Market Overview: DAX 40 Futures

DAX futures broad bear channel pause at the 13000 big round number. We have been saying for the past few months that the market might need to spend some time here to decide where to go next. The bulls see a double bottom to set up a major trend reversal and longer-term bull trend resumption but they have lacked follow-through. The bears see a continuation sell and a harmonic measured move and the second leg of the January bear breakout.

DAX 40 Futures

The Weekly DAX chart

- The Dax 40 futures weekly was a small bull doji at the 13000 big figure. It is a micro double bottom with last week and a potential double bottom with March 7th.

- We have been saying since March that the bears would want to get a second harmonic move down – and it seemed too far away. But slowly they have kept pushing it down. It looks like we might get there after all.

- The bulls see a higher close than March but also we treaded below March. That’s not great for them. But it still could be a higher low, major trend reversal. They know we failed to get a reversal last month and this second time might work.

- Its a wedge and a reversal swing setup they need a follow-through bull bar to change traders minds.

- They see the consecutive bear bars as a sell climax and the bottom of a trading range, so the math favors buying here. They want a follow-through buy signal like a High 1 or High 2 for a test up to the top of May.

- We said last week there would be buyers below, but we never traded much higher so what does that tell us? No one wants to buy high yet.

- They also see a possible wedge bottom and might scale in lower on an overshoot reversal swing.

- Bears see a broad bear channel from January and now we are forming a trading range. They see the lower high major trend reversal in January and expected 2 legs down and we are in the second leg.

- They see the failed breakout by the bulls, a bull trap and collapse from the breakout point as a sign to keep selling above prior bars. The bears might expect a measured move from the consecutive bear bars last few weeks, which would bring us new lows for the year.

- As the harmonic and measured move are around the same area, it suggests we might get there but we don’t have to go straight down. Another bear market rally for a few weeks back to the moving average and then a third leg down might also get us there.

- It is reasonable to expect sideways to down trading from here with a possible High 1 buy setup above and a sell below the wedge. Next week will be interesting!

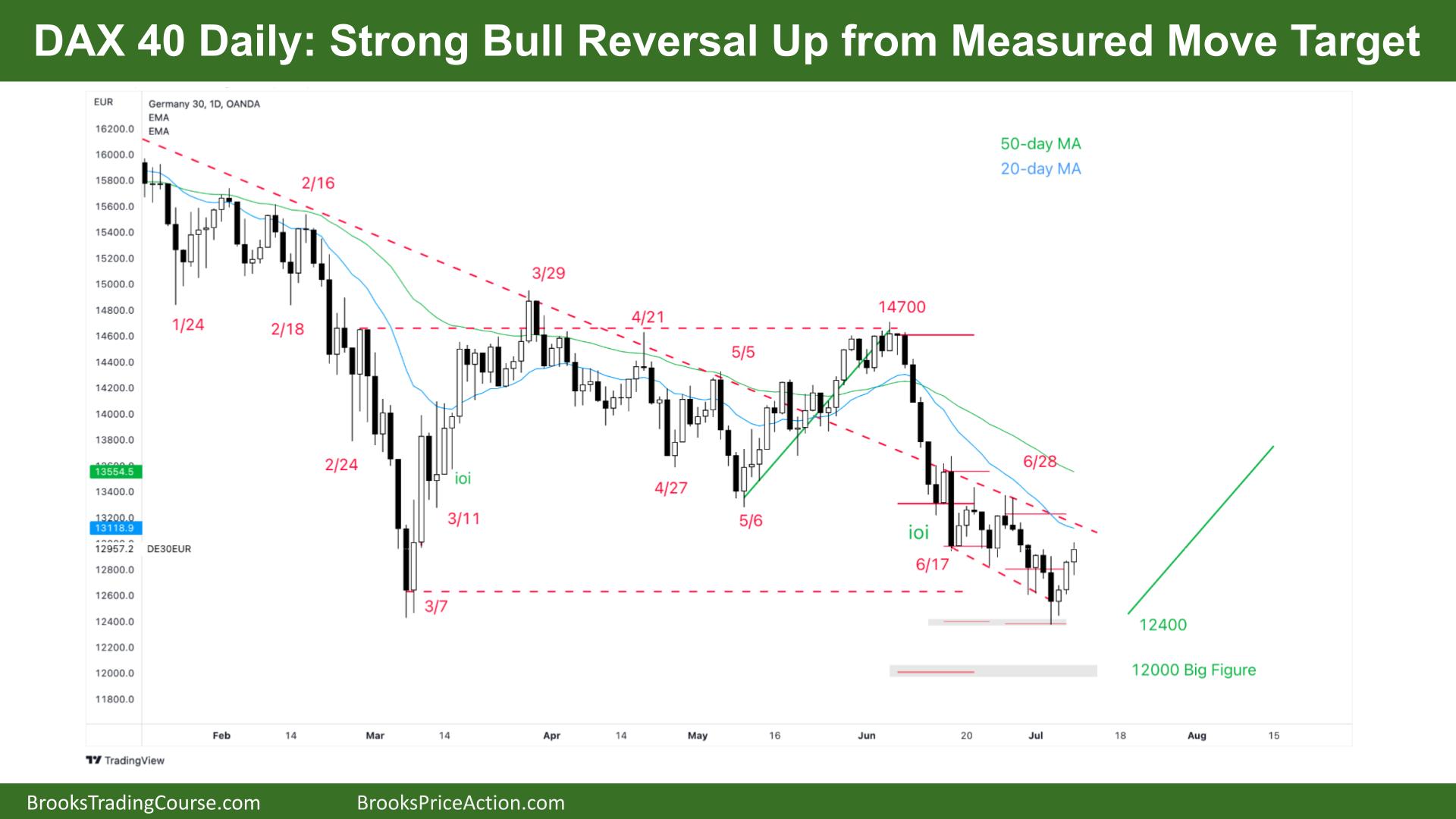

The Daily DAX chart

- The Dax 40 futures on Friday was a 3rd consecutive bull bar closing above it’s midpoint so we might gap up on Monday. We are probably always in long.

- We said last week that the bears had two measured move targets to get to and they hit them on Tuesday and reversed up strongly. Big claps to us, it doesn’t often work so smoothly like that! Hope you traded it as well.

- The bulls see the first time of having 3 bull days in a row for one month so it’s a rendered buying pressure. It’s a double bottom and it’s setting up the two attempts at a major trend reversal which has a higher probability. They see a wedge and an overshoot last week so it’s a swing buy and will expect a measured move and two legs up.

- The bears see at best the bottom of a trading range for the bulls. They will look to sell the first Low 1 and above around the June 28th high.

- They know the bottom of a trading range is a better buy but it is likely to still be scalped around the trend line above last week.

- The bulls will target the moving average and above. They want a close above the average and a follow-through.

- The bears will sell the moving average again – it’s been 6 weeks since they last did it and it was profitable then.

- We’ve been sideways the last 2 weeks so it’s a tight trading range and breakout mode, and it could be a bull breakout, but they need bigger bars and small tails above.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thanks Timothy.

I have a generic question hope you don’t mind me asking here, may I know whether you trade on Futures or CFD? Since most of the platform providers in UK sell either spreadbetting or CFD except Interactive Brokers for retailers on Futures, which one closely resembles Al’s patterns? I tried spreadbetting on indices but they’re manually derived from futues and constantly adjusted for dividends and interest rates keeping it discreet by providers make them less transparent and thus they don’t reflect actual fair trade price nor the pattern like gaps, close price etc.

Any observations that you would like to share amongst spreadbet vs CFD vs Futures would be greatly appreciated.

Cheers

NK