Market Overview: Crude Oil Futures

The weekly candlestick was a Crude oil weak close above the 20-week EMA (exponential moving average) and the bear trend line. The bulls need to create follow-through buying next week to increase the odds of reaching the April high. The bears want a reversal down from a double top bear flag with June 5 high and from a lower high.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull bar with a long tail above.

- Last week, we said if the bears continue to fail to create sustained follow-through selling, the odds will swing in favor of the bull leg beginning.

- The bulls want a reversal from a higher low major trend reversal (June 12) and a micro wedge (May 31, Jun 12, and June 28).

- They got a bull bar closing above the 20-week exponential moving average and the bear trend line.

- They will need to continue creating follow-through buying trading far above the 20-week exponential moving average and the bear trend line to increase the odds of higher prices.

- The long tail above this week’s candlestick indicates that the bulls are not yet strong.

- The next target for the bulls is the April high.

- The bears want a retest of the May 4 low followed by a breakout below.

- However, they have not yet been able to create sustained follow-through selling from the 10-week tight trading range.

- The bears hope that this week was simply a lower high pullback. They want a reversal down from a double top bear flag (Jun 5 and Jul 13) around the 20-week exponential moving average and bear trend line area.

- They will need to create strong consecutive bear bars to increase the odds of a retest of the May low.

- The market is in a 34-week trading range. The last 10 weeks formed a tight trading range.

- Traders will BLSH (Buy Low, Sell High) in trading ranges until there is a strong breakout from either direction with follow-through buying/selling.

- For now, traders will see if the bulls can create a follow-through bull bar following this week’s close above the 20-week exponential moving average and bear trend line area.

- Or will next week close as a bear bar below the 20-week exponential moving average thereby increasing the odds of a retest of the May low?

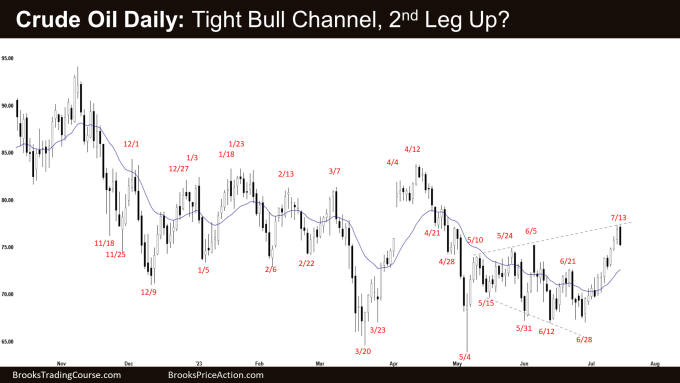

The Daily crude oil chart

- Crude oil traded higher for the week followed by a pullback on Friday.

- Last week, we said the odds of the bull leg may have already begun and traders will see if the bulls can continue to create follow-through buying or will the market trade slightly higher but stall around the 9-week trading range high area.

- This week broke above the 9-week tight trading range with follow-through buying.

- The bulls want a reversal up from a wedge bull flag (May 31, Jun 12, and June 28) and a higher low major trend reversal.

- They want a strong breakout above the 10-week tight trading range and a retest of the April high.

- The move up is in a tight bull channel. That means persistent buying.

- Odds slightly favor at least a small second leg sideways to up after a brief pullback.

- The bears hope that the tight channel up is simply a buy vacuum within the smaller 10-week trading range.

- They want the market to reverse lower from the expanding triangle and retest the May low.

- Crude Oil has been trading within a 34-week trading range. Poor follow-through and reversals are common in trading ranges.

- Traders will BLSH (Buy Low, Sell High) in trading ranges until there is a strong breakout from either direction with follow-through buying/selling.

- The market is currently trading around the middle of the 34-week trading range. It could be an area of balance between the bulls and bears.

- For now, traders will see if the bulls can continue to create follow-through buying or will the market stall and trade back into the 10-week trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thanks Andrew for a clear analysis! As a price action trader of oil are there specific events that you advise traders to be flat some time before the release of news like FOMC for Spy? Thanks!

Hi Profezy,

A good day to you.. thanks for going through the report..

It depends on each individual market that you are looking at.. it can be crude oil, soybean oil, or palm oil and so on..

For commodities, additional considerations are the fundamental (e.g. supply and demand) factors on top of the technical (charts).

However, I find that mastering the charts would always put you a step ahead.. because the move (spike or strong move in one direction) would often happen first on the charts.. days ahead (sometimes weeks ahead).. and the fundamental news would then follow much later on..

It could be intentional or unintentional suppression of news.. it doesn’t matter.. just know that news can be and often are late..

If you were waiting for the news to enter or exit, by the time it arrives, it may be quite late and the damage is done..

Each commodity would have their own fundamental factors.. supply, demand, currencies, policy changes, spreads vs related markets, weather, shipping congestion, seasonality (xmas, or other seasonal demand cycles), and many others..

Even then, I find the charts give me better clarity and having the fundamental factors as a secondary considerations would be better for me..

Sorry for the long answer.. hope that helps..

Best Regards,

Andrew

Thanks Andrew for great info, it helps alot! Have a great day

Thank you for sharing, Andrew!

Dear Team,

You’re most welcome..

Have a blessed week ahead..

Best Regards,

Andrew