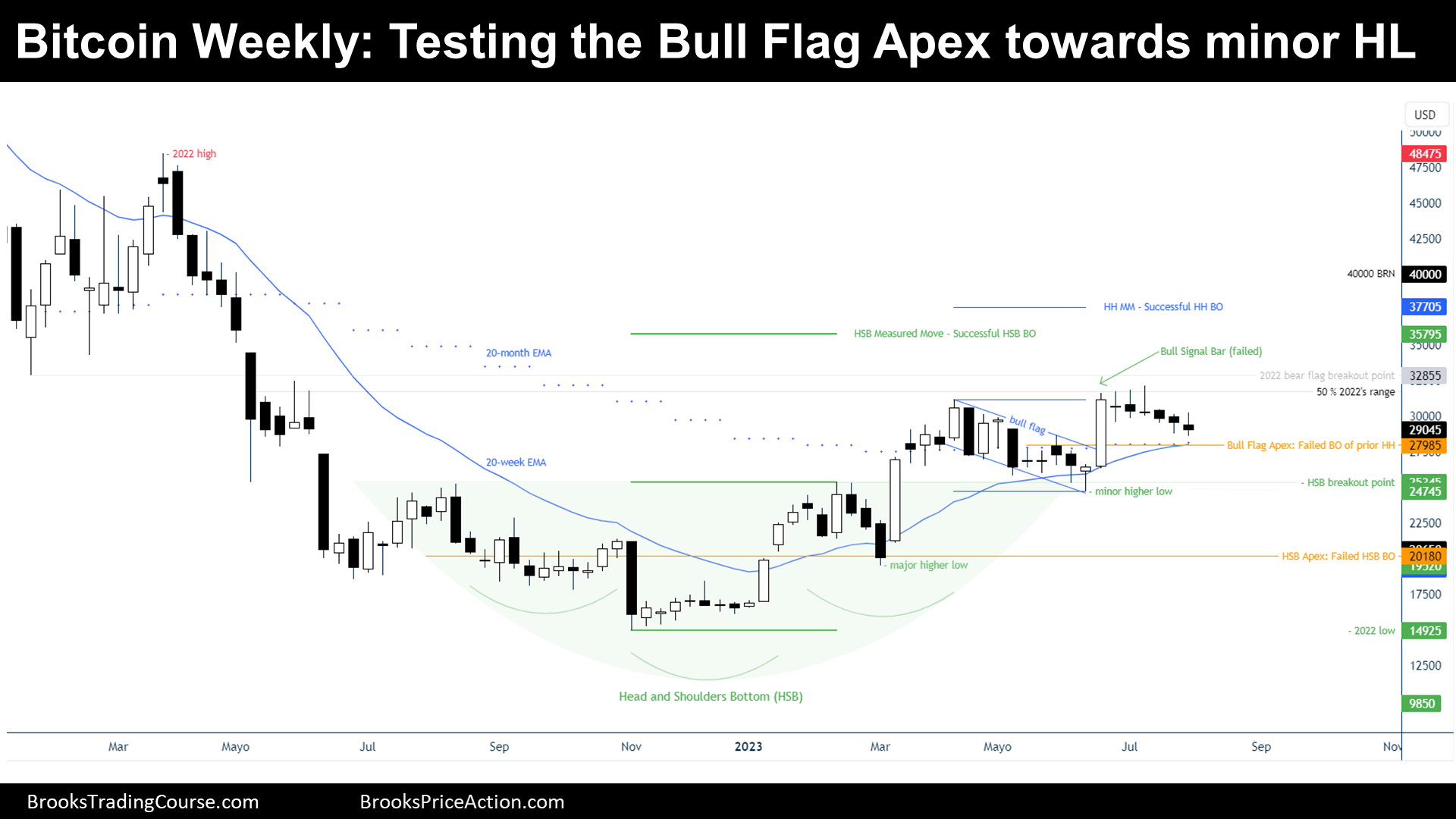

The Weekly chart of Bitcoin futures

Analysis

- This week’s candlestick is a bear doji. This bear bar, it is following two consecutive bear bars.

- The context is the following:

- There is a Head and Shoulders Bottom, and the bulls did a breakout of the neck line.

- The bulls tested the breakout point during the creation of a bull flag, and then, the price reversed up strongly from there and created a bull signal bar.

- The Bulls wanted a measured move (MM) up based upon the size of the bull flag. Instead, the price is returning to the Apex of the bull flag.

- If the price gets to the Apex, it means that the price it is more likely within a trading range than within a trend market cycle.

- Bulls:

- They want a reversal up from the Apex and then create another opportunity to buy. Their minimum objective will be the HSB MM.

- Bears:

- They want to get to the major higher low, there, there will probably be buyers. But first, it has to test the minor higher low.

- Many retail traders have their stop loss at the minor higher low, a place that the price can perfectly test and then do a resumption up of the trend.

Trading

- Bulls:

- They are out of prior trades, or at least partially. Now, they want to buy more.

- Before buying, they should wait for a double bottom to form or a good bull bar surging from the Apex.

- Bears:

- They would like to sell a low 2, but the price it is still above the 20-week EMA and many would wait until they see strong bears, before selling.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.