Market Overview: DAX 40 Futures

DAX futures moved up again this week, so we are always in long at the 20-Week Moving Average (MA.) It has been an extended bear trend down to the lows of the COVID breakout, and we are testing the breakout on October 28th, 2020. We have retraced 2 years of price action, forming a larger trading range, so bulls are most aggressive in buying. Most bull moves have become traps, however, and traders should look to buy low, sell high and scalp until clear.

DAX 40 Futures

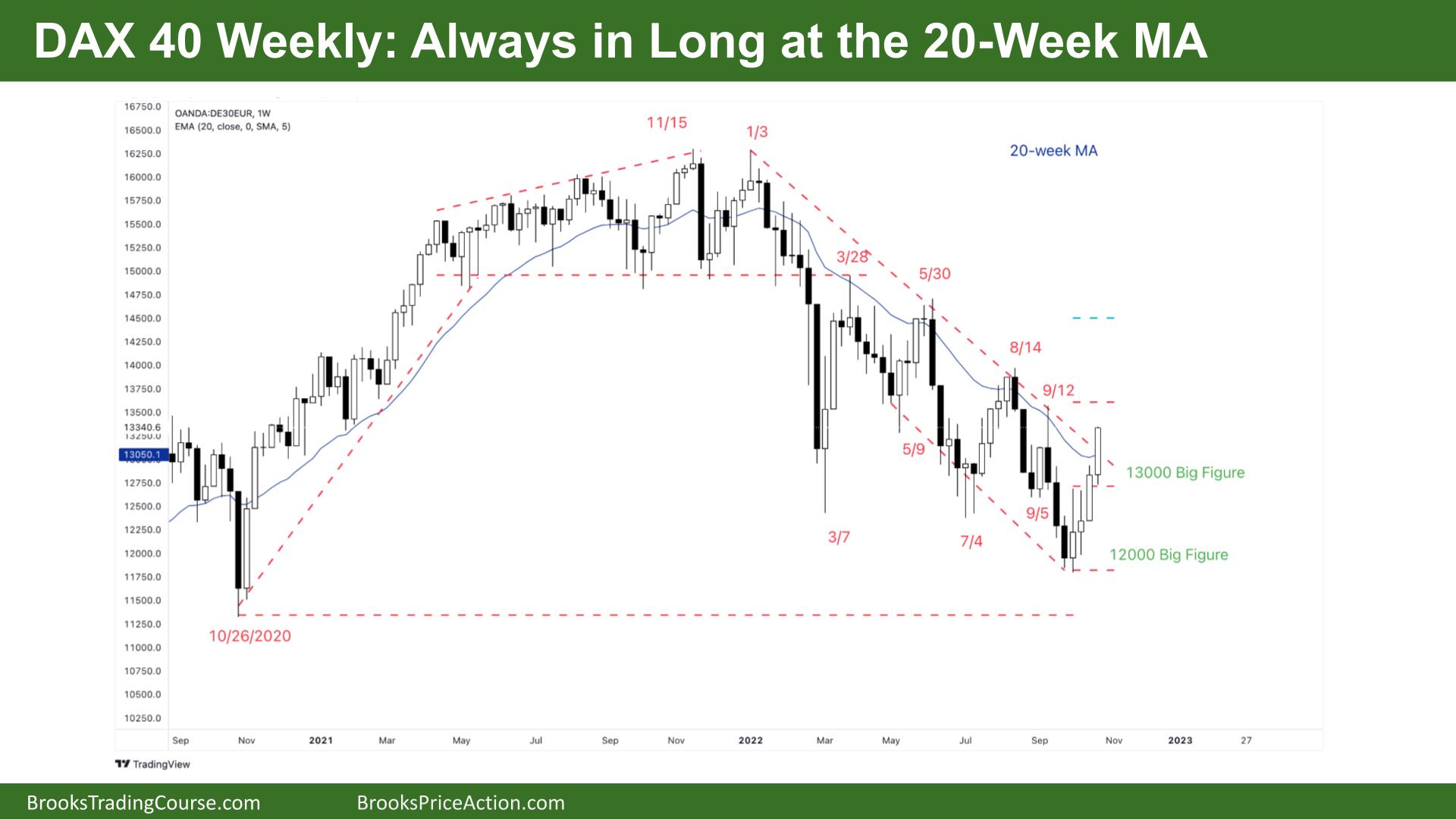

The Weekly DAX chart

- The DAX 40 futures was a big bull bar closing on its high so we might gap up on Monday.

- It is the 5th consecutive bull bar, so a 5-bar micro channel and traders will buy the first pullback to go below the low of a prior bar.

- The bulls see a wedge bottom with many ways to draw it. They see we are low in a trading range and have been buying new lows and making money for months.

- The highs have been going above swing points allowing bulls to exit breakeven on their first position and a profit on their second.

- The bulls want consecutive bull bars above the moving average and a higher low to set up a head and shoulders bottom and swing higher for a measured move.

- The bears see a broad bear channel and a new low of the year. They expected 2 legs sideways to up and to sell again at the moving average. They see last week as a double-top bear flag.

- It is also a 20-bar moving average gap bar sell, but without a sell signal. It might trap bears as this is the 5th push down in the channel and the 5th and 6th pushes have a high probability of failing.

- If the bulls get the breakout, we could head to the May 5th high, which is a measured move from here.

- Traders will be watching to see if bears get trapped and can get out or not. If not, and it reverses back up again, it could be a very strong breakout and a high-probability buy.

- Bears might also see 3 pushes up and a parabolic wedge, and if there is a strong reversal bar, it could move quickly down.

- If you had to be in, better to be long or flat.

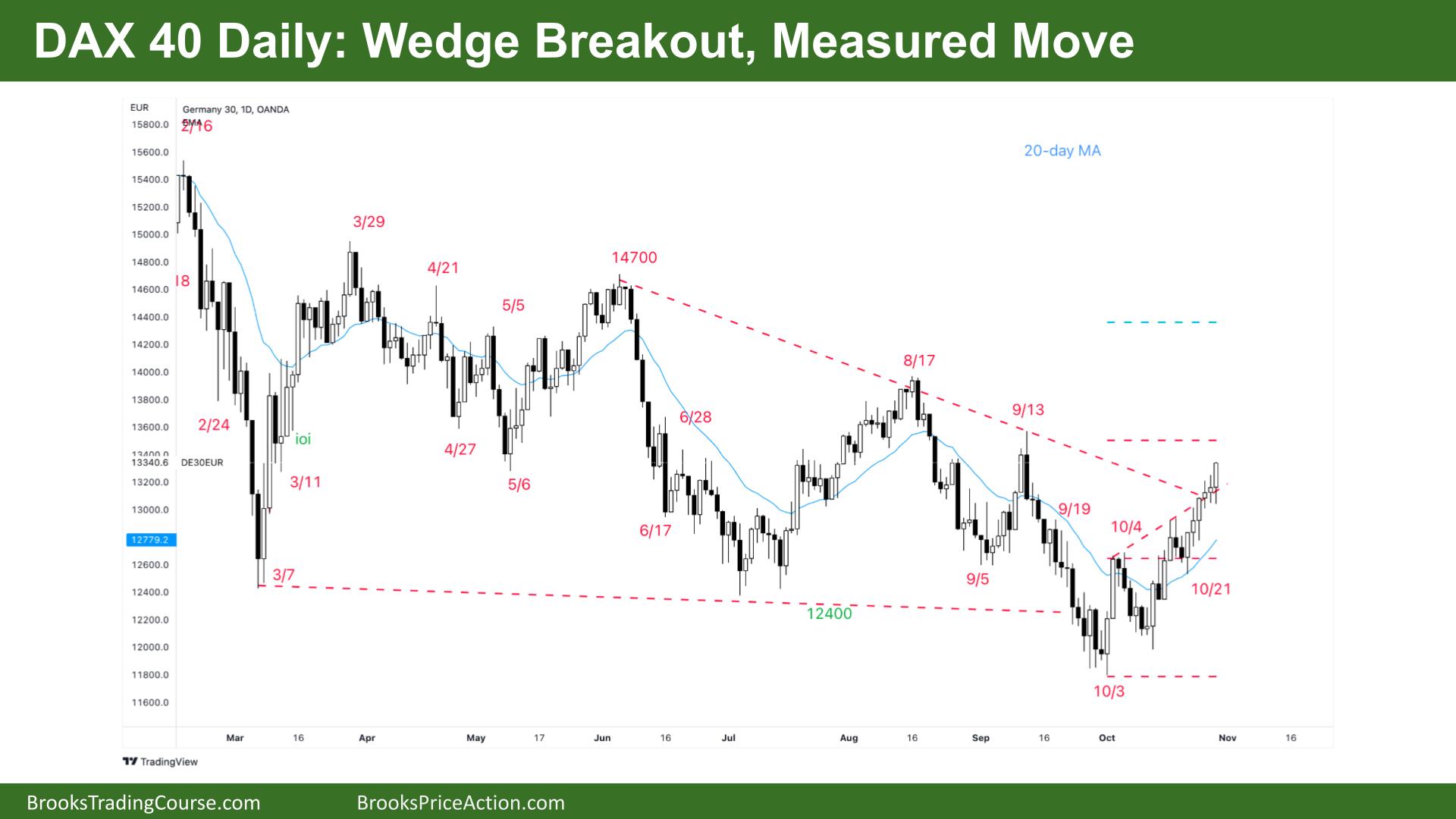

The Daily DAX chart

- The DAX 40 futures on Friday was a bull outside up bar closing on its high so that we might gap up on Monday.

- It is the 6th consecutive bull bar which is unusual, so we should pull back soon, and most traders will expect a second leg, which may even be one bar.

- The bulls see 3 pushes up and a breakout above a wedge top and are looking for a measured move up to the August 17th high.

- The bears see a possible buy climax high in a trading range and will look to short the failed breakout for a move back down to the lows of the range.

- The move is strong enough that traders will expect another leg. The bars are big, so the position size should be smaller.

- It is always in long, so traders should be long or flat. Big bars late in a trend attract profit taking so we should pull back here.

- The bulls see a lower low major trend reversal, a failed breakout below the low of a trading range and a wedge with March, June and October. Some wedge bottoms will have a third leg that breaks through a double bottom before reversing up strongly.

- Because it’s always in long on the weekly chart, bears can scale in, but some were trapped selling above October 4th and had to buy back shorts.

- Its been an extended bear trend for over 6 months, so most traders will expect this reversal to be minor and form a larger trading range and not reverse into a bull trend.

- Bears will sell the double top with September 13th but should expect a smaller leg sideways to up and scale in.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.