Market Overview: DAX 40 Futures

DAX futures printed 3 bear bars on the monthly chart, a bear spike, for the first time since 2019. When the market has a moment of clarity, it usually pulls back. When it doesn’t, it creates a magnet to test later. We’re low in a tight bull channel, so traders will expect it to convert into a trading range first, so more likely we bounce soon. The bears might get one more leg (just one bar) as the MA from

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a bear spike, a big bear bar closing near its low, so we might gap down next week.

- It is the first bear bar to go below the MA in many months. Likely, bulls will buy it.

- It is a bear microchannel, 3 bear bars in a row with a gap between the first and third bars. Every high is lower than the one before. Bears will likely sell above the last two bear bars and make money.

- It was not a great swing entry on this chart – a credible second entry short, and some traders will say, a wedge. But the signal worked, which traps traders – some into an opposite bad trade, and some out of that short.

- We will likely pull back and create a second leg on this chart. Even if just one bar.

- The bears broke a swing low to put it into a trading range. The bulls want a buy signal here but might get an inside bar or small reversal. Other bulls will look to buy lower and wait for the energy to dissipate.

- Last year, traders got stuck shorting the MA, and we went up. That price might be important to test again – it is a little lower than we are now.

- The stop is far away, so the probability is down. Nothing to buy here.

- Always in short so traders should be short or flat.

- The traders looking for a duelling lines pattern can now see it clearly with the double top. A wedge to a double top is a reliable entry signal for a swing.

- Expect sideways to down next month.

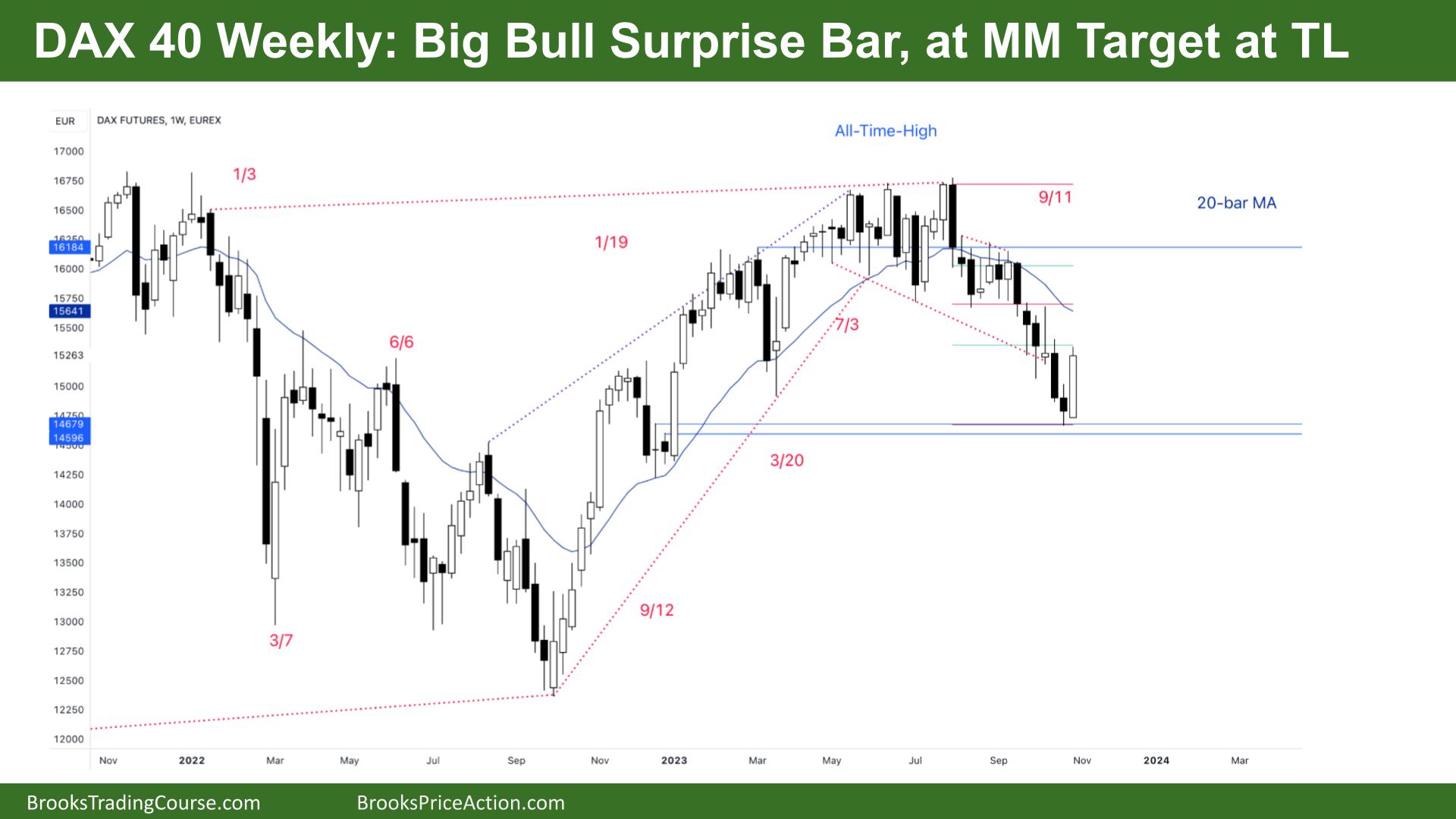

The Weekly DAX chart

- The DAX 40 futures was a big bull bar closing on its high, so we might gap up next week.

- It was a test of the weak buy signal in September last year. Bears got stuck scaling in and higher, and most lost money. Others sold higher and got a chance to get out breakeven with a profit on the higher sell.

- It was a swing target, a MM from above. The 3 consecutive bear bars, breaking below the MA was a reasonable swing sell.

- It is a High 2 , but the High 1 was a weak doji, so most traders would prefer a smaller signal bar.

- We have been in a trading range for a long time, and TRs are disappointing. I think next week with get a follow-through bar to disappoint bulls who were waiting and bears who are shorting above its high but we shall see.

- It is a reasonable swing buy, but low probability. That means the stop is likely to get hit. Many bulls will keep a smaller position to buy underneath.

- Some bears will wait to sell above the last bear bars, and others wait for something at the MA, seeing it as too low.

- It will probably be sideways to up next week as this bar gets triggered and we see if the bulls will get a close above.

- It is still a bear spike on the monthly so this pullback should fail and produce a test of the low again.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.